- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where is the jump to link?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

To self-employed expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

To deduct seld employment expenses you need to upgrade to TurboTax self employed or TurboTax Home and Business.

To enter your self employment expenses:

- Type Schedule C in the Search box

- Select the Jump to link

- Answer Yes to Did you have any self-employment income or expenses? ? and answer the questions until you get the First, select the expenses you know you had screen

- Select your expenses, then Continue

- Then select Start or Edit or Add expenses for this work

- Select Start next to an expense type that you had

- Enter your expense description and amount, and answer any other questions we ask

- If you had more than one expense for a type, select Add another row to include them all

- If you have additional expenses of other types, repeat steps 3 through 5 to add more

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

trying to get to 1099-LTC keeps referring me to 'jump to' when i do not get that response. I have typed it in exactly like requested (in addition to other ways as well)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

@Motherskeeper wrote:

trying to get to 1099-LTC keeps referring me to 'jump to' when i do not get that response. I have typed it in exactly like requested (in addition to other ways as well)

Click on Federal Taxes (Personal using Home & Business)

Click on Wages & Income (Personal Income using Home & Business)

Click on I'll choose what I work on (if shown)

Scroll down to Less Common Income

On Miscellaneous Income, 1099-A, 1099-C, click the start or update button

On the next screen - On Long-term care account distributions (Form 1099-LTC), click the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

sep contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

Please try these steps to enter your SEP IRA contributions:

- Click "Wages & Income" (under Federal) on the left

- Scroll down and click "Show more" next to "Other Business Situations"

- Scroll down and click "Start" next to "Self-Employment Retirement Plans"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the jump to link?

cant find a jump to for extension using the downloaded version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

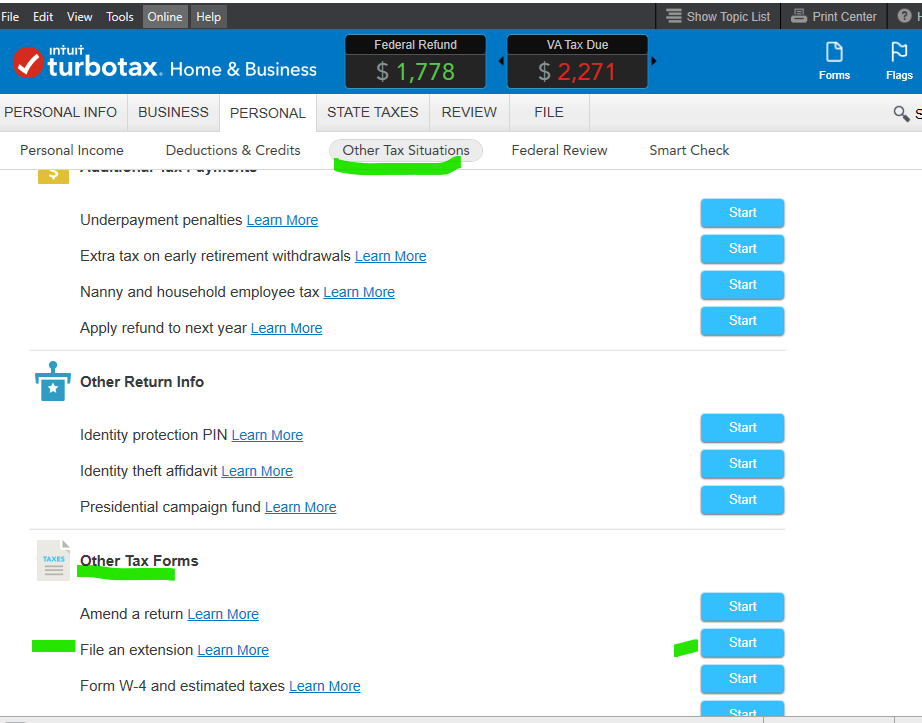

Where is the jump to link?

To file an extension in TurboTax for Windows:

Go to the Other Tax Situations tab at the top

Scroll down to Other Tax Forms

Click on Start for File an Extension

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mtks2011

New Member

mtks2011

New Member

tianwaifeixian

Level 4

curts314

New Member

Liangtwn

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill