- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Self-employment income reporting by quarter (uneven income by quarter)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

Why doesn't turbo tax ask me for my income earned by quarter when I file? It asks me for estimated tax payments by quarter for Fed/State. But it doesn't have a space for reporting income earned by quarter. I earn my income unevenly throughout the year. My income is more heavily based in the 3rd / 4th qtrs and I get penalized for not reporting it correctly.

Can Turbo tax update their form to include when income is earned by quarter so they can automatically fill out schedule 2210 (federal) or Schedule U (WI State)?

Or can a question be asked to prompt for form 2210 or Schedule U?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

I have submitted your suggestion for an enhancement to the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

If you have an underpayment penalty on the return then the option to fill in the 2210 AI is presented to you. Always complete the entire interview screen by screen so you don't miss this option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

your income by quarter is not what Turbotax needs

for estimate tax requirements it's income and deductions for the first 3 months, then the first 5, then the first 8, and finally the whole year (automatic from the return)

and you are correct that Turbotax does not really provide for that varying income

however, in the estimated tax options section, you can check either 90% or 100% of the esyimated 2022 tax but you have to calculate this

there is a section Estimated Taxes and Form W-4 Worksheet

there is a 2022 expected column so you would need to annualize the amounts for each of the periods. don't forget about the self-employment tax section.

for the first 3 months multiply by 4 each item of income (net schedule c, interest, dividends, qualified dividends and other items of income and deductions (other than expenses reported on schedule c) and items of income or deductions subject to limitation (such as HSA, IRA schedule A tax deduction, mortgage interest - you can only annualize up to their limit

5 months multiply by 12/5

8 moths multiply by 12/8

the full year is automatic

once the annualized taxes are calculated you de-annualize the total taxes by

3 months multiplying by 1/4

5 months - 5/12

8 months - 8/12

12 months automatic

now you have the cumulative taxes that need to be paid in for each period. form those you subtract amounts paid for prior periods

making uneven estimated tax payments may require you to complete the Annualized Income section of form 2210 otherwise Turbotax computes penalties based on 1/4 of the total tax being due each period and from that subtracting timely estimated tax payments.

the main issue with using the 90%/100% 2022 tax requirement is law changes that can affect the amounts and leave you owing penalties.

also the

as you can see the AI method can be complicated in getting to the correct numbers if you have other than a very simple return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

Thank you! I think an enhancement to the program would be fantastic. If we were able to populate the gross revenue by quarter in the same form as the estimated tax payments, then it would recognize that 2210 and Schedule U would be needed and automagically fill in those forms. Manual entry is complicated and error prone. And unless you do the step by step instructions, you miss it. Even when I use the step by step instructions, it doesn't ask me for any variance.

I appreciate your submission for a program enhancement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

