- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax Year Prior to 2020: I want to talk to a HUMAN

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

Why can I can't take my thumbs up back. I was given no choice but thumbs up and when I try to give a thumb up to a real post , the robot stops me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

how can i have a verbal conversation with a human?

I am having a difficult time saving all the asked for info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

please help me with my problem of saving all the asked for info.i want to save it all asap.can you help me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

ease contact me by phone. [phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

Sorry—no one can call you from the user forum. This is the public user forum. You can post a question here and someone will try to help.

Phone support is not provided with the Free Edition. If you are using a paid version of the software or if you purchased PLUS you can get phone support when customer support is there. Otherwise, post your question here and someone will try to help.

To call TurboTax customer support

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

Customer support is available from 5 a.m. to 9 p.m. Pacific time

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

I purchased TurboTax deluxe through Amazon. I'm now trying to pay the $25.00 charge to e-file my California state return. I chose the option to have my federal refund reduced by the $25.00 charge but in completing the transaction, it wants to charge me the $45.00 for the app as well. How do I just do the $25.00 addition? mona

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

Yes there is an EXTRA $45 Pay with Refund service charge in California. So you have to pay the $25 with a credit card. Go back though the FILE tab and watch what click on. There is one screen that will trip you up. If you are in California you need to remove the Premium Service first

https://ttlc.intuit.com/community/downgrading/help/how-do-i-remove-premium-services/00/26266

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

In California Desktop program to remove Audit Defense and Premium Services you have to change to pay the 20/25 state efile fee by credit card and not by having it deducted from your federal refund. Or print and mail state for free. Go back through the File tab again and change to pay with a credit card. Then if Audit Defense is still there you can remove it.

See this screen shot,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

@freeturbo1633 wrote:That was not a human responding. That was a digital device and not a human response. THERE ARE no humans to respond here only digital watchdogs down thumbing posts like yours and mine.

There is no mechanism in the forum to "downthumb."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

So I see the system is not intuitive enough to forward the question I already typed...SMH. I filed my taxes jointly this year and needed to get a download of last year's taxes that I filed alone. This system does not make it easy. It keeps wanting me to file this year with no option to select "documents" from left side as directed by your instructions. PLEASE make it easy to simply download without doing business for the current year, which I have already done business with you but jointly. Please focus on being more customer centric for 2022 as these frustrations are not felt with all online tax systems. THANKS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

@motorman1965 wrote:

So I see the system is not intuitive enough to forward the question I already typed...SMH. I filed my taxes jointly this year and needed to get a download of last year's taxes that I filed alone. This system does not make it easy. It keeps wanting me to file this year with no option to select "documents" from left side as directed by your instructions. PLEASE make it easy to simply download without doing business for the current year, which I have already done business with you but jointly. Please focus on being more customer centric for 2022 as these frustrations are not felt with all online tax systems. THANKS

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

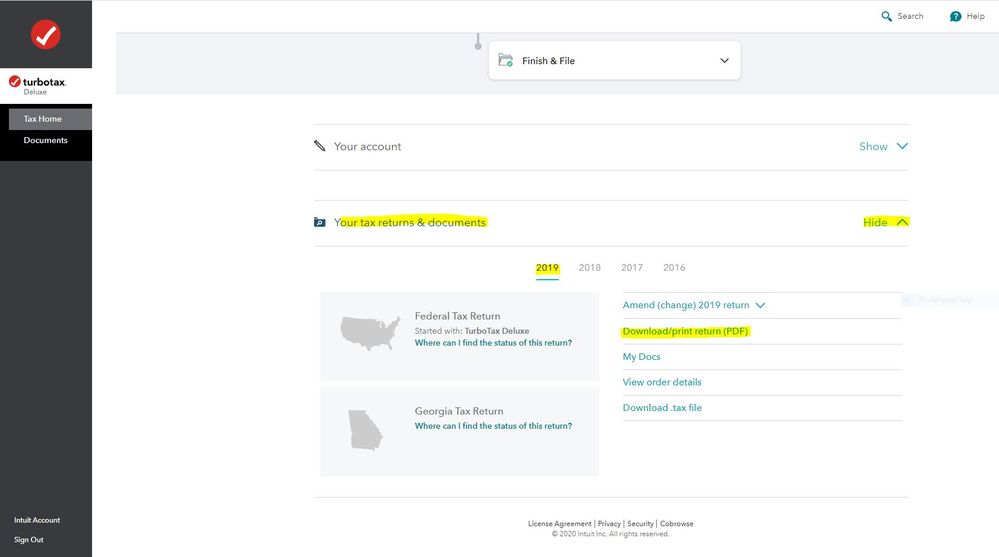

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

OR -

You may have to start a 2020 tax return before the links on the Tax Home web page become available. In that case start the 2020 tax return with the User ID you used for the 2019 return. Once some basic information has been transferred over, Tax Home should be visible on the left column. Click on Tax Home and then the other links will be shown as in this screenshot.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

Yes. I believe they engage in unscrupulous practices. I think they will end up with a class action lawsuit eventually. It won't matter because they will have bilked so much money from customers that they will come out ahead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

You might be human but your wonder phone line is not.

Now all I need is the ability to update my account info with new a/c no and routing. I will not have a refund so it does not give me the option. Also it does not allow me to input my pin from IRS for fraud.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

You can enter your IRS Identity protection PIN under Other Tax Situations section of TurboTax. While in your return:

- Go to Search at the top of the screen.

- Enter "Identity Protection PIN" in the search box.

- You will see a Jump To function that will take you to the Identity Protection PIN input screens.

- There add your Identity Protection PIN.

You will not be able to change banking deposit information if you do not have a refund. If you have a balance due, you would be able to add the banking information for direct debit to pay your 2020 balance due. This would be added in the File section of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I want to talk to a HUMAN

I want to find my tax documents from last year but I forgot the account and I had to open up an new one This year. Please email me [email address removed]

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17520162976

New Member

user17520079359

New Member

gabbie2343

New Member

montemontemayor-

Level 1

mrsholmes705

New Member