- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule K-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1

My Schedule K-1 Box 17 Code V shows "STMT." On the accompanying statement for Code V, there are four entries and corresponding amounts:

1) ordinary income (loss);

2) Section 179 deduction;

3) W-2 wages; and

4) unadjusted basis.

The Box 17 info in TurboTax for Code V shows "Section 199A information." Which of the four amounts listed above do I enter into the Code V box? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1

You should enter all four numbers in TurboTax so that TurboTax can calculate your QBID (qualified Business Income deduction).

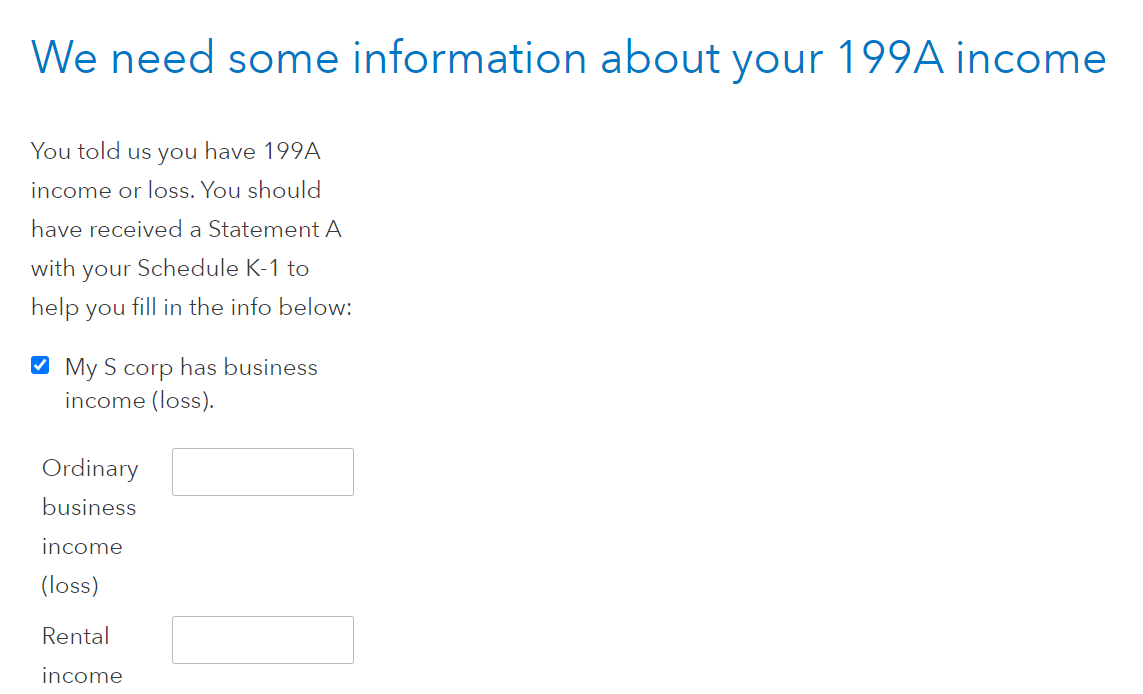

When entering your Schedule K-1, follow the TurboTax interview until you arrive at a page titled We need some information about your 199A income (see screenshot).

On that page, put a checkmark on the item you wish to enter and a box will appear so you can enter the item.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1

You should enter all four numbers in TurboTax so that TurboTax can calculate your QBID (qualified Business Income deduction).

When entering your Schedule K-1, follow the TurboTax interview until you arrive at a page titled We need some information about your 199A income (see screenshot).

On that page, put a checkmark on the item you wish to enter and a box will appear so you can enter the item.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mgarnett2040

New Member

brandonrmaclennan

New Member

skj

Level 3

jrhester

New Member

paul1701

Level 2