- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: What is IRS treas 310 tax ref

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Bro I feel you I don’t know what’s taking them long even when I filed my taxes a long ass time ago

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

I received $9 in interest on my 2019 tax refund, so I received no 1099 because those were sent to people with over $10 in interest. However, I am required to report all interest, but I do not know what FEIN to use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

You don't need it. Just enter US Treas or IRS and the put the amount in box 1.

Enter a 1099-Int under

Federal

Wages & Income

Interest and Dividends

Interest on 1099INT - Click the Start or Update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

i have a pending transaction set for the 24th in my bank account could this be my tax refund because i haven't got it yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

In this forum we are unable to see your return and information but you can track and get personal updates on your return by clicking here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

You would need to call the IRS, they are the government entity that sent the stimulus’s to the nations needy families.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

The meaning of IRS TREAS 310 and other codes can be quite confusing but it generally refers to some form of government payment.

"IRS TREAS 310 tax ref" is either a tax refund or interest paid (by IRS) on a late tax refund.

Stimulus payments can also include the IRS Treas 310 code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Sorry but you're not 100% accurate since I didn't receive my kids part and didn't get form 1444. (Not your fault but the Gov.) I had to file my taxes and I normally don't file in order to get the missing part of the stimulus check. Which after I filed it's not showing its pending in my bank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Sadly the IRS did not follow their own instructions all the time and some folks didn't get all the stimulus they were expecting and many of the 1444 & 1444b forms didn't seem to make it either. All you can do is apply for the missing money on the 2020 return which is added to your regular refund. When the IRS will send the money is TBD ... check the IRS WMR? tool every couple of days for a progress report.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Where do you enter IRS TREAS 310 in Turbotax for Filing 2020 Taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Huh? That will be the description on your bank account for the refund Direct Deposit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

If you are asking where to enter the amount of stimulus payments you got in advance in the 2020 program :

To do this in TurboTax, please follow these steps:

- Log into TurboTax.

- After entering all your information click "Federal Review" at the top of your screen.

- On the screen "Let's make sure you got the right stimulus amount" click "Continue".

- You will be asked about the amounts of first round and second round stimulus payments you received. If you did not receive a payment enter "0".

- TurboTax will then calculate the amount of stimulus payment remaining that you are still entitled to get.

- Any stimulus amount remaining due to you will show as a credit on line 30 of the 1040.

For additional information please see Stimulus FAQ at the end of the TurboTax article.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Yes it is very sad, no one is perfect. But yes I filed 2020 taxes and just got the 2nd Stimulus money today for what was missing from my 2 kids. And with my leg broken in 4 spots and now I have a rod in it I won't be able to work for awhile let alone walk. Will be another 6+ months before I can somewhat walk again.

We will all get through this together, just have to help others no matter how when you can.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

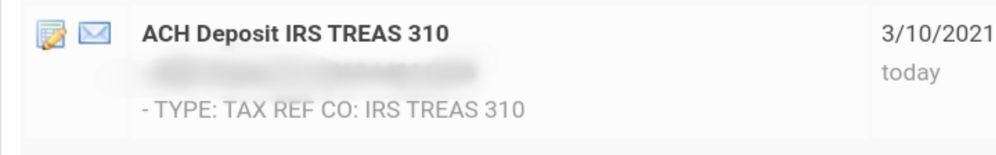

You don't enter that anywhere in TurboTax, it's the description that shows in your bank account when it's pending or after in your account statement.

Example of mine below in the screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is IRS treas 310 tax ref

Yes, look at my screenshot above for my account statement to show you what we mean.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kthomann35

New Member

marya912

New Member

tpgrogan

Level 1

QRFMTOA

Level 5

in Education

JKGab

Level 2