- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

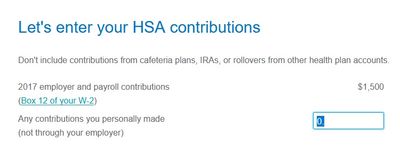

If I understand you correctly, part of your HSA contribution was a payroll deduction that you did with your employer, and that the code W amount in box 12 on the W-2 contained both your employer's contribution and your payroll deduction contribution, but then, on the screen headed "Let's enter your HSA contributions" (see screenshot below), you entered your payroll deductions again on the second line as a "personal" contribution?

What you need to do is to go back to the HSA interview (Federal->Deductions & Credits->Medical->HSA MSA Contributions). Proceed through the interview. You may see a screen that asks if you made any contributions to your HSA (actually, it means, "did anyone make contributions to your HSA?"); if you see this answer, "yes".

However, depending on your previous input, you may directly see this screen "Let's enter your HSA contributions" (see the screenshot above).

If you previously entered any part of the code W amount on the second line ("personally made"), then get rid of it. I assume that you will probably enter zero here to zero out the previous number. Then you can continue your return.

Try that and see if the excess contribution message doesn't go away.