- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Setting up Quicken categories to sync with Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Setting up Quicken categories to sync with Turbotax

I'm using Quicken 2015. This year I purchased Turbotax 2018 to complete my form 1040. I'm a self-employed person. As I'm going through the Turbotax wizard it's asking me about rental income (I rented a bedroom in my home). As I explore how to report this I learn that I can import the information from my account in Quicken 2015. I want to do that properly. My question: How do I set up the categories (and tags?) so that the information in my Quicken 2015 file imports correctly?

Related questions:

-> Is there a document that tells how to do that (or a YouTube 'how to'?)?

-> What do the names of the categories have to be?

-> What if I have a category like 'phones' which is tax-related (because I use the phone for personal and business use)? How do I designate the portion of that expense that is for business and for personal use?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Setting up Quicken categories to sync with Turbotax

How to import from Quicken 2016 or earlier. You can not directly import older years. Only the last 3 years of Quicken.

https://ttlc.intuit.com/questions/1899278-how-do-i-import-from-the-txf-file

It doesn't matter what you call the category. You need to assign your category to a tax line item number.

https://www.quicken.com/support/how-assign-tax-form-line-items-category

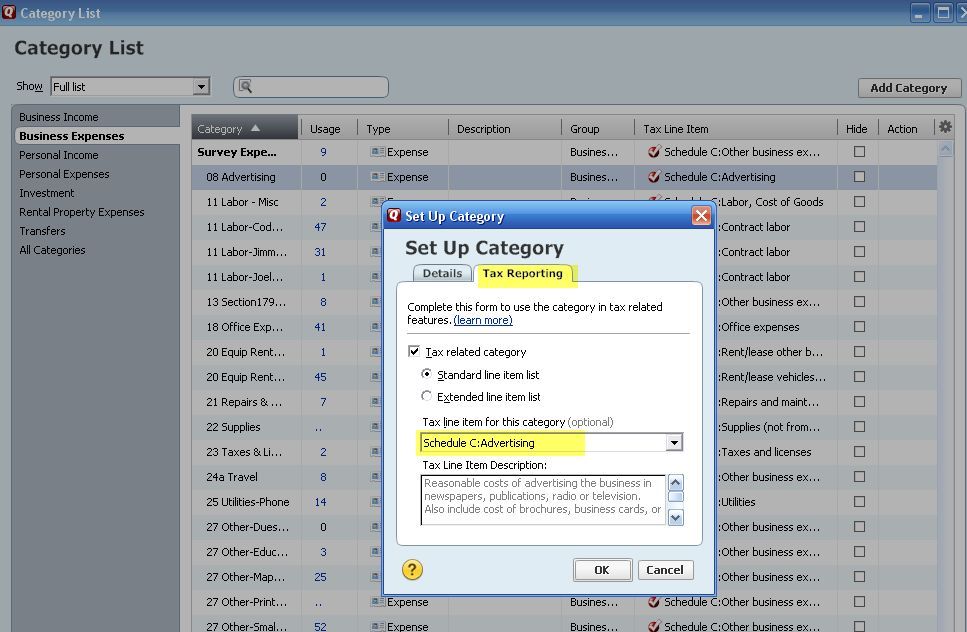

To check the tax line assignment open the Category list by either clicking on the Category Icon or go to Tools-Category List or Ctrl+Shift+C. Then select the category and right click on it to Edit it. Click on the Tax Reporting Tab and check the box for Tax related and pick a Schedule C: tax line item.

Here is a screen shot of mine. As you can see I named my schedule C categories with the schedule C line number. You can use any name you want. Then you assign each category to the tax line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Setting up Quicken categories to sync with Turbotax

I guess when you enter your phone bill you would have to split it to 2 categories for personal and business.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jaygourley

Level 2

Patrik_Polar

New Member

user17702310532

New Member

Themushj

Level 3

Bruce32dc

New Member