- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where should I enter interest earned from a land contract that I hold?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should I enter interest earned from a land contract that I hold?

Topics:

posted

October 10, 2021

9:33 AM

last updated

October 10, 2021

9:33 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

4 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should I enter interest earned from a land contract that I hold?

In the interest section unless you are also getting principal payments ...

October 10, 2021

9:41 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should I enter interest earned from a land contract that I hold?

Enter it like you got a 1099 INT for interest and put the amount in box 1

Enter a 1099-Int under

Federal

Wages & Income

Interest and Dividends

Interest on 1099-INT - Click the Start or Update button

October 10, 2021

9:42 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should I enter interest earned from a land contract that I hold?

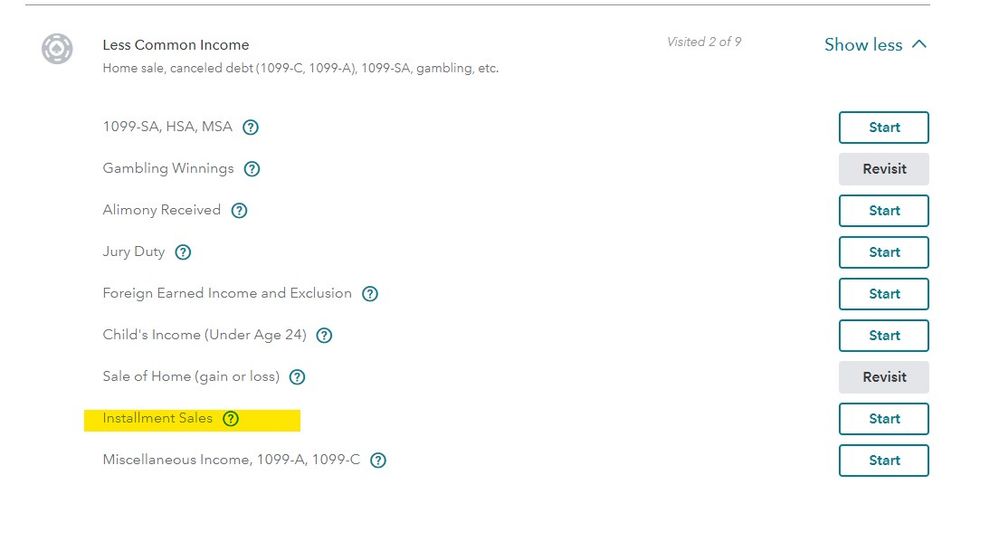

Interest and principle payments for installment sales go here :

October 10, 2021

9:43 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where should I enter interest earned from a land contract that I hold?

October 10, 2021

9:45 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jstan78

New Member

rhartmul

Level 2

1973Duster

New Member

MK3386

New Member

altheaf

Level 1