- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- SSDI TAXABLE INCOME

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSDI TAXABLE INCOME

.

My sole source of income is SS Disability 2018 to 2020, I am single and own a home. No Federal income taxes are taken out. For 2018 from SS box 5 = $31,000 2019 =$31,900 and 2020 = $32,400. When I calculate notice 703 for each year taking 50% of incame line A. on line B. the instructions for Si9ngle 1. suggests NO TAXABLE INCOME SINCE AT 50%, is about $15 to $16K well below the $25K so NON TAX. In 2017 a CPA did not put any income under line 7 form 1040 and I rreceived a $900 REFUND BUT WHEN I DID MY TURBO TAX 2018 FEDERAL USING THE $31,000 FROM FORM SSA-1099 PER ABOVE BOX 5 .....I OWE ABOUT $3,000 OR ALMOST A $4,000 SWING. WHEN FILLING OUT INCOME ON TURBO TAX DO I PUT THE FULL $31,000? DOES IT SEEM RIGHT (BASED ON IRS LAW) THAT I WOULD HAVE TO PAY 10% WHEN I AM TOTALLY DISABLED AND CAN'T WORK?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSDI TAXABLE INCOME

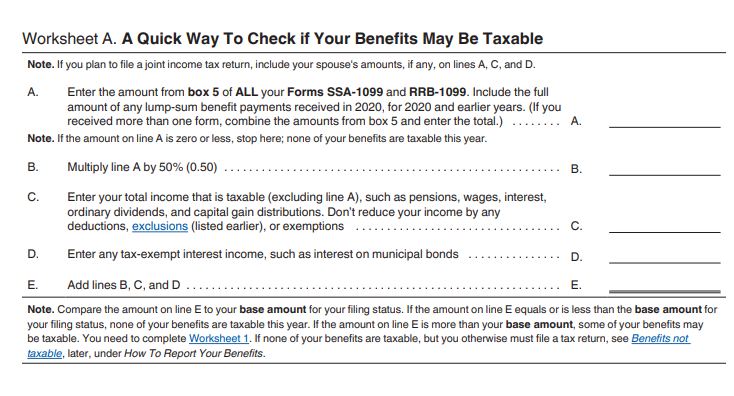

Something seems wrong somewhere. Below is the worksheet. If this is your only income and there is no withholding, you don't need to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSDI TAXABLE INCOME

Thank you Coleen,

Why do you think sometthing is WRONG?

In NOTICE 703

A = BOX 5 my BENEFITS = $31,000

B = ENTER 1/2 A = $15,500

C,D = 0

E = B + C+D = $15,500 OR PER 1. BENEFITS NOT TAXABLE BELOW $25,000

1. How are BENEFITS different than WAGES?

2. IF I FILE

For 1040 lINE 5 = 1 EXEMPTION

7 = 0 WAGES ?

Is there a Deduction either Itemized since I own a home and pay interest = $4,100, Taxes = $896 and PMI = $1,066? OR USE STANDARD DEDUCTIONS?

3. AM I DO A REFUND OR NO SINCE I HAVE NOT PD FED TAXES?

4. I HAVE NO WITHHOLDINGS BUT WOULD LIKE TO FILE Such that i have filed 2018 - 2020 so they have heard from me.

5. I DO OWE SOME BACK TAXES and considering, if IRS asks to begin a repayment plan. I owe a large amount back to 2008, what YEAR can IRS collect back to?

Thanks Coleen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSDI TAXABLE INCOME

If you have no other income you DO NOT need to file. SS or SSDI or ssi is not taxable at all. It is only partially taxable if you have Other income above the amounts listed. And there is no benefit in claiming deductions or credits or dependents.

SS Benefits is not Wages. Wages are only from jobs where you get a W2.

You only get a Refund if you have withholding taken out from W2 wages or from other kinds of 1099 income.

You do not need to file every year. Only if you have income to report. The IRS doesn't care. If you want to file a return for some reason you will have to print and mail it. Or you can enter $1 of fake interest to let you efile. You could get a blank 1040 form and enter all zeros on it.

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Here are the 1040 Instructions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSDI TAXABLE INCOME

Thanks for your answer, I will take your advice and not file.

Another ?

I DO OWE SOME BACK TAXES and considering, if IRS asks to begin a repayment plan. I owe a large amount back to 2008, from a premture withdrawal from an IRA.

What YEAR can IRS collect back to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSDI TAXABLE INCOME

How far back can the IRS go to audit my return?

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don’t go back more than the last six years.

This is from the ABA:

1. The IRS Typically Has Three Years. The overarching federal tax statute of limitations runs three years after you file your tax return. If your tax return is due April 15, but you file early, the statute runs exactly three years after the due date, not the filing date. If you get an extension to October 15, your three years runs from then. On the other hand, if you file late and do not have an extension, the statute runs three years following your actual (late) filing date. There are many exceptions discussed below that give the IRS six years or longer, however.

2. Six Years for Large Understatements of Income. The statute of limitations is six years if your return includes a “substantial understatement of income.” Generally, this means that you have left off more than 25 percent of your gross income. Suppose that you earned $200,000 but only reported $140,000. Given that you omitted more than 25 percent, you can be audited for up to six years. Maybe this understatement was unintentional or you reported in reliance on a good argument that the extra $60,000 was not your income. The six-year statute applies, but be aware that the IRS could argue that your $60,000 omission was fraudulent. If so, the IRS gets an unlimited number of years to audit. What about not an omission of income, but overstated deductions on your return? The six-year statute of limitations does not apply if the underpayment of tax was due to the overstatement of deductions or credits.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

colehabbels

New Member

waynelandry1

Returning Member

anonymouse1

Level 5

in Education

oreillyjames1

New Member

rodiy2k21

Returning Member