- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax will not let me edit HSA Contribution amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

I entered my HSA contribution without realizing it was already calculated from my W2. Therefore, I need to go back and edit/delete it so I don't receive a bigger refund than I'm owed. TurboTax will not let me do this. Please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

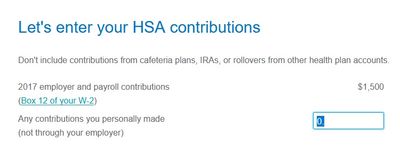

If I understand you correctly, part of your HSA contribution was a payroll deduction that you did with your employer, and that the code W amount in box 12 on the W-2 contained both your employer's contribution and your payroll deduction contribution, but then, on the screen headed "Let's enter your HSA contributions" (see screenshot below), you entered your payroll deductions again on the second line as a "personal" contribution?

What you need to do is to go back to the HSA interview (Federal->Deductions & Credits->Medical->HSA MSA Contributions). Proceed through the interview. You may see a screen that asks if you made any contributions to your HSA (actually, it means, "did anyone make contributions to your HSA?"); if you see this answer, "yes".

However, depending on your previous input, you may directly see this screen "Let's enter your HSA contributions" (see the screenshot above).

If you previously entered any part of the code W amount on the second line ("personally made"), then get rid of it. I assume that you will probably enter zero here to zero out the previous number. Then you can continue your return.

Try that and see if the excess contribution message doesn't go away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

Thank you and yes, your understanding is spot on. My issue seems to be a technical one as the site will not allow me to make the changes you suggested.

When I click 'Edit', I am taken to 'Your HSA Summary' page where it lists the additional deduction. I click 'Edit' on that page and it takes me to the 'Tell us about your health-related accounts...' page. I proceed through the steps, yet I am never brought back to the section where I previously entered the additional personal contributions. I even tried to get there a different way under tax breaks>Medical>Show More>Revisit but I end up on the same route as above.

Is there a way to reset this section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

Well, I am not sure what screen you are looking for, if it is not the one I showed...but one of the "opportunities" with TurboTax's dynamic screen flow is that it can sometimes be a challenge to get back to where you were...

To your new question, yes, you can "reset" by deleting all your HSA data and starting over. This is the process:

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

6. go back and redo the entire HSA interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

I'm having the exact same problem and its driving me insane. It's locked onto $0 but I need to change it to $8k. There seems to be no fix and the web software has locked down this feature to be unchangeable. Absurd.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

elizabethripley

Did you return to the HSA interview, to the screen, "Let's enter [name]'s HSA contribution"? This is the screen that has the code W amount (from box 12 on the W-2) on the first line, and the second line is for "personal" contributions (that is, contributions made directly to the HSA, not through the employer). You evidently made an entry on the second line, even though all your contributions were probably included on the first line.

You need to change the number on the second line ("Any contributions you personally made (not through your employer)") to be the amount that you sent directly to the HSA custodian. This number likely should be zero.

Have you done that?

Hazzmatt

"It's locked onto $0 but I need to change it to $8k." - What is locked onto $0? Do you mean the first line on the screen I referred to above (2024 employer and payroll contributions)? Of course it's locked in because this number is taken directly from the code W amount in box 12 on your W-2. This is the amount of HSA contributions that your employer has already sent to your HSA custodian as well as the number that your employer has already sent to the IRS when they sent a copy of your W-2 to them.

What is it that you are trying to do?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

Right. I understand the difference in the 2 lines. I didn't enter anything into the "personally made" field. This is for my wife. I realized she doesn't have a W in her W-2 form in section 12. She has a DD. The description for a DD sounds similar to W, but it's not. For some reason DD is total health care premiums, whereas my W is for HSA contributions. I don't know why hers is different since we both have HSA accounts we contribute to. Must be some bureaucratic nonsense. But anyway, the "interview" on Turbotax doesn't say anything about it being a W. It just says box 12, which isn't specific enough and is confusing. The field should be editable or the instructions should make more sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax will not let me edit HSA Contribution amount

So did her employer make any contributions to her HSA or did she contribute to her HSA by means of payroll deductions? If either of those are true, then her employer made a mistake on her W-2.

Yes, code DD is for the sum of what her employer paid for health care premiums plus whatever she paid for health premiums. The code W refers ONLY to contributions to the HSA.

Note that there are a few employers who do a so-called "passthrough" contribution: Some or all of the amount under code DD is diverted to the HSA, so they print no code W even though contributions are made to the HSA.

However, this does not appear to be sanctioned by the IRS - the W-2 instructions, for example, make no mention of this process.

So ask them if they are doing a "passthrough" and if they aren't tell them they need to issue a corrected W-2 with a valid number for code W in box 12.

In this case, it's not bureaucratic nonsense, it's that employers don't read the IRS instructions and/or don't understand them. The W-2 Instructions (line above) are written for the employer to tell them how to complete the form, not for the taxpayer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

MaxRLC

Level 3

carsonschafer

New Member

MaxRLC

Level 3

kkrana

Level 1