- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi Amy,

Thank you so much for looking at this. I just generated the diagnostic file in the desktop version. The Token Number is 1199853.

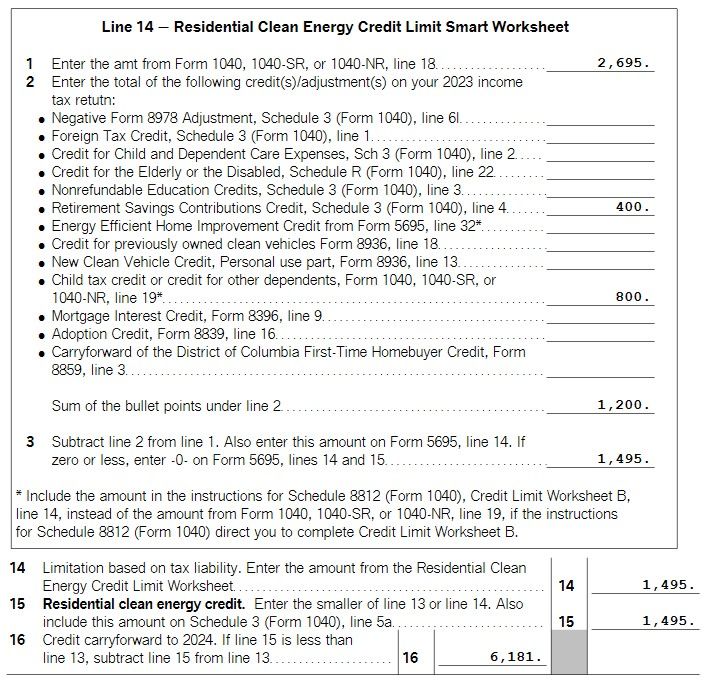

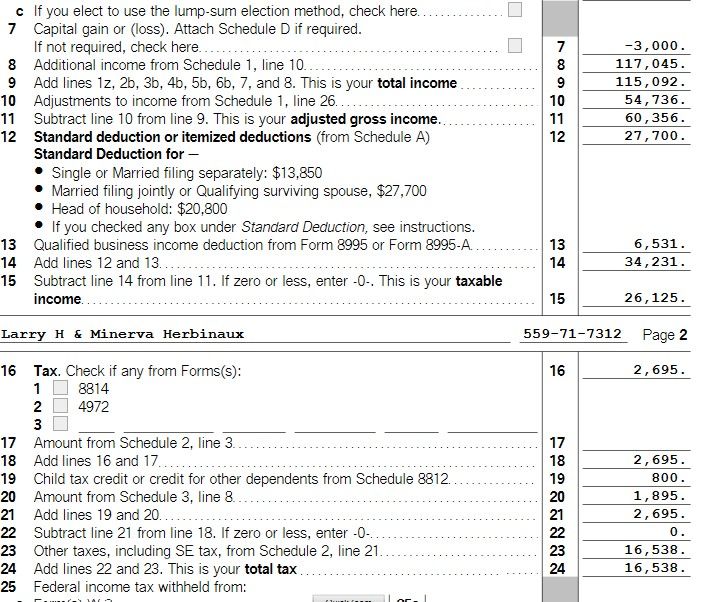

I think the issue has to do with the Residential Clean Energy Credit Limit Smart Worksheet:

- Taxable Income - The credits can only be applied to the tax on my taxable income.

- SE Tax - This is a lot higher this year because the money I put into my solar system could not be put into my business to lower my P&L. The tax credit cannot be used to reduce this, right?

- Summary - I made the assumption I would get a full tax credit reducing my liability from $6193 to $12.

- Question - Do you see anything I can do to improve my situation? After reviewing everything to get a better understanding, I don't think there is much that can be done. It's just rough to have to pay the $6193 after putting down $25588 to improve our environment.

March 1, 2024

11:57 AM