- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

Despite leaving the company in 2023 and only having residual garden leave pay in 2024, my W-2 has 3 pages: one for CT where I live, and 2 for other states I did not work / live in. So I have 3 pages for boxes 15-17 with different amounts in line 16 and 17 for each state.

Do I need to "add another state" and add these amounts in? And what impact will that have on my taxes? I won't be paying extra tax on this, i.e. entering in wages 3 times in box 16 right?

For context, the CT state tax (box 17) is $300 but the NY (where I don't live and didn't work) has $50K. And then a 3rd state lists $1200.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

The first thing I'd suggest is checking the paystub for this bonus to ensure that the W-2 is reporting state tax withholding correctly. If your paystub shows the additional states being withheld, you'll need to include all of the states on your W-2 and file nonresident returns in those additional states.

When you prepare the returns, make sure you allocate $0 of income as earned in those states. This will ensure you get a refund from those states since none of your income would be taxable to those states. You will still have a balance due on your Connecticut return since there was little tax withheld.

If the paystub shows all of the withholding being for Connecticut, your old employer should issue you a corrected W-2 with the correct amount showing for boxes 15-17.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

Let's go through them.

NY -The state begins with residency. Be sure you have nonresident selected. When it asks if all of your wages were earned in NY, select No.

Go through entering zero wages, zero whatever else you have.

No taxable income will refund any tax withheld.