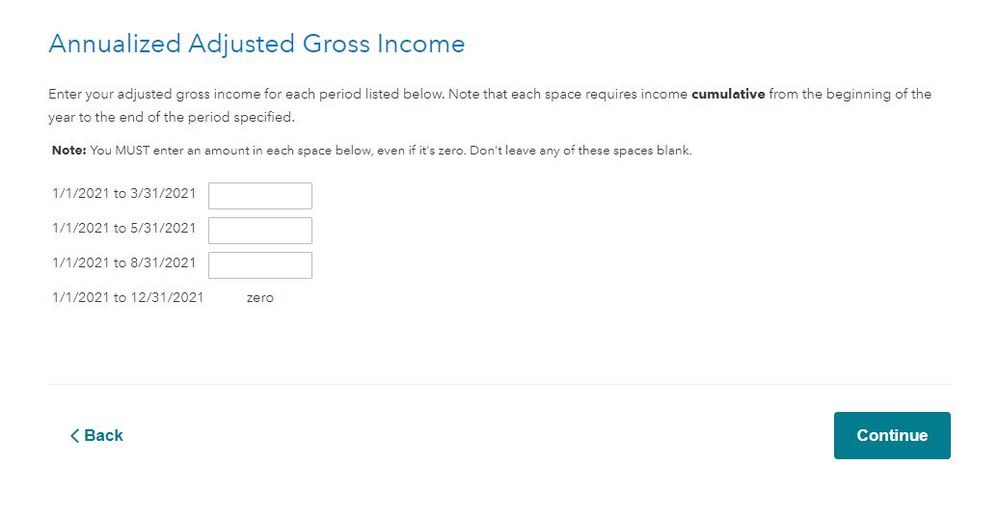

I believe when you go though the 2210 penalty section it will ask you for income by quarter, or actually the weird dates like Jan 1- Mar 31 and then Jan 1- May 31 then Jan 1-Aug 31, then Jan 1-Dec 31. See 2210 page 3.

https://www.irs.gov/pub/irs-pdf/f2210.pdf

I tried doing an online test return with lots of income and owing 21,000 tax due. I went to Other tax situations-Underpayment penalty and it only says No Underpayment penalty! So I couldn't get a screen shot to show you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

OK I got to the penalty screen. Don't know why it says zero for the 4th one? UPDATE...After I filled in the top 3 boxes it auto populated the total income in the last box for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

@Kelly C wrote:Thank you! I think an enhancement to the program would be fantastic. If we were able to populate the gross revenue by quarter in the same form as the estimated tax payments, then it would recognize that 2210 and Schedule U would be needed and automagically fill in those forms. Manual entry is complicated and error prone. And unless you do the step by step instructions, you miss it. Even when I use the step by step instructions, it doesn't ask me for any variance.

No, that wouldn't work. When you fill out the estimated payments section to prepare the Estimates for Next year's return you don't know your income for the year yet. You are entering estimated amounts. Then when you fill out the 2210 underpayment penalty form in your tax return, the year is over and you enter the exact amounts, not the estimated amounts. The Estimates you prepare are for this current year that you will be filing next year. The 2210 needs the prior year actual amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

I'm not sure if this is the right place to look. But I know TTX will already ask you about this so as to reduce or completely eliminate underpayment penalties.

If you'll take a look under the "Other Tax Situations" tab you'll see a selection for "Underpayment Penalties". Work that section through. I "think" you have to answer no to a screen that asks about W-2 income, before it will ask the questions you need it to ask.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

Thank you for your help. When I meant enhancement to the program by entering in revenue by quarter, I meant to add it to the screen where you enter your estimated tax payments you made for that tax year. Not the screen for next year when it calculates the tax payments for you (which I never use, because my income is so sporadic).

I have never had questions pop up that ask me to enter my income by quarter, which is the problem. It never asks "Do you earn your income evenly throughout the year?" If it did and you answered "No", then it could provide you with a pop up box to enter your income as you earn it and auto populate form 2210 and Schedule U for Wisconsin. This should be at the time you enter your income, not afterwards if and when you may get a penalty for underpayment. I don't believe it works well the way it is currently established. It is not intuitive.

Does this make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

Thank you! But, that takes a lot of steps to hopefully get to the right place. It is error prone and the reason why I'm not filling out my tax forms completely. If you are using the Business edition of TTX, then it should recognize that you earn revenue from a business and not income from an employer. Which means you may have seasonality to your revenue where it generates higher levels of revenue during different quarters. Why doesn't TTX ask a simple question at the time you enter your revenue to capture the seasonality of your business and revenue generation?

This would gather the right information upfront and determine what forms would need to be filled out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment income reporting by quarter (uneven income by quarter)

I hear what you are asking for but the program is written for the masses and the most common situations which yours is not so I doubt they will change the program at this time. Most users will employ the safe harbor method to avoid penalties which is the easiest method to use to avoid the annoying form 2210AI. And most folks cannot compile the info needed "quarterly" for the 2210 form as they don't keep detailed records and don't understand how to break out the credits and taxes as needed for the 2210.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mogajdys1

New Member

DeeSHC

Level 2

bensons9

New Member

tsauer1936

Returning Member

SaltPepper

Level 2