- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: What type of income would this be?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of income would this be?

Thanks, this is really helpful. When entering investment income that falls under "No Financial Institution," would I enter all of them together regardless of what they are?

For example, if I sold some sports cards, but also sold some tools for a profit, would those be all l under the same one, or would I have two entries named "No Financial Institution" because they are different types of items?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of income would this be?

Different lots or types of investments should be reported separately, such as one lot of collectibles and another lot of tools.

If the tools were work tools that were expensed or depreciated on Schedule C, then report the basis of the tools as zero or whatever adjusted basis remains.

See this TurboTax tips article for more information on reporting capital gains and losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of income would this be?

In regards to selling game consoles. There were some I purchased (at retail) in 2021, but returned in early 2022. Would I indicate that as end of '21 inventory and/or that I actually closed business in '22, or since I returned all that was remaining and and did not make any sales in '22, simply treat it as 0 inventory and close of business at the end of '21?

I don't know if this is splitting hairs, I just want to do things properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of income would this be?

If you purchased a game console at the end of 2021 and returned it for a refund in early 2022 when you were no longer operating a business and it was never recorded as business inventory or held for later resale as an investment, then it was simply a personal item returned for a refund and does not need to be reported on a tax return.

See this tax tips article for more information on business expenses.

See this tax tips article for more information on the purchase and sale of assets for investment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of income would this be?

I purchased three Xbox consoles in 2021, tried selling them online via Offerup/Facebook Marketplace, but ended up returning them for a refund in 2022. I did not do any inventory/tracking beyond what could be found in my related accounts and emails.

When I bought them my intent was to resell what I could for profit then return what I could not sell. I had no intent to keep any of them. It just so happened that it occurred over the course of a New Year, creating these questions. There were no further related sales in 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What type of income would this be?

Since there was no tracking of them, as long as you did not take any type of deduction for them, then there is nothing you need to do. If you did not take a deduction for them on your 2021 return, then you would not need to add that as income on your 2022 return. It is like the consoles never existed. In this case, you would say you closed the business in 2021.

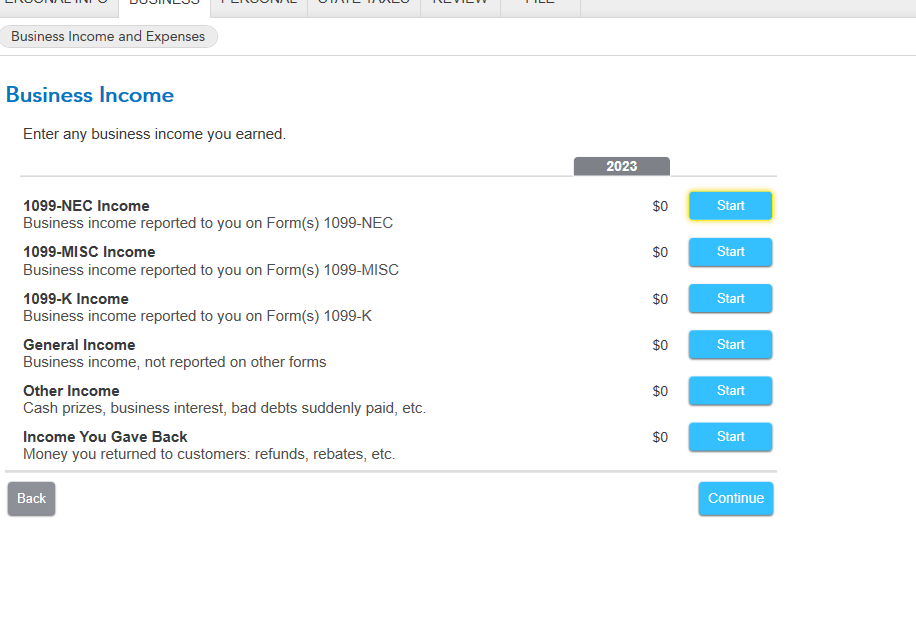

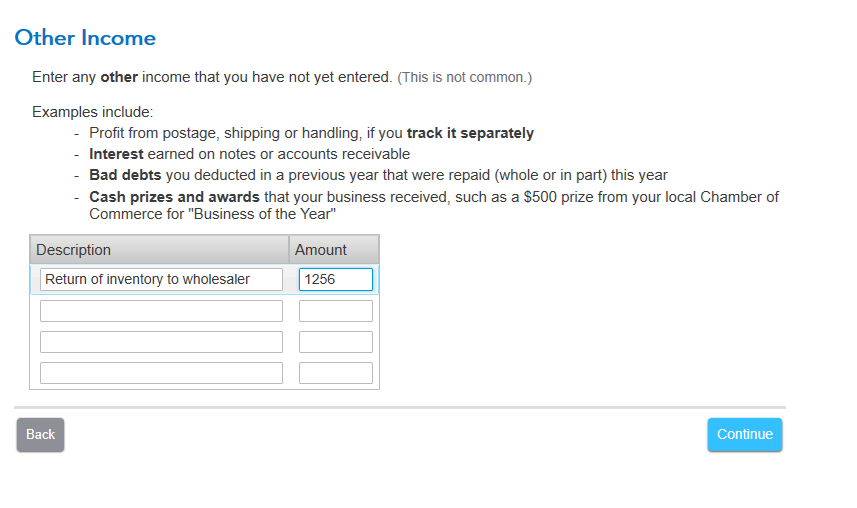

If however, you did take any type of deduction for the consoles in 2021, then you would need to report the return as income on your 2022 return when you returned them. So that mean you would need to report the business closed in 2022, not 2021. You would report this as Other Income in the business section for your 2022 return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

v8899

Returning Member

dcgelectriccorp

New Member

ed 49

Returning Member

chinyoung

New Member

Katie1996

Level 1