- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbo tax fees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

I purchased Turbo Tax Premier from a store and downloaded the program to my computer. Why do I need to pay turbo tax fees (refund processing fees) when e-filing and selecting direct deposit into my checking account?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

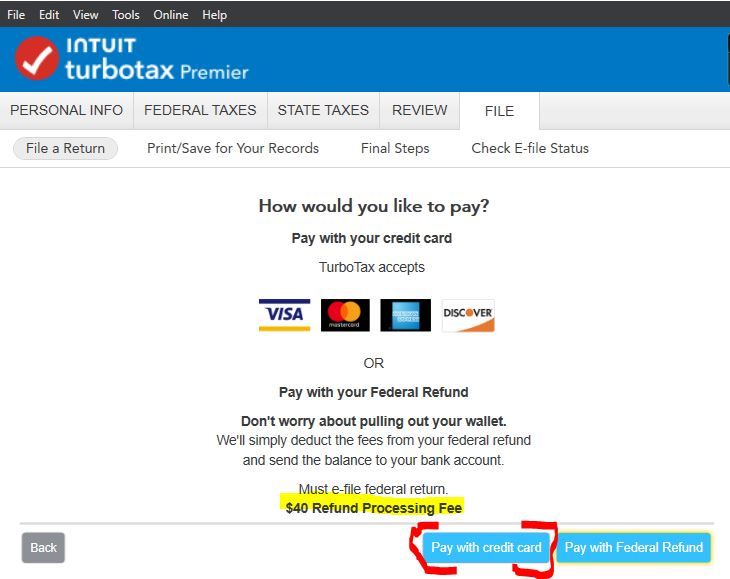

For some reason you selected to pay the state e-file fee from your federal tax refund which has a $40 charge.

If you have not e-filed the 2024 tax return, go back to the File section and when land on the screen to pay the e-file fee select Pay with Credit Card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

No one is providing a good answer to my question. I have used Turbo Tax Premier for many years, filed many tax returns and never came across this problem before. This is the first year that it didn’t come with a CD so after purchasing I had to download the program using the special pass code. When it came to finally e-filing the federal tax return and specifying to direct deposit the tax refund, it’s asking how I want to pay for the $40 refund processing fee. Federal e-filing is free but this is the first year I’ve come across having to pay for a refund processing fee. It won’t let me proceed beyond that so the only way to not pay this fee is to mail in my tax return and still have the refund direct deposited into my bank account. My question is why is there this $40 refund processing fee that I never had to pay before?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

Please call TurboTax Customer service. Here is a link: Turbo Tax Customer Service

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

Why is there even a $40 refund processing fee this year when I never had to pay it prior years. I already paid for the TT program and Federal e-filing is free so why this refund processing fee now!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

@Jhhama wrote:

Why is there even a $40 refund processing fee this year when I never had to pay it prior years. I already paid for the TT program and Federal e-filing is free so why this refund processing fee now!

If you are using the desktop editions of TurboTax and have a state return to be e-filed there is a $25 e-file fee for the state return. On the page for you to pay for this fee is a screen asking you to select how to pay. You should have selected Pay with Credit Card and not Pay with Federal Tax Refund. Choosing that option has the $40 processing fee. If you have not filed the 2024 tax return, click on the File tab and go through this section until you land on the payment screen and then choose Pay with Credit Card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

This is a fee if you are paying your TurboTax fees out of your refund like DoninGA said. You need to call Customer Service to have them do a screenshare with you to see what you are selecting that is bringing this up.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

I agree with Jjjama – no one is providing a good answer: “I have used Turbo Tax Premier for many years, filed many tax returns and never came across this problem before. This is the first year that it didn’t come with a CD so after purchasing I had to download the program using the special pass code. When it came to finally e-filing the federal tax return and specifying to direct deposit the tax refund, it’s asking how I want to pay for the $40 refund processing fee. Federal e-filing is free but this is the first year I’ve come across having to pay for a refund processing fee. It won’t let me proceed beyond that so the only way to not pay this fee is to mail in my tax return and still have the refund direct deposited into my bank account. My question is why is there this $40 refund processing fee that I never had to pay before?”

I was outraged to have to pay a processing fee to get my refund. I also have used Turbo Tax Premier for years. Federal e-filing is free. The only option to get the refund was direct deposit with a fee, or have the government mail me a check which was many weeks (and with the state of things right now that felt like a risk). The fee was supposed to be $40. I just got my refund of 3322.00 and my direct deposit was 3254.94 – so $67.06 in fees. Why? Everyone keeps talking about paying the state filing fee with a credit card to avoid the fee – this has nothing to do with my state return, this is my federal return, the only option was direct deposit with an (apparently) $67.06 fee, or get mailed a check in many weeks. This is new. Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

There is always an extra fee if you want refund processing. Nothing has changed.

With the desktop version, installed on your own computer (from a CD or download) you have already paid the basic fee to use the program. However, there are several optional fees you might encounter. For example, if you purchase the Deluxe version and want to upgrade to Premium or Home and Business, there is a fee. There is a fee for Audit Defense. And there is always an extra fee to e-file a state return.

You can choose to pay these extra fees with a credit card and that's the end of it. Or, you can choose to have the extra fees deducted from your refund, but that always involves an extra fee for that service.

The simple answer is to no agree to any optional services, and to either mail your state tax return or pay the state e-filing fee with a credit card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax fees

I finally got clarification. The $40 refund processing fee was only if you wanted to deduct the state e-file charges from your federal tax refund then they would charge another $40 to process that transaction. So if you say you’ll pay the state e-file charges with a credit card, then there’s no $40 processing fee. It wasn’t clear to me and wasn’t explained that way in Turbo Tax. But once you say you’ll pay the state e-file charges with a credit card, the system will let you proceed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vets_isb

New Member

Scullbrianna

New Member

fredp08

New Member

queenmendo67

New Member

amy-cannava

New Member