- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You will need to Edit every 1099-INT that has box 8 interest in it, and every 1099-DIV that has box 11 dividends in it.

1) IF you hold a bunch of individual Municipal Bonds, the Tax-exempt interest is usually reported in box 8 on a 1099-INT form.

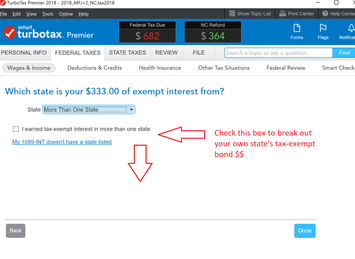

On the pages that follow the main form, there is a place where you MUST indicate whether the municipal bond interest (box 8 ) came from

a)"More than one state"

..Or...

b) Only your resident state (rare.. unless you hold only individual bonds from your own state)..

..Or..

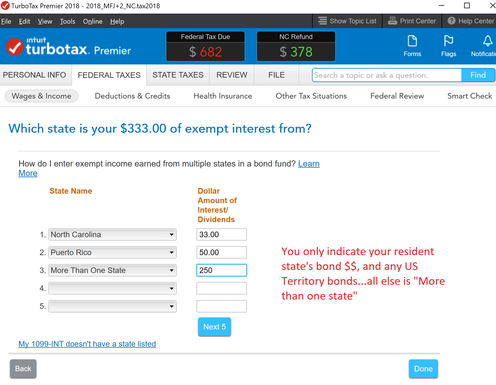

c) break it down to show bonds from your own state, the US territories, and all else as "More than one state" (picture 1 & 2 below).

__________________

2) IF you held Mutual funds with both Taxable bonds and Tax-Exempt Municipal bond holdings, those are reported on a 1099-DIV form. With all "non-municipal" dividends in boxes 1a, 1b, and the tax-exempt municipal dividends in box 11.

On the followup pages you again indicate the Municipal bond breakdown for box 11 came from

a) "More than one state"

..Or..

b) Only your resident state (rare... unless you hold a state specific mutual fund).

..OR..

c) break it down to show bonds from your own state, the US territories, and all else as "More than one state". (looks the similar to picture 1 & 2 below),

d) but a warning for a few states (CA and MN.) do not allow a breakdown unless the Mutual fund you owned contained more than 50% of it's holdings for that state for CA, or 95% MN-bonds for MN residents.. (...And IL doesn't allow a break-out at all for IL municipal bonds held in a Mutual Fund)

3) For a 1099-DIV, if some of the $$ in box 1a or 1b came from US treasuries....then you have to calculate the actual $$ amount from the data the Mutual fund gives you at year-end...On one of the pages that follows the main software form, you get a page where you check a box to indicate that some was US bond interest...and then the next page allows you to enter the $$ amount associated with that. (For a 1099-INT, if you hold individual US bonds, the US bond interest will be in box 3 of that form, and the software handles it automatically without further input by you)

a) "More than one state"

..Or..

b) Only your resident state (rare... unless you hold a state specific mutual fund).

..OR..

c) break it down to show bonds from your own state, the US territories, and all else as "More than one state". (looks the similar to picture 1 & 2 below),

d) but a warning for a few states (CA and MN.) do not allow a breakdown unless the Mutual fund you owned contained more than 50% of it's holdings for that state for CA, or 95% MN-bonds for MN residents.. (...And IL doesn't allow a break-out at all for IL municipal bonds held in a Mutual Fund)

3) For a 1099-DIV, if some of the $$ in box 1a or 1b came from US treasuries....then you have to calculate the actual $$ amount from the data the Mutual fund gives you at year-end...On one of the pages that follows the main software form, you get a page where you check a box to indicate that some was US bond interest...and then the next page allows you to enter the $$ amount associated with that. (For a 1099-INT, if you hold individual US bonds, the US bond interest will be in box 3 of that form, and the software handles it automatically without further input by you)

________________________

Example: You received $1000 of box 11 on a 1099-DIV. You live in NC and the broker indicates that 2% came from NC. So you break out $20 for NC, and $980 for "More than one state". That saved you $1 on your NC taxes since NC taxes at ~5% of the $20.

Whether it's worth the effort for you to break out the $$ from your state depends on the size your own-state bond holdings.

_______________________________________________

________________________________________

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

October 27, 2019

5:06 AM