- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax Year Prior to 2020: How do I get rid of my form 8615?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

In your example of 40K support, with student earned income of 20K; that is not more than half of their support.

Also, since your student had unearned income over $2,200 (scholarship award that was not spent on support or education expenses) a Form 8615 would be required.

Click this link for more info on the Kiddie Tax.

This link has details on What is Unearned Income?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

My mistake, I rounded. Consider the earned income to be $21k which is more than half the $40k support.

I'm still reading it as the student would be a dependent because they don't meet the dependent support test, but would not owe Kiddie tax, because earned income is more than half support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

I still would like to solve this problem. How to remove the 8615 for when the filer is:

1) Dependent (does not meet "independent" support test)

2) Does not owe kiddie tax (does have earned income more that 50% of support)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

@clobber88...It appears you are trying to delete Form 8615 because it does not seem to apply to your tax situation. If that is the case, here are the steps to follow to delete Form 8615 or any other form in TurboTax.

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

Here is a link to a TurboTax article discussing how to delete a form which you also may find helpful.

How to View and Delete Forms in TurboTax Online

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

Thanks for the response. Does simply deleting the form undo everything correctly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

@clobber88...Yes, by deleting Form 8615 you will delete any entries that relate to the form. In addition, if there is any other information on your return that is dependent on information contained within Form 8615, that other information will also be changed.

As a way of background, Form 8615 is used to figure your child’s tax on unearned income. The form is only required to be included on your return if all the conditions below are met:

- Your child had more than $2,200 of unearned income.

- Your child is required to file a tax return.

- The child was either:

- Under age 18 at the end of 2021,

- Age 18 at the end of 2021 and didn't have earned income that was more than half of the child's support, or

- A full-time student at least age 19 and under age 24 at the end of 2021 and didn't have earned income that was more than half of the child's support.

- At least one of the child's parents was alive at the end of 2021.

- The child doesn't file a joint return for 2021.

Thus, if the above conditions do not apply to your tax situation, then there is no need to include Form 8615. All information that you had previously entered to create this Form 8615, which it appears you may no longer need, will be deleted once you delete that form in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

Right, the problem with Turbo Tax 8615 as I see it is:

3. The child was either:

- A full-time student at least age 19 and under age 24 at the end of 2021 and didn't have earned income that was more than half of the child's support.

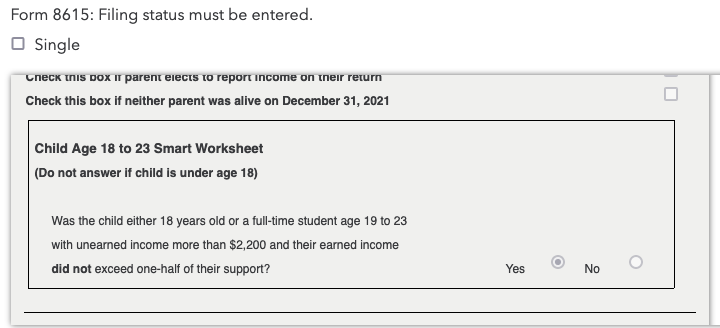

This question is never asked during the interview. Turbo Tax appears to generate the 8615 based on the dependency test which is is similar but not the same. When you tell TT you are a dependent and have unearned income, it automatically makes you do the 8615.

The case is that the filer is a dependent as determined in the worksheet for support . Even though they had earned income more than half of their support, they did not use that earned income.

However for the purpose of 8615, they did have earned income more than half their support. For that test, you dont actually have to use it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

Hi, Was this problem ever solved? The above issue applies to me (Earned more than 50% of my support), but my parents still paid the majority of my support. I literally can't file until I'm able to delete this form, or just edit it to answer the question correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

I still have not seen a solution and don't know how I will handle it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

You do not delete Form 8615. Support is support. There is no new definition for it. The instructions for Form 8615 refer you back to the dependency.

Support. Your support includes all amounts spent to provide the child with food, lodging, clothing, education, medical and dental care, recreation, transportation, and similar necessities. To figure your child’s support, count support provided by you, your child, and others. However, a scholarship received by your child isn’t considered support if your child is a full-time student. For details, see Pub. 501, Dependents, Standard Deduction, and Filing Information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

@ColeenD3 Yes, we understand the concept of support from the 8615 instructions you sent. However, the same instructions say you only owe kiddie tax if, "age 18 at the end of 2021 and didn’t have earned

income that was more than half of the child's support." This is distinctly different from the dependency support test (where you have to actually spend the earned income).

The question still stands. That is, how to handle a student who is a dependent (parents paid 100% support), but who did have earned income more than 50% of that support (just did not spend it)- and therefore does not owe kiddie tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

Funds in a savings account are not considered in the support test.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

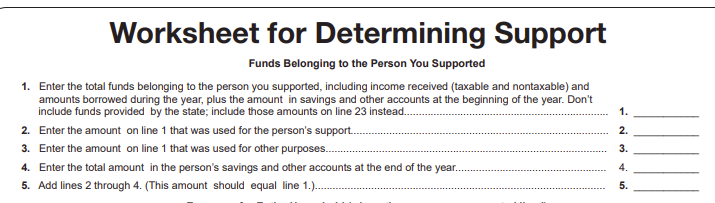

Yes they are. Line #1 in your screenshot says, "plus the amount in savings and other accounts at the beginning of the year." And then Line #4 says, "Enter the total amount in the person’s savings and other accounts at the end of the year."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

Yeah to further clarify what Clobber is stating, TurboTax is auto selecting "Yes" for the following question. This is simply incorrect for my situation, I easily earned more than half my support. It is just not what was used for my support, in my case I lived with my parents for 8 months, with them supporting me for that time. I only used a small portion of my income to support myself for the following 4 months. It is insanely frustrating that TurboTax does not realize that the following question, and dependency are not identical questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: How do I get rid of my form 8615?

Trying to delete the form won't work if you don't answer this question correctly that YES you did provide more than half your support. Thanks this was very helpful!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JB_Tax

Returning Member

Ed-tax2024

New Member

MojoMom777

Level 3

in Education

DAT159

Level 1

PPSMissie

Returning Member