- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: What all is included inn abstract and recording fees?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

Abstract – A title insurance professional must perform a title search and produce documentation on the home’s title. The abstract is a concise summary of that search and official documents related to the immovable property. ($100-$200 depending on the length and complexity of the abstract)

Government Recordation Charges – The recording fee is paid to a government body which enters an official record of the change of ownership. ($85 for the Cash Sale/Deed, $225 for a mortgage, and these charges will vary slightly from parish to parish)

According to the IRS:

"These are recorded on your Closing/Settlement statement (HUD). Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including:

- Abstract fees

- Charges for installing utility services

- Legal fees

- Recording fees

- Surveys

- Transfer taxes

- Title insurance

- Any amounts the seller owes that you agree to pay (such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions)."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

Abstract – A title insurance professional must perform a title search and produce documentation on the home’s title. The abstract is a concise summary of that search and official documents related to the immovable property. ($100-$200 depending on the length and complexity of the abstract)

Government Recordation Charges – The recording fee is paid to a government body which enters an official record of the change of ownership. ($85 for the Cash Sale/Deed, $225 for a mortgage, and these charges will vary slightly from parish to parish)

According to the IRS:

"These are recorded on your Closing/Settlement statement (HUD). Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including:

- Abstract fees

- Charges for installing utility services

- Legal fees

- Recording fees

- Surveys

- Transfer taxes

- Title insurance

- Any amounts the seller owes that you agree to pay (such as back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions)."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

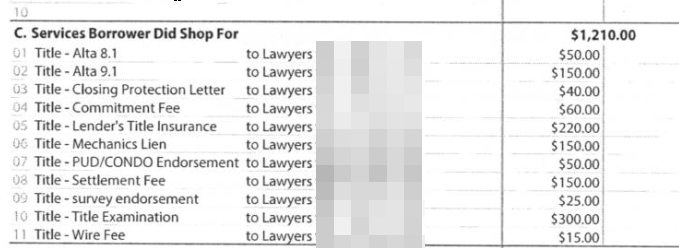

I have attached fees, can you tell me which one is "Abstract Fee", Legal fee, title search, document preparation, land survey, transfer or stamp taxes?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

That is not a HUD-1. There is no correlation between the items you asked about and what is on the form you sent.

Please see these links for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

All I had was a closing disclosure. I called out mortgage company and she said as of 2017 they were not long using the HUD1 form. My form looks exactly like the one posted above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

2017 was about when the form was changed. The HUD-1 is a required disclosure form. See this:

'According to the RESPA act, the HUD form is to be used by all lenders of loans providing funds for real estate purchases and refinances of real estate loans and must be given to the borrow at least one day prior to the date of settlement.'

Hopefully, you received something that reflected the actual (and not proposed) costs of the sale/purchase of the property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

Attached is Closing disclosures. In addition to this I received ALTA Combined Settlement Statement which looks like this one here - https://files.consumerfinance.gov/f/201311_cfpb_kbyo_closing-disclosure.pdf

Do you have any recommendations how can I find what is abstract and fees. I was able to locate recording fees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

Property documents including deeds, mortgages, litigations, tax sales and so on are included in the Abstract. It also includes a list of all the people that owned the property, and when they owned it.

Recording Fees are for the filing of the Deed and your mortgage within your County.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

From my research it looks like the HUD-1 is no longer required.

Recently, the Consumer Financial Protection Bureau stated that the current 3-page HUD-1 Settlement Statement is “replete with…technical and legal jargon… that may be more confusing than helpful. Complicated and lengthy disclosures can make it hard to answer or even ask the right questions.”

Because of what the CFPB believes, they have decided to do away with the HUD-1 settlement forms including the Good Faith Estimate and the Truth-in-Lending disclosure and replace them with forms entitled “Loan Estimate” and “Settlement Disclosure Form” also known as “Closing Disclosure form”. This change was effective October 3rd, 2015. The National Association of Realtors (NAR) is hosting a series of webinars on the topic. To learn when the next one is, go to Realtor.org/respa. Below are examples of the new forms:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

@lilacs After 8 responses, 3 of which were from "Experts", it seems to me that your questions wasn't really answered. I have the same question as you because my Closing Disclosure does not explicitly identify "Abstract" fees. If these are in fact the $100-200 Title Search fees, as mentioned above, then why does my Closing Disclosure devote a line for "Title - Search and Exam" not "Abstract" (which in my case was $17.50), and why does Turbo Tax have an entry box for "Legal Fees, Title Search, Document Preparation"? There must be a correct answer to this question since Turbo Tax devotes an entry box for this topic. Can someone please elaborate on an accurate answer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

As JohnB5677 mentions above the Abstract is a bundle of documents that would include a title search. Many times an "Abstract" is not part of the closing so the other items would be individually listed. That is why you see the lines separated in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

I understand. Title companies in different states and even counties have different billing methods and even the property involved could be a factor. There may not be an abstract and the closing may not require an abstract.

In any case you only enter an item once in TurboTax. Some closings include an abstract which has many of the fees in box two included. In that case you only need to enter the abstract and recording in box 1.

Some closings do not include an abstract and the items will be broken out and you would put them in box 2.

Some closings have a combination; there may be an abstract and/or recording fee plus some of the other items listed in box 2. You would separate into appropriate box 1 or 2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

I am confused, what is exaclty abstract? anything related to the title?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What all is included inn abstract and recording fees?

Has anyone figured out how to map the fields as posted above on February 6, 2020 8:16 PM to the fields TurboTax requires? Do all of the numbers in section C belong on the tax form?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Daytonmark

New Member

xmastune2050

New Member

Priscilla1985

Returning Member

bmshah1

Level 3

bmshah1

Level 3