- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

Dear experts,

I have a Supplemental form from ETrade, which has 2 columns for each RSU sale: Adjusted Cost Basis and Cost Basis.

Question 1) Should I use Cost Basis (reported in 1099-B) or Adjusted cost basis ?

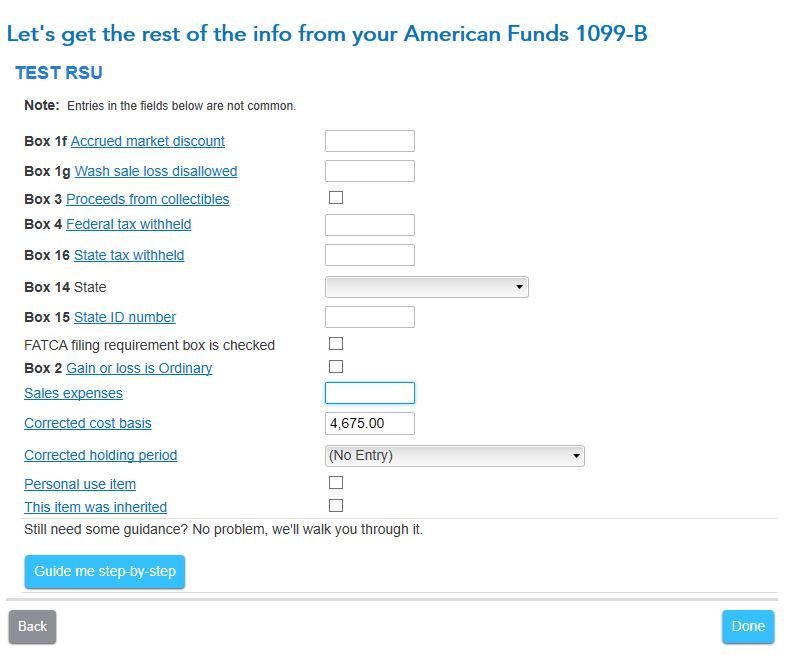

I am using TT Premier which takes "Cost Basis" by default. So I tried to correct it to enter "Adjusted Cost Basis". I edit each entry -> "Guide me step by step "-> .. "Tell me a bit more about this sale" -> Changed Cost basis number to Adjusted cost basis.

Question 2) Should I also choose "My Form 1099-B reports incorrect cost basis" for it to take effect? Because if I don't choose this, the cost basis is being taken in calculations.

Thanks so much for your advice!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

"1) ESPP: The "Adjusted Cost Basis" in ETrade Supplemental Form is different from "Cost Basis" in 1099-B. Should I correct those entries as well to the "Adjusted Cost Basis" in TT" and choose ""My 1099-B reports incorrect cost basis"?

2) RSU: The "Cost Basis" is 0 , so should I just correct it to Adjusted cost basis in TT?

As I said, ultimately you want to use the correct cost basis which should be the adjusted cost basis reported in the supplemental information provided by the broker. To keep life simply you could just change the basis reported on the 1099-B and be done with it. You wouldn't have followed IRS procedure - enter the basis on the 1099-B, then adjust it, and use a code to indicate why it was adjusted - but that's a "style" issue, not one of substance, and the IRS can't really lay a glove on you if your gain or loss is wrong. The only possible (remote) downside to this is that some computer would notice it an spit out a letter to you, that you'd have to respond to.

I don't use the MAC version but in the Windows version the easiest way to handle the trades correctly is to enter the 1099-B as it reads, click a button below the 1099-B entry form reading "I'll enter additional info on my own" then on the next page enter the correct basis in the "Corrected cost basis" box, and you are done.

The other way to do is is the enter the 1099-B exactly as it reads and then click a button below the 1099-B entry form reading "Guide me step by step." That's the path where you tell TurboTax about where you acquired the stock you sold and TurboTax gives you a customized interview for the stock. i think that's where TurboTax asks you if the amount reported on the 1099-B is correct.

It sounds to me like you might be clicking on that "Guide me Step by Step" button on the page where you enter the correct basis, (I'm assuming the MAC and Windows programs are the same here), and you don't want to do that!

Either use the 1st method of the 2nd method, but not both!

Since you have a desktop version I'm assuming that all the Forms, Schedules and Worksheets are always available to you, as they are in the Windows program. If so, simply open the Form 8949 where the trade(s) are reported and make sure you have them right. If they are not correct, go back to the interview, delete the trades and start over. Use either the "direct correction" of basis method (easiest and least error-prone) or use the step by step method.

(I've answered thousands of "stock" questions in here and have generally advised against using the step by step methods if you know what you're doing. The only exception I'll make to that generalization is if you have Disqualifying Dispositions of ESPP stock, then I'd suggest using the step by step method in that case.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

"Question 1) Should I use Cost Basis (reported in 1099-B) or Adjusted cost basis ?"

Ultimately, to determine you gain or loss, you do use Adjusted Cost Basis. Procedurally you're supposed to enter the amount reported by the broker and then adjust the amount such that the reported amount, the adjustment used for the calculation, and a code for the adjustment is shown on Form 8949. It sounds like you've done all that.

"2) Should I also choose 'My Form 1099-B reports incorrect cost basis' for it to take effect?"

