- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

The unemployment tax break was reported yesterday (3/22) to been updated on Turbo Tax; however it's not yet reflected on my return (online version, not software). I am eligible, so why isn't it showing up?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

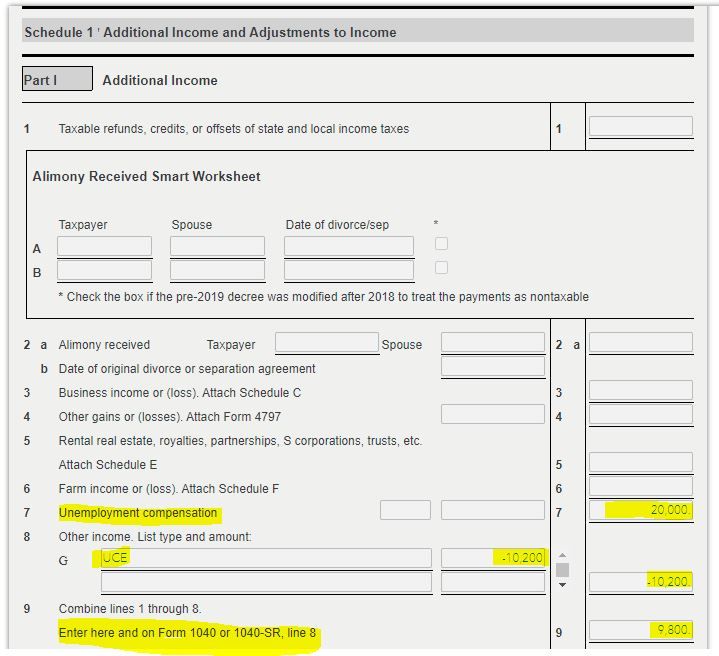

On Schedule 1 Line 7 is the unemployment compensation you entered. On Line 8 is the exclusion amount as a negative number. What is shown on your Schedule 1?

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

Thanks for your quick response...Line 8 is blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

@DeckerPair wrote:

Thanks for your quick response...Line 8 is blank.

Is your 2020 AGI $150,000 or more? If so you are not eligilbe for the exclusion.

Otherwise delete the Form 1099-G for the unemployment compensation and re-enter.

Enter 1099-g in the Search box located in the upper right of the program screen. Click on Jump to 1099-g

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

The $10,200 brings our AGI to under $150K. I've tried deleting and re-adding G but get the same results. My understanding is that it's based on *modified* AGI; meaning we do qualify since it reduces AGI to under $150K.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

@DeckerPair wrote:

The $10,200 brings our AGI to under $150K. I've tried deleting and re-adding G but get the same results. My understanding is that it's based on *modified* AGI; meaning we do qualify since it reduces AGI to under $150K.

It is your modified AGI before the unemployment exclusion, not after.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

On March 12 the IRS said to include unemployment in determining modified AGI; however today (3/23) they decided that means without regard to any unemployment compensation. What does that mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

Here's a link to the article:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

This is what the IRS states - https://www.irs.gov/forms-pubs/new-exclusion-of-up-to-10200-of-unemployment-compensation

1.Add Lines 1 thru 7 on the Form 1040

2.Add Lines 1 thru 6 on the Schedule 1

3.Any amount on Line 8 Schedule 1 (not the exclusion amount if shown)

4.Total of 1, 2 and 3

5.Any amount on Line 10c of Form 1040

6.Add 4 and 5

7.Is the amount on line 6 $150,000 or more?

a. [ ] Yes. Stop You can't exclude any of your employment compensation

b. [ ] No. Go to line 8

From the IRS worksheet -

Unemployment Compensation Exclusion Worksheet – Schedule 1, Line 8

- If you are filing Form 1040 or 1040-SR, enter the total of lines 1 through 7 of Form 1040 or 1040-SR. If you are filing Form 1040-NR, enter the total of lines 1a, 1b, and lines 2 through 7.

- Enter the amount from Schedule 1, lines 1 through 6. Don't include any amount of unemployment compensation from Schedule 1, line 7 on this line.

- Use the line 8 instructions to determine the amount to include on Schedule 1, line 8, and enter here. Do not reduce this amount by the amount of unemployment compensation you may be able to exclude.

- Add lines 1, 2, and 3.

- If you are filing Form 1040 or 1040-SR, enter the amount from line 10c. If you are filing Form 1040-NR, enter the amount from line 10d.

- Subtract line 5 from line 4. This is your modified adjusted gross income.

- Is the amount on line 6 $150,000 or more?

a. [ ] Yes. Stop You can't exclude any of your employment compensation

b. [ ] No. Go to line 8

- Enter the amount of unemployment compensation paid to you in 2020. Don't enter more than $10,200.

- If married filing jointly, enter the amount of unemployment compensation paid to your spouse in 2020. Don't enter more than $10,200. If you are filing Form 1040-NR, enter -0- .

- Add lines 8 and 9 and enter the amount here. This is the amount of unemployment compensation excluded from your income.

- Subtract line 10 from line 3 and enter the amount on Schedule 1, line 8. If the result is less than zero, enter it in parentheses. On the dotted line next to Schedule 1, line 8, enter "UCE" and show the amount of unemployment compensation exclusion in parentheses on the dotted line. Complete the rest of Schedule 1 and Form 1040, 1040-SR, or 1040-NR.

When figuring any of the following deductions or exclusions, include the full amount of your unemployment benefits reported on Schedule 1, line 7 (unreduced by any exclusion amount): taxable social security benefits, IRA deduction, student loan interest deduction, nontaxable amount of Olympic or Paralympic medals and USOC prize money, the exclusion of interest from Series EE and I U.S. Savings Bonds issued after 1989, the exclusion of employer-provided adoption benefits, the tuition and fees deduction, and the deduction of up to $25,000 for active participation in a passive rental real estate activity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

Using the IRS worksheet, I got 7B (continue to #8). I don't understand #8...I received more than $10,200 unemployment; why does it say not to enter more than $10,200?

If I understand this correctly, I AM supposed to get the full 10,200 and Turbo Tax isn't figuring it correctly (yet, perhaps because of the IRS change today?). Do I need to wait until the new change is incorporated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

#8 it must mean because 10,200 is the max amount you can exclude.

Then See #10....

Add lines 8 and 9 and enter the amount here. This is the amount of unemployment compensation excluded from your income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

The worksheet shows I should meet the AGI to get the exclusion. So TT needs to update their software (again) to exclude the Unemployment Compensation, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Tax Break reported on 3/22 to be updated on Turbo Tax; however I don't see it yet

@DeckerPair wrote:

The worksheet shows I should meet the AGI to get the exclusion. So TT needs to update their software (again) to exclude the Unemployment Compensation, correct?

Ran some numbers using the online editions and it sure looks like the software is using the prior IRS worksheet. Need to get confirmation from the TurboTax Moderators.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jacelynwillis

New Member

joegrillope

New Member

vithlanisamay

Returning Member

IndependentContractor

New Member

scatkins

Level 2