- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: WHERE is the state taxable portion input in to turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Yes, Exempt-interest dividends are not subject to federal income tax however they may be subject to state income tax or the Alternative Minimum Tax (AMT). The exempt dividend income must be reported on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

That is what I also need to know. Where and how do we show the dividends that are only federally exempt on state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

1) IF you hold a bunch of individual Municipal Bonds, the Tax-exempt interest is usually reported in box 8 on a 1099-INT form.

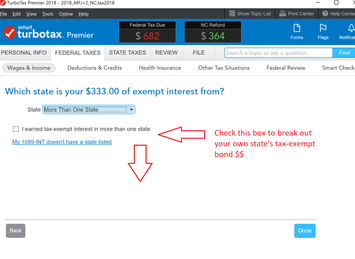

On the pages that follow the main form, there is a place where you MUST indicate whether the municipal bond interest (box 8 ) came from

a)"More than one state"

..Or...

b) Only your resident state (rare.. unless you hold only individual bonds from your own state)..

..Or..

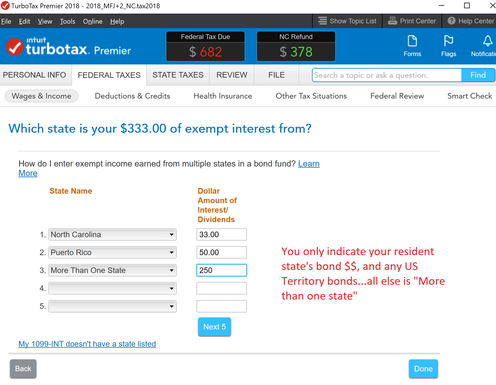

c) break it down to show bonds from your own state, the US territories, and all else as "More than one state" (picture 1 & 2 below).

__________________

a) "More than one state"

..Or..

b) Only your resident state (rare... unless you hold a state specific mutual fund).

..OR..

c) break it down to show bonds from your own state, the US territories, and all else as "More than one state". (looks the similar to picture 1 & 2 below),

d) but a warning for a few states (CA and MN.) do not allow a breakdown unless the Mutual fund you owned contained more than 50% of it's holdings for that state for CA, or 95% MN-bonds for MN residents.. (...And IL doesn't allow a break-out at all for IL municipal bonds held in a Mutual Fund)

3) For a 1099-DIV, if some of the $$ in box 1a or 1b came from US treasuries....then you have to calculate the actual $$ amount from the data the Mutual fund gives you at year-end...On one of the pages that follows the main software form, you get a page where you check a box to indicate that some was US bond interest...and then the next page allows you to enter the $$ amount associated with that. (For a 1099-INT, if you hold individual US bonds, the US bond interest will be in box 3 of that form, and the software handles it automatically without further input by you)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Thanks for response. Most of my muni income is federal exempt but NONE is state exempt. So when on the federal return I enter the exempt amount, that exempt amount gets automatically carried over to state return. My thought is on state form go the "other situations" option and then select additions. The form requires you to describe the addition and I would state Fed Exempt Dividend that is not State exempt and then enter the amount. I ran a dummy return and when I did that, it did adjust my state tax obligation appropriately by adding back in the federal exempt income. Would this be acceptable?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

PS

Not individual muni bonds. Bond funds such as Vanguard etc. Very small portion of same can be attributed to SC, my state, which I could under the same category on state return "other situations" ,select "subtractions", and enter that amount with a description of why and it automatically subtract from my state tax obligation. Again, in dummy return it seems to work fine. Your thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Might work, but that is not the proper way to do it with the software. Your way would have it in line 3v, and none of the "Other" subtractions described in the SC1040 instructions list SC bond interest as one of the "Other" subtractions that belong on that line. Anything else could prompt an SC audit, or letter requesting more information as to why you didn't take it out of line 1d to begin with.

https://dor.sc.gov/forms-site/Forms/SC1040Instr_2018.pdf

________________________

Mutual funds report their state totals in box 11 of the 1099-DIV....and then, in the software, you specify the SC-only sub-portion as I noted in my response above. When done properly that way, then only the non-SC bond interest will show up as an addition on line 1d of the SC1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Your response greatly appreciated. I think I understand what you are recommending but not so sure can fully implement. Will fool around with a mock return and see how it goes. Also have to claim credit for NJ taxes paid on contributions to Tax Deferred Annuity as I am taking RMD. SC taxes the RMD but I can get a calculated credit for those NJ taxes paid. Not sure where I would enter that in the SC return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

I think I have it. Assuming I had 10000 in fed exempt dividends, I would enter that number in box 11 and then under State/Territory column use "XX" to represent a fund with no state exempt dividends and enter 10000 less what small amount that is attributed to SC state investment within the fund in next line. So assuming 200 in SC eligible dividends, there would be 9800 in the XX line and 200 in SC line. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

If you are screwing around in Forms Mode Mostly Yes (you shouldn't be, you are inviting disaster unless you really know what you are doing.......you should stick to the interview) ..'

Box 11 …………..10000

…...then two lines in the table breakdown...

First line: SC...……..200

2nd line: XX...…….9800

and the very bottom of the table, below the Total and just above the box 12 entry: (State where the dividends were earned...…" …...MX...and not XX.

Those XX and MX codes are not specifically defined anywhere because you are not supposed to be using Forms Mode except in unusual circumstances to quickly fix particular problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Again, I have gotten an education. I think I learned enough to just have the account do it. Moved from NJ to SC last year after selling house in NJ and a condo in SC so definitely needed an expert. Perhaps best thing to do is just have them do taxes again for '19. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Gave it one more shot. Finally see it. After entering exempt dividends, just continue to page through and eventually get to page that you referred to where asked to which state or multiple states are the exempt dividends attributed to. Would just enter the amount on line one for SC portion of exempt dividends and then on line two enter " more than one state" for remainder of exempt dividends. When I did that and checked the "forms" it clearly made the entry for SC and XX in the amounts I entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

I have had the same problem. Actually, had to do a few amendments to my state due to the calculations being "off." Turbo Tax makes this process very difficult and unfriendly for the user to figure out. I did just what you said my state with the amount that it should be tax exempt and the remaining amount for multiple states and NOW I cannot get to view my state form prior to filing to see if Turbo Tax did it correctly? I am sooooo frustrated. I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is exempt-interest dividends non- taxable in Fed and State ?

Did you find that doing it this way - entering your state and putting the exact amount that should be tax exempted out of the total from the federal tax exempt and then do multiple states and add the remaining amount from the total federal tax exempt amount worked? I did exactly that but am afraid to file without checking it and Turbo does not let you view the entire STATE form without paying for it? So frustrating. Got audited by my state in the past and it was calculated incorrectly by TURBO - due to the POOR instruction on how to recalculate this manually so I am afraid to file...any suggestions on how I can be sure TURBO did this correctly?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CWP2023

Level 1

user17521061672

New Member

track06

Returning Member

mikejunk1

Returning Member

Vermillionnnnn

Returning Member

in Education