I don't know how you entered your sale, using either the RSU step by step interview, or simply entering the original information on the 1099-B entry screen and then correcting that by clicking "I'll enter additional info on my own." (That's the method for "desktop" TurboTax and I assume "online" TurboTax does something similar.) Look at your Form 8949 before submitting the income tax return. If the calculated gain or loss is correct, you show and adjustment and a Code for the adjustment, then you've done things absolutely correctly, however you got there. AS A PRACTICAL MATTER, as long as you've stated your gain or loss correctly - that's really your obligation as a taxpayer - then showing an adjustment and a code just aren't all that important.

To get it right procedurally, then "Yes".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

Thanks a lot for your kind reply Tom! I am using TT Primier MAC desktop version. I first fed my E*Trade 1099-B form to TT . Then Update on "Stocks, Mutual...", -> "here's the investment sales info we have so far" => Edit on E*Trade -> screen titled "Here's all the sales reported by E*Trade.."-> Edit on each RSU value -> Guide me step-by-step->"My sale involves one of these uncommon situations" -> Stock -> Continue -> I bought this stock -> Continue -> Screen "Tell me a bit more about this sale" -> then I corrected the "Cost Basis" to be the adjusted cost basis from ETrade Supplemental form (12000) instead of the value from their 1099-B (9000). Now the only question is whether I should choose "My 1099-B reports incorrect cost basis" , because if I don't, it seems to be take the 9000 Cost basis instead of 12000 Adjusted cost basis. That's what I am confused about. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

Also, I noticed 2 scenarios : 1) ESPP and 2) RSU

1) ESPP: The "Adjusted Cost Basis" in ETrade Supplemental Form is different from "Cost Basis" in 1099-B. Should I correct those entries as well to the "Adjusted Cost Basis" in TT" and choose ""My 1099-B reports incorrect cost basis"?

2) RSU: The "Cost Basis" is 0 , so should I just correct it to Adjusted cost basis in TT?

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

"1) ESPP: The "Adjusted Cost Basis" in ETrade Supplemental Form is different from "Cost Basis" in 1099-B. Should I correct those entries as well to the "Adjusted Cost Basis" in TT" and choose ""My 1099-B reports incorrect cost basis"?

2) RSU: The "Cost Basis" is 0 , so should I just correct it to Adjusted cost basis in TT?

As I said, ultimately you want to use the correct cost basis which should be the adjusted cost basis reported in the supplemental information provided by the broker. To keep life simply you could just change the basis reported on the 1099-B and be done with it. You wouldn't have followed IRS procedure - enter the basis on the 1099-B, then adjust it, and use a code to indicate why it was adjusted - but that's a "style" issue, not one of substance, and the IRS can't really lay a glove on you if your gain or loss is wrong. The only possible (remote) downside to this is that some computer would notice it an spit out a letter to you, that you'd have to respond to.

I don't use the MAC version but in the Windows version the easiest way to handle the trades correctly is to enter the 1099-B as it reads, click a button below the 1099-B entry form reading "I'll enter additional info on my own" then on the next page enter the correct basis in the "Corrected cost basis" box, and you are done.

The other way to do is is the enter the 1099-B exactly as it reads and then click a button below the 1099-B entry form reading "Guide me step by step." That's the path where you tell TurboTax about where you acquired the stock you sold and TurboTax gives you a customized interview for the stock. i think that's where TurboTax asks you if the amount reported on the 1099-B is correct.

It sounds to me like you might be clicking on that "Guide me Step by Step" button on the page where you enter the correct basis, (I'm assuming the MAC and Windows programs are the same here), and you don't want to do that!

Either use the 1st method of the 2nd method, but not both!

Since you have a desktop version I'm assuming that all the Forms, Schedules and Worksheets are always available to you, as they are in the Windows program. If so, simply open the Form 8949 where the trade(s) are reported and make sure you have them right. If they are not correct, go back to the interview, delete the trades and start over. Use either the "direct correction" of basis method (easiest and least error-prone) or use the step by step method.

(I've answered thousands of "stock" questions in here and have generally advised against using the step by step methods if you know what you're doing. The only exception I'll make to that generalization is if you have Disqualifying Dispositions of ESPP stock, then I'd suggest using the step by step method in that case.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

Thank you very much Tom!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

Variations of this same question get asked year after year after year. I have been both an asker and an answerer, and yet I'm still not certain.

I think the heart of the problem is the terms that are used. With an E-trade account, they have a column called "Adjusted Cost Basis." Simple. Next is where do I enter my Adjusted Cost Basis in TurboTax?

Turbo Tax has no place to enter "Adjusted Cost Basis" per se. They do have a box called "Corrected Cost Basis."

Is that the same? That is, when you see the blank Turbo Tax box asking you to enter your "Corrected" Cost Basis, do you enter the amount from your E-Trade "Adjusted Cost Basis?"

You will, unfortunately, see different answers to that question. I still am unsure of the definitive answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter Adjusted cost basis from ETrade, should I also check 1099-B reports incorrect cost basis?

It would be great if Turbotax fixes that. Filled manually by mentioning corrected cost basis but IRS sent an email flagging since the etrade does not report the adjusted cost basis and you have to deal with that. I remember in the past there was an option to attach the 1098 form but now it does not show in etrade (it says supplemental) and turbotax also options do not help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeff7

Level 3

pinguino

Level 2

rmsaliba

New Member

Solar Eclipse

Level 3

sarkarp

Level 1