- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Since there was no tracking of them, as long as you did not take any type of deduction for them, then there is nothing you need to do. If you did not take a deduction for them on your 2021 return, then you would not need to add that as income on your 2022 return. It is like the consoles never existed. In this case, you would say you closed the business in 2021.

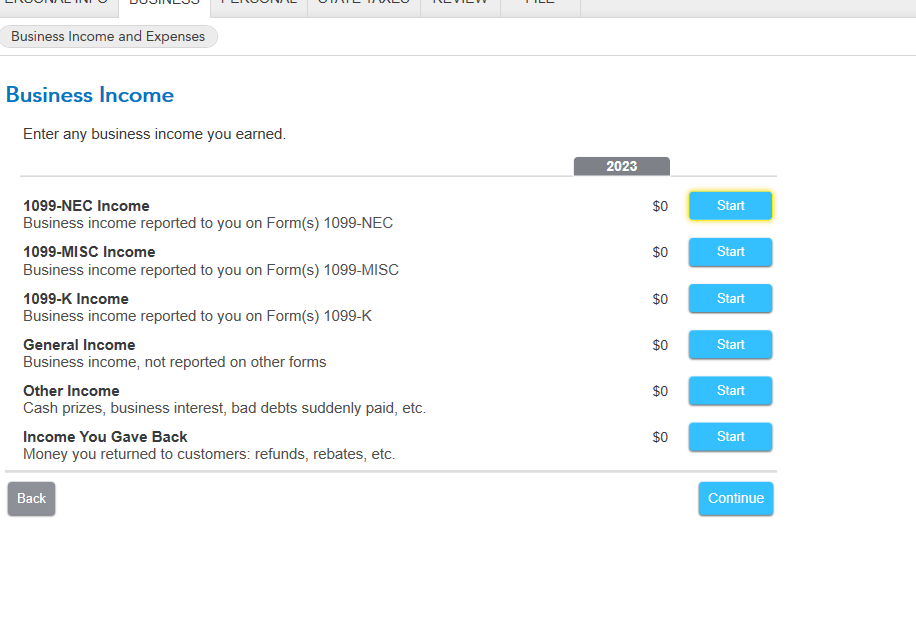

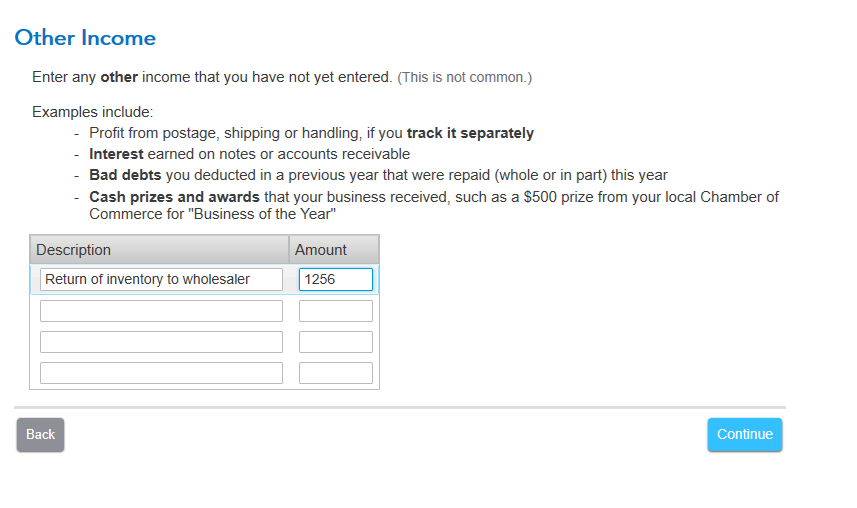

If however, you did take any type of deduction for the consoles in 2021, then you would need to report the return as income on your 2022 return when you returned them. So that mean you would need to report the business closed in 2022, not 2021. You would report this as Other Income in the business section for your 2022 return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 16, 2024

3:11 PM