- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solar Tax Credit 2023 => Amortized over 5 years?

I originally installed my solar panels and system in 2015 and was able to take the full tax credit in the same year.

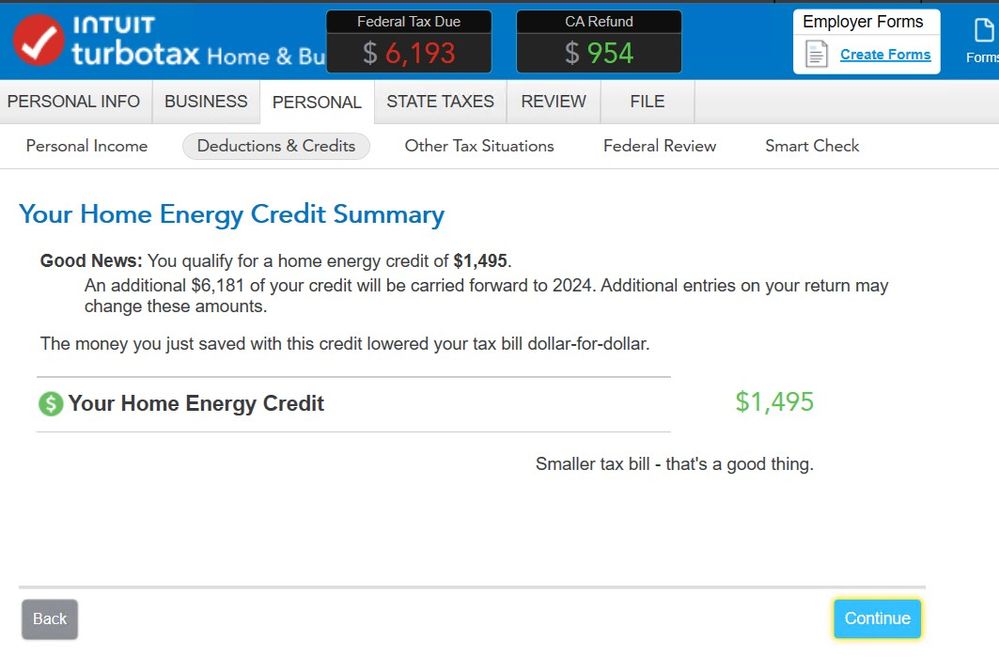

In 2023, I added a few more panels and a battery backup system and was guided through the solar credit screens. It asked me if the energy improvement would be used for 5 years or more and I said yes. My cost for the upgrade in 2023 was $25588 and 30% of this should be $7676. Turbo tax said I would only receive $1495 in 2023. It said I would receive another $1495 next year. First off if it is amortized over 5 years it should be 7676 / 5 => $1535 and second, I don't want to amortize it over 5 years. I planned my taxes around a full tax credit and now will have to pay the IRS $6100.

I have looked at the https://www.irs.gov/credits-deductions/residen[product key removed]y-credit and no where does it say the credit is amortized over 5 years.

I looked at The Solar Tax Credit Explained [2023] which explains the solar tax credit for 2023 and no where does it say the credit is amortized over 5 years.

Why is turbo tax amortizing it over 5 years and can I change this?

Update:

I watched another video and it explained very well that the tax credit will cover my current tax liability for the current year and any remainder will be carried over to the next year, Federal Solar Tax Credit Guide - How it Actually Works & What You Need to Know . The problem is that TurboTax is not doing this. It is only giving me a $1495 credit for this year and after this credit is applied, I still owe over $6100 back to the federal government.

NOTE: I am self employed and I am getting a QBI tax credit and during the calculation it is doing 20% of my QBI; I'm wondering if this is the reason why I can only take 20% of the credit in 2023. I am grabbing at straws here, but just trying to provide as much about my situation as possible.

Thanks,

Larry