in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Solar Tax Credit 2023 => Amortized over 5 years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

I originally installed my solar panels and system in 2015 and was able to take the full tax credit in the same year.

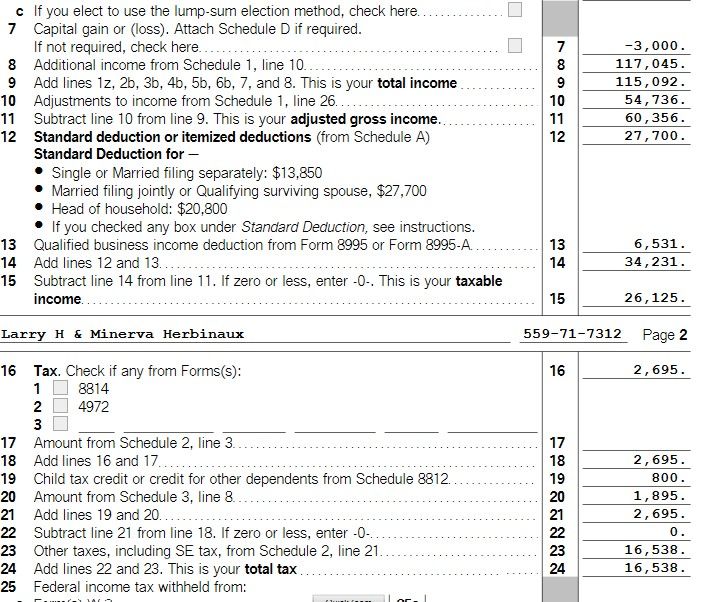

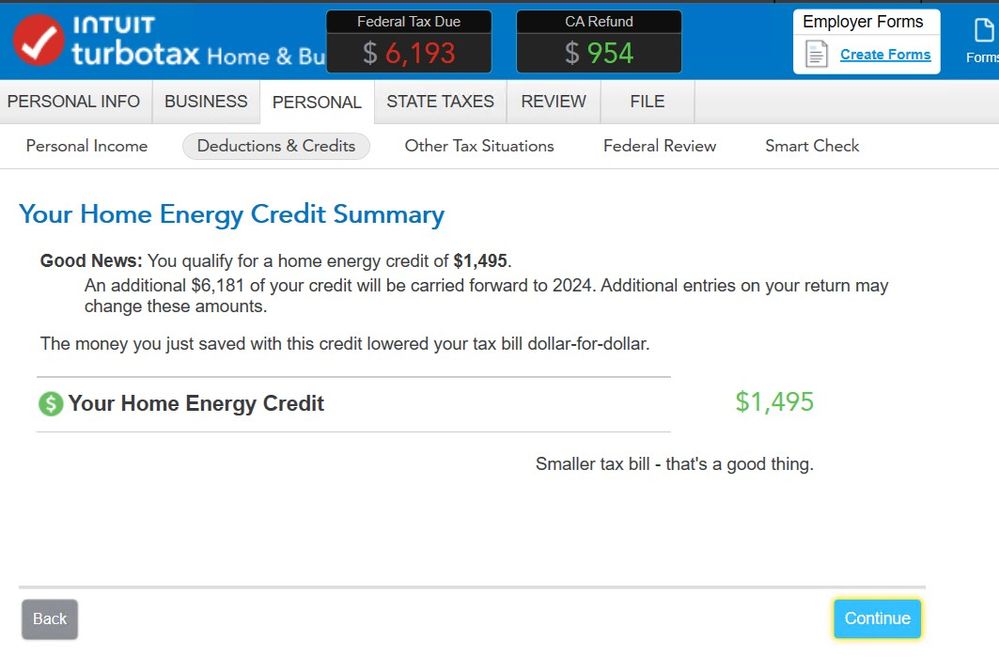

In 2023, I added a few more panels and a battery backup system and was guided through the solar credit screens. It asked me if the energy improvement would be used for 5 years or more and I said yes. My cost for the upgrade in 2023 was $25588 and 30% of this should be $7676. Turbo tax said I would only receive $1495 in 2023. It said I would receive another $1495 next year. First off if it is amortized over 5 years it should be 7676 / 5 => $1535 and second, I don't want to amortize it over 5 years. I planned my taxes around a full tax credit and now will have to pay the IRS $6100.

I have looked at the https://www.irs.gov/credits-deductions/residen[product key removed]y-credit and no where does it say the credit is amortized over 5 years.

I looked at The Solar Tax Credit Explained [2023] which explains the solar tax credit for 2023 and no where does it say the credit is amortized over 5 years.

Why is turbo tax amortizing it over 5 years and can I change this?

Update:

I watched another video and it explained very well that the tax credit will cover my current tax liability for the current year and any remainder will be carried over to the next year, Federal Solar Tax Credit Guide - How it Actually Works & What You Need to Know . The problem is that TurboTax is not doing this. It is only giving me a $1495 credit for this year and after this credit is applied, I still owe over $6100 back to the federal government.