NC

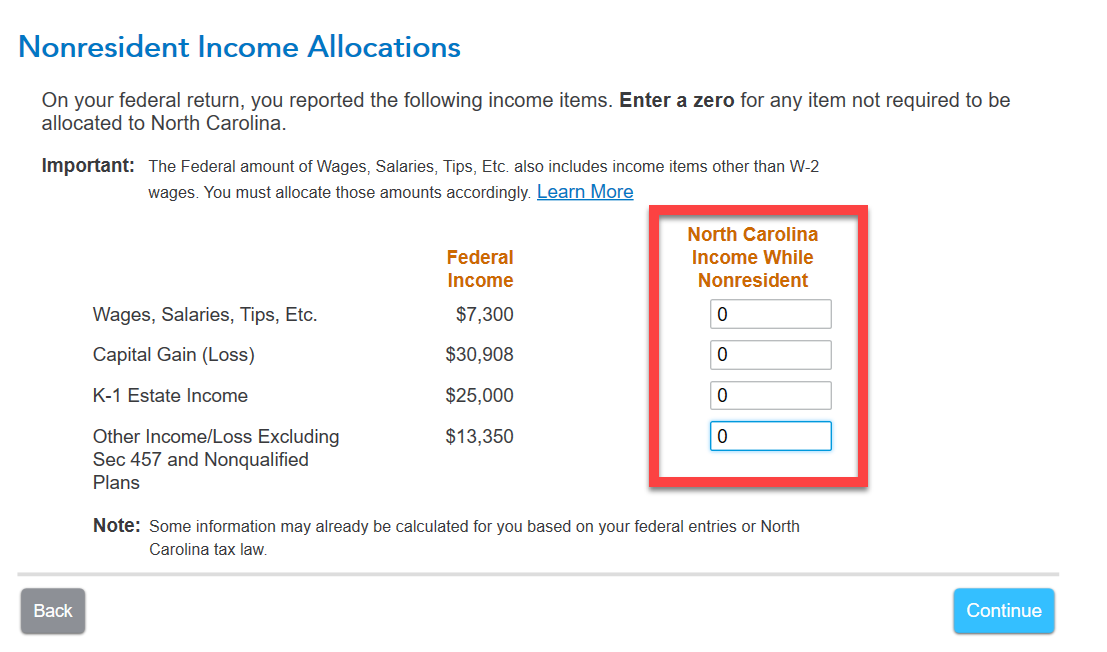

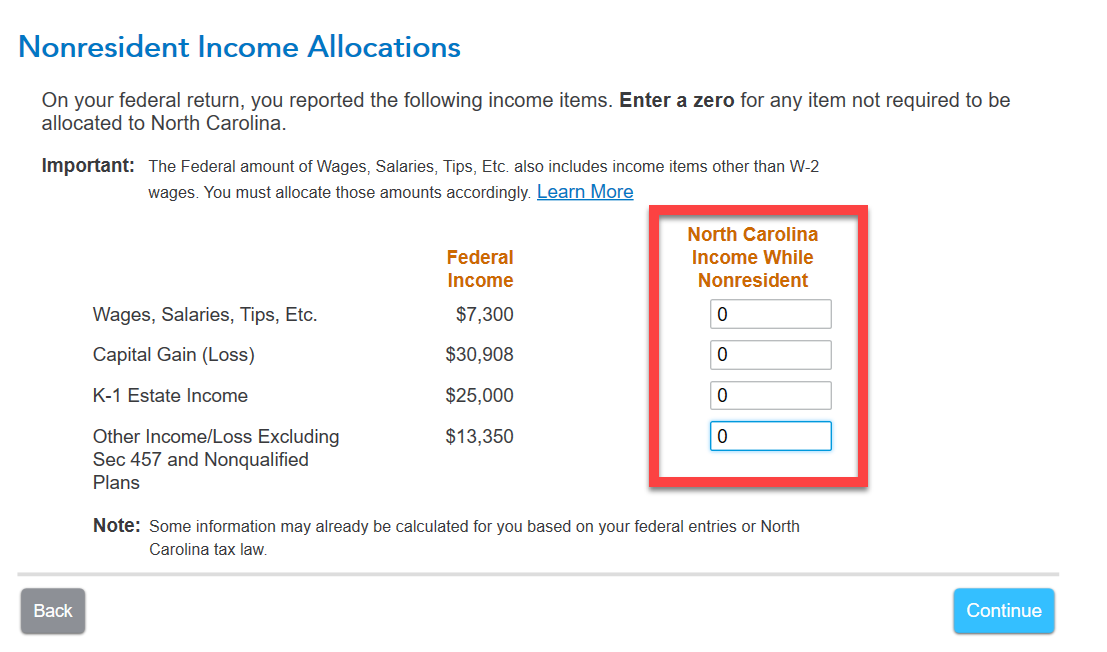

Be sure you have selected nonresident and go until you see the Part-Year and Nonresident Income section. Enter zeroes and continue entering zeroes.

You will end up zero taxable percentage of income

You will get a refund of tax withheld.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

Please clarify your question.

- What is the value in box 1?

- Did you contact the employer, or HR to request an explanation?

Please contact us again to provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

The value in box 1 was my 2023 bonus paid in 2024 along with severance that extended into 2024. I left the firm in September of 2023. The employer has not been helpful.

I'm not sure I understand your question though - for 2024, I did not work for this company and only received the amounts above. Yet (1) I have 3 W-2 pages for NY and NC in addition to CT, (2) my CT tax paid was only a few hundred dollars when in fact it should have been in the tens of thousands, (3) my NY taxes paid are in the tens of thousands despite not working/living in the state, and (4) TT is showing I owe all the CT tax but getting none of the NY benefit. If you swap out my NY tax amount in box 17 for the CT box 17, I would likely get a refund instead of owing a ton. I have no idea why page 3 is for NC - I didn't step foot in that state in 2024 and the firm is based in MN...

Is that helpful?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

The first thing I'd suggest is checking the paystub for this bonus to ensure that the W-2 is reporting state tax withholding correctly. If your paystub shows the additional states being withheld, you'll need to include all of the states on your W-2 and file nonresident returns in those additional states.

When you prepare the returns, make sure you allocate $0 of income as earned in those states. This will ensure you get a refund from those states since none of your income would be taxable to those states. You will still have a balance due on your Connecticut return since there was little tax withheld.

If the paystub shows all of the withholding being for Connecticut, your old employer should issue you a corrected W-2 with the correct amount showing for boxes 15-17.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

This is a great response, thank you. I looked at that payslip and it has NY and NC tax withheld and none for CT. I did ask back then and their response was: "it depends on the the state in which you were hired" and didn't think anything further of it (I did live in NY but moved 2 years ago, 4/1/23).

My follow up question is how/where do I "allocate $0 of income as earned in those states"? Where is that field?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

You're welcome!

After set up the returns as a nonresident and progress through the screens, you'll come across pages asking how much income you earned in each state. You can just enter zeroes in the boxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

I've gone through the screens multiple times and still can't find where to enter 0s for NY and NC (didn't work there). The nonresident options didn’t even appear for me.

Additionally:

The income allocation screens don’t seem to match what you described.

The meter at the top hasn’t adjusted for NY and NC, though I’m not sure if that’s relevant.

Can you point me to the screen name or section where I should be entering 0s for NY and NC? If it’s a specific step in the State section, should I be selecting or deselecting anything to trigger the right screens?

Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

Let's go through them.

NY -The state begins with residency. Be sure you have nonresident selected. When it asks if all of your wages were earned in NY, select No.

Go through entering zero wages, zero whatever else you have.

No taxable income will refund any tax withheld.

NC

Be sure you have selected nonresident and go until you see the Part-Year and Nonresident Income section. Enter zeroes and continue entering zeroes.

You will end up zero taxable percentage of income

You will get a refund of tax withheld.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-2 has multiple states, even though I only worked in one. Do I need to enter it all?

@AmyC that was SUPER helpful - half the time, it's hard to follow the advice because you can't even get to the screen and the other half is actually filling it out correctly; your advice was crystal clear and helped me get this fixed - thank you!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jorgeortioneto

New Member

lori

New Member

Gulbickib

New Member

hessiont58

New Member

b_lglez

New Member