- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

@bobweissman Don't know if this will help your situation or not but you can use Forms and then the 1099-B Worksheet to enter any sales. This will populate the preliminary Schedule D and Form 8949 and enter the gains or losses on the 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

@DoninGA wrote:@bobweissman Don't know if this will help your situation or not but you can use Forms and then the 1099-B Worksheet to enter any sales. This will populate the preliminary Schedule D and Form 8949 and enter the gains or losses on the 1040.

Thanks! That did get me closer to a plausible result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

I have the download version of premium. I don't see the worksheet. I do see the Schedule D but I can't populate it. Can someone please help? I need estimated 2020 taxes/numbers for financial aid due mid January.

*nevermind* it just came out in today's update!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

@laur2 wrote:

I have the download version of premium. I don't see the worksheet. I do see the Schedule D but I can't populate it. Can someone please help? I need estimated 2020 taxes/numbers for financial aid due mid January.

You can use Forms and then the 1099-B Worksheet to enter any sales. This will populate the preliminary Schedule D and Form 8949 and enter the gains or losses on the 1040.

Click on Forms. When in Forms mode click on Open Form in the upper left of the screen. Type in form 1099-B. Click Form 1099-B Worksheet to open the worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

the instructions have been out online (NOT draft) since 12/21/2020 so what is the hangup?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

@sisjhd00 wrote:

the instructions have been out online (NOT draft) since 12/21/2020 so what is the hangup?

The Schedule D instructions for tax year 2020 were only made available by the IRS on 01/05/2021.

TurboTax cannot finalize the schedule or the instructions until the IRS has also finalized the form and instructions and the the IRS has to approve the TurboTax form and instructions before it can be made available for filing in the TurboTax software.

The Schedule D and Form 8949 are estimated to be available on 01/14/2021

Go to this website for IRS forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

Schedule D has been working for a week or so. I don't know about anything else. They released it before that estimated time at least the update about a week ago solved it for me. I don't think it was available anywhere on 12/21/2020 though as someone else just posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

Why is this made a requirement to e-file when it does not even apply to me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

I am showing that the Schedule D is available for both online and Download/CD versions of TurboTax. Please click here to view online forms, and click here to see Download/CD forms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

My Turbo Tax indicates Schedule D is not ready - it is March 7? Please advise, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

@Baron2020 wrote:

My Turbo Tax indicates Schedule D is not ready - it is March 7? Please advise, thank you.

The Schedule D and Form 8949 have been available for several weeks.

Verify your software is up to date. Click on Online and then click on Check for Updates.

If you get a message that your program is up to date, save your tax return and close the TurboTax program.

Re-boot your computer. Open the TurboTax program and see if the problem persists. If it does then close the program.

Uninstall and re-install the TurboTax 2020 software. The program should update to the latest release after starting. The Schedule D and Form 8949 should now be available.

Note - The 2020 tax data file for your tax return is not removed by uninstalling the software as it is in different location then the TurboTax program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

I'm having the same problem, did they fix it for you yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

Exactly! I agree. That is apparently a change in 2020 that capital gain sale info cannot be entered manually a capital gains worksheet. It can only be done using the interview method, which I strongly dislike and find to be very tedious. I bought the Deluxe version, as I have done for years. Does anyone know if you can manually enter data directly on a capital gains worksheet in the 2020 Premier version of TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

Hello! Could you please tell me how? I have found it impossible to manually enter any data at all on any type of capital gains worksheet using the 2020 Deluxe version of TurboTax . Sales data can only be entered using the interview method, which I dislike and find very tedious. This is a change from prior years, since Schedule D reporting was apparently "dumbed down" in 2020, at least in the Deluxe version. Can anyone tell me if capital gain/loss data can actually be manually be entered on a worksheet in the Premier version? If so, I may need to upgrade.

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will Turbo Tax 2020 have Schedule D ready so I can input my data and make plans about last minute stock transactions so I can minimize my tax?

@ OrlandoSam wrote:Exactly! I agree. That is apparently a change in 2020 that capital gain sale info cannot be entered manually a capital gains worksheet. It can only be done using the interview method, which I strongly dislike and find to be very tedious. I bought the Deluxe version, as I have done for years. Does anyone know if you can manually enter data directly on a capital gains worksheet in the 2020 Premier version of TurboTax?

EDIT NOTE: Additional info and clarity added 4/06/2021 at 1:55 AM Pacific

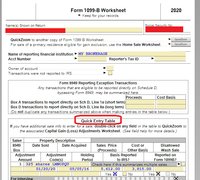

Are you wanting the quick method to enter multiple sales transactions of stocks/bonds/mutual funds, etc. to figure gain and loss? Deluxe Edition can indeed handle the Quick Entry method on a worksheet as explained below. It also allows one to enter summaries of multiple sales if/when allowed and desired in the table. I'll also include a couple of screen images below.

NOTE: I'm a fellow user, not a TurboTax employee, and don't have Premier to compare, so I can only talk about what I experience with Deluxe. I don't know if the Quick Entry Table is the same or different in Premier.

I suspect you are using the term "capital gain worksheet" loosely. Are you asking how to report multiple sales transactions in a table on the Form 1099-B Worksheet instead of entering the sales transactions in the interview step-by-step mode?

See this image below of the Form 1099-B Worksheet. Is this what you want? This image is from the Deluxe Edition (Windows version). When you make entries in the Quick Entry Table, the sales transactions flow to the Form 8949, or if summaries are entered and marked as such, in certain cases (Box A and Box D transactions with no adjustments) the summaries flow directly to Schedule D bypassing Form 8949.

NOTE: There is actually a separate place on the Worksheet where those types of Box A and Box D summaries (i.e, without adjustments) can be entered just above the Quick Entry Table. If you use that dedicated space, do NOT also enter them in the Quick Entry Table, or they will show up twice (you'll even see that warning on the worksheet.)

After you enter 4-5 transactions or so, a scroll bar will magically appear along the right side of the table, and it will automatically keep adding more transaction fields. That same worksheet also allows one to make an entry that summarizes multiple sales if/when allowed and desired, and by placing an X in the multiple sales summary-indication field.

.

.

NOTE: If you haven't already started a Form 1099-B Worksheet, you'll need to do so. You can generate one either by answering the first few screens of the step-by-step 1099-B interview, or you can generate one in Forms Mode manually using this method:

.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MeeshkaDiane

Level 2

patamelia

Level 2

patamelia

Level 2

WDM67

Level 3

mikejack52

New Member