NOTE: I am self employed and I am getting a QBI tax credit and during the calculation it is doing 20% of my QBI; I'm wondering if this is the reason why I can only take 20% of the credit in 2023. I am grabbing at straws here, but just trying to provide as much about my situation as possible.

Thanks,

Larry

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

Oh no, your return is correct. The tax liability limits and orders the nonrefundable credits. The 5695 goes against tax liability, not SE. I don't have any extra tricks to help. I hope you enjoy the system!

Reference: Instructions for Form 5695

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below and @AmyC:

TurboTax Online:

Sign into your online account.

Locate the Tax Tools on the left-hand side of the screen.

A drop-down will appear. Select Tools

On the pop-up screen, click on “Share my file with agent.”

This will generate a message that a diagnostic file gets sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

Open your return.

Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

Hi Amy,

Thank you so much for looking at this. I just generated the diagnostic file in the desktop version. The Token Number is 1199853.

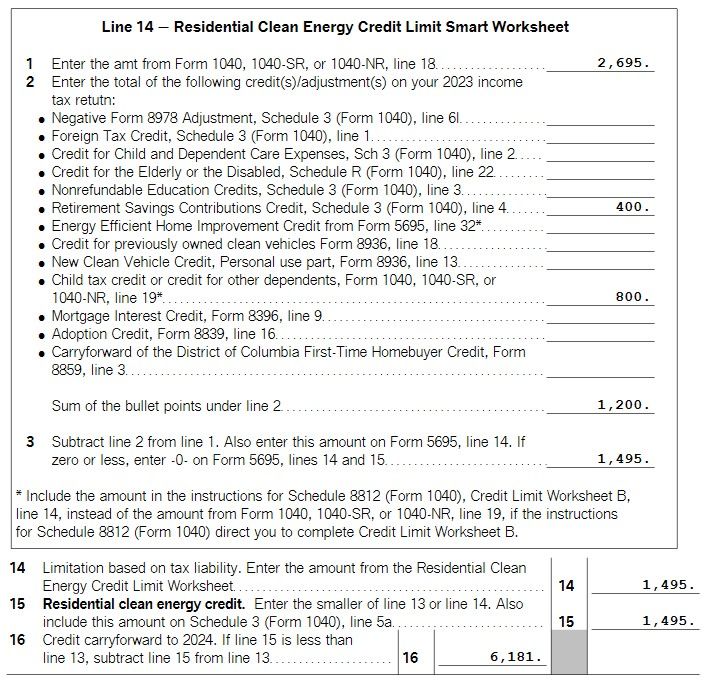

I think the issue has to do with the Residential Clean Energy Credit Limit Smart Worksheet:

- Taxable Income - The credits can only be applied to the tax on my taxable income.

- SE Tax - This is a lot higher this year because the money I put into my solar system could not be put into my business to lower my P&L. The tax credit cannot be used to reduce this, right?

- Summary - I made the assumption I would get a full tax credit reducing my liability from $6193 to $12.

- Question - Do you see anything I can do to improve my situation? After reviewing everything to get a better understanding, I don't think there is much that can be done. It's just rough to have to pay the $6193 after putting down $25588 to improve our environment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

Oh no, your return is correct. The tax liability limits and orders the nonrefundable credits. The 5695 goes against tax liability, not SE. I don't have any extra tricks to help. I hope you enjoy the system!

Reference: Instructions for Form 5695

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

Yeah, I know. After digging into the details, I figured out what was going on. I do love the system. I am able to store the energy on the battery and use it between 4PM - 9PM when rates are much higher; they go up every year. We have an EV too and are now completely self-sufficient.

Thanks again for your help.

Larry

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

Hi @AmyC ,

I am writing you back 6 months later because the IRS sent me a tax bill for 1495 along with a few penalties because I missed the first letter they sent me. The $1495 equals the amount of my first year tax credit for the solar upgrade I performed in 2023. In both of the letters, I do not see the reason why I owed this money, I just had to determine it by looking through my return. Normally, don't they send a letter stating why you owe money when you have paid the full amount in taxes owed stated on the 1040 form?

At this point, I don't know why they decided I can't receive this credit. In 2015, I put in my original solar system, but it did not have a battery. I took the full tax credit in 2016. In 2023, I added 3 more solar panels and performed a battery upgrade (added a battery system). I found out that my tax credit was going to be spread over 5 years which we talked about 6 months ago. I wasn't happy, but at the same time, I understood.

Turbo Tax stated that the return was correct, so where do we go from here? How do I engage the IRS concerning this? They did not leave a contact number to discuss. It looks like I am in some form of collections because it says payment is required immediately. Can Intuit / Turbo Tax help rectify this situation, because it did guarantee that my return was correct?

Thanks,

Larry

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

soccerdad720

Level 2

user17525953115

New Member

user17524963565

New Member

mason-jennifer-a

New Member