- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Was not aware that I needed to file 1099G

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

how do I find out if I filed a 1099g?

I thought I did and I’m embarrassed to admit that I’ve checked and can’t see anything other than “your filing looks correct “

I honestly thought that after I filed, Uncle Sam would have sent me a refund on the tax I paid on my unemployment.

I’m not being petty. Honestly.

I just thought that I was due a refund.

Just askin’

And thank you for any help and/or advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

Hello Gcmbga!

You can do one of two things (or both):

- Check you tax return on Turbo Tax. Go to the Federal Section, Wages and Income and look for your 1099-G.

- Go to the IRS page and request your online transcript. Link : https://www.irs.gov/individuals/get-transcript The transcript will show what you filed on your return as income.

If you find that you did leave out the 1099-G, then you should amend your return. Amending your return is free when using Turbo Tax!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

Hello Gcmbga

It can be alot to remember if you entered a tax document to be included on your tax return! You would have received a Form 1099G form the state that issued your unemployment compensation. The data from the Form 1099G would have been entered on to your tax return.

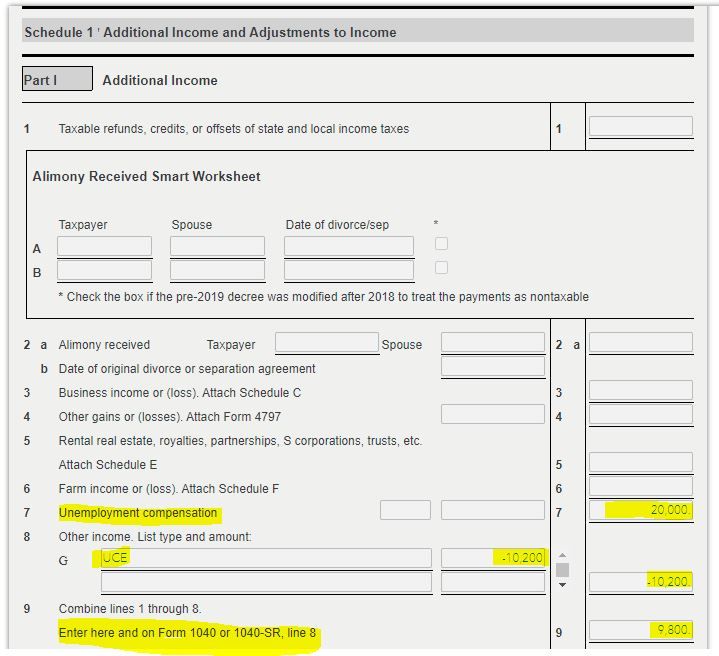

First, you'll want to review your return to confirm you included the unemployment compensation on your tax return. It would appear on your 2020 Schedule 1 Line 7. If it was included, you will want to confirm the exclusion if eligible is on your 2020 Schedule 1 Line 8.

If the unemployment compensation and exclusion are both included, great job!

If the unemployment compensation is included, and no exclusion, then you do not need to amend, the IRS is automatically adjusting the returns.

The IRS has said that payments will continue "throughout the summer," which means that unless we hear something else, payments could continue through September 22nd.

If you did not include the unemployment compensation on your tax return, then you would need to amend.

https://turbotax.intuit.com/tax-tips/amend-return/how-to-file-an-amended-return-with-the-irs/L6kO691...

I hope you find this helpful!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

When did you file? You needed to enter the full gross 1099G unemployment you received. Your unemployment compensation will be on Schedule 1 line 7. The new 10,200 exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

If you didn't include the 1099G you need to file an Amended return to add it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

Look at your tax return.

On Schedule 1 Line 7. If there is an amount entered that is the unemployment compensation you entered.

If you filed your 2020 tax return be for the exclusion was in effect, the amount from Schedule 1 Line 9 will flow to your federal tax return Form 1040 Line 8 and will include the amount of UC you entered.

If you filed on or after March 26, 2021 the UC will be excluded from your income.

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

On your tax return look at Schedule 1 Line 7. This will be amount of unemployment you reported for 2020. If you had withholding from the unemployment it will be the amount on line 25b of Form 1040 or Form 1040-SR.

If you reported the unemployment and you paid the tax on the first $10,200 then you will receive a refund of that tax paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

Did you use Turbo Tax online? Get a copy of your return.

How to get a copy after filing

Here's an alternate way to print by opening the filed return back up to print at the Print Center, where you can also get the worksheets.

Log in and at the Tax Home or in the section Your Tax Returns & Documents for 2020, look for a link Add a State. Click on Add a State. (you don't really add one. That's just to open your return back up.)

After the return is open, click in the left menu column on TAX TOOLS, then PRINT CENTER.

Then choose Print, save, view this year's return.

The next screen should offer some options: Just my tax returns or include government worksheets (optional), or include government and TurboTax worksheets (optional.)

or You can request a transcript from the IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

I believe I was around 19k in unemployment.

I’m struggling to get computer connected at the same time my phone is going dead.

So frustrating.

Like I said, I’m not being petty, I’ve just had some unexpected car issues and could use the help.

That’s it in a nutshell.

I wouldn’t have even cared had it not been for this. Ugh

Thanks for the help.😉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

I am sorry you are having computer and car problems. Many people are telling others that they are getting money back, but that is not always true. If you really did overpay, then you will get the money back at some point,.

But everyone who received unemployment is not going to get a credit, just those who overpaid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

I filed AND received my return way before the amendment.

I’m looking at my returns now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

I’d be happy to send you the pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

No do not send a pdf to anyone or here. We are just other users. This is a public user forum and it is not safe.

How much is on 1040 line 8? Do you have a Schedule 1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

Ok.

My UC was 19,751

That is on my return. For sure.

but did I get compensated for the tax I paid on that?

Just asking any trust me…I hate this petty sh..tuff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

Nothing reported on line 7 but line 8 was my unemployment income of an embarrassing 19,750

Line 9 is my total of 25,250

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Was not aware that I needed to file 1099G

I’m assuming it’s a schedule 1. But line 8 was 19,751.

(which I assumed- and did - have taxes taken out of each check (because I didn’t want to owe)

Thats the whole thing that I was hoping to get a refund from.

Again and reiterate, not being petty, just that car troubles have come about.

i honestly thought I was due a 700 or so check/deposit and waited and waited.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lchan

Level 3

cottagecharm11

Level 4

adrianadablopez

New Member

briberglund123

Level 1

jasonlarsenconst

New Member