- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax update to 2021 American Rescue Plan

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

@Bolivious wrote:

I'm using Home and Business software and trying to find where Schedule 1 line 8 is to put the Unemployment Credit of $10,200. How do I get there?

The unemployment compensation exclusion was updated across all TurboTax platforms, online and desktop, on 03/26/2021.

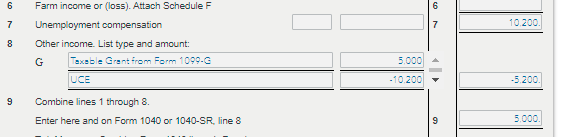

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Have you updated your software to the latest release? Are you using a Windows or a Mac personal computer?

You do not enter the exclusion on Schedule 1. The TurboTax software calculates the exclusion and enters that on Schedule 1.

To view the Schedule 1 click on Forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

You don't manually enter information onto Schedule 1. All you do is enter the unemployment and the program will make the adjustment.

Re: New Exclusion of up to $10,200 of Unemployment Compensation

The program has been updated to automatically apply the adjustment for unemployment as long as you have entered it in the appropriate section as outlined below.

You will enter the unemployment information in the federal interview section.

- Select Income & Expenses

- Scroll down to All Income and select Unemployment

- Select Unemployment and paid family leave

- You will be able to enter your information from your Form 1099-G

The adjustment will be reflected on Schedule 1, Line 8G.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

Yes, I know the deadline for Federal is May 17 but my state is due on April 15th - and If I do not pay , the interest begins. Turbo Tax needs to get the update in ASAP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

That's too bad that your state hasn't changed their deadline to line up with the Feds. Right now, the delay is not TT's fault. Here's a synopsis of the process, as explained by a TT employee earlier in the thread:

1. Congress passed legislation in March, stating what needs to be done, but they didn't say how to implement it.

2. The IRS is now trying to figure out how to implement all the changes that Congress told them to do. i.e., they have to figure out what forms need new or different line item instructions, then they have to actually change the forms and write instructions for all the new changes. Then they have to figure out how these changes affect other parts of the tax code. Probably this APC that we now don't have to repay will get counted as income. Is that new bit of income taxable or not? (If I had to guess, I would say that it will be taxable, that any excess APC we received will now be basically considered a taxable grant, but don't quote me on that.) The IRS has to decide this, and make further changes to other forms, too. This is where the process currently is.

3. After the IRS figures out how to implement all the changes, then TT and other tax software companies have to write the code for the software updates, then send those software updates to the IRS for testing and approval.

4. Only once the IRS approves the software updates will TT be allowed to push the updates down to us, the end-users.

I still counsel patience. If anything, you should be contacting your state legislators and asking them to push your state deadline back to be in line with the Feds. Any change in your Federal taxable income is probably going to also change your state taxable income, too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

Others have asked similar questions, but I haven't seen an actual satisfactory answer from TurboTax yet, so...

I already filed my taxes and owed money. I received unemployment income, so my taxes need to be refigured and the amount I owe reduced. When will I be able to make this change in TurboTax? I'm not going to pay more than I owe and wait for a refund. That is not a satisfactory solution at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

The IRS guidance to those who have already filed prior to ARPA being passed is to NOT file an amendment, that they will fix it on their end. What I would do, if I were in your shoes where you have filed but not yet paid the amount your return said you owed before ARPA passed would be to run the TT update and let it fix your numbers, so that you will know how much you now owe, or how much you should now be getting as a refund, but do NOT file the updated tax forms. At this point, either pay the new amount you owe, or sit back and let the IRS eventually send you a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

Is there an answer for this or do I need to post somewhere else?

--------------------------------------------------------------------------------------------------

"I have 2 dependents. One is 17. I only see one 1,400 child tax credit on line 28. Are you saying I only get 1 child tax credit even though she should qualify with the new laws? Why were we waiting for the software to update for this year's return if the new COVID laws don't affect taxes until next year?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

If you have 2 dependents and one if 17, your total child tax credit for 2020 would be $2500 ($2000 plus $500). The dependent over 16 is only eligible for $500 while the dependent under 17 is eligible for $2,000. Since your tax liability on line 22 must be zero, you received the maximum additional child tax credit for 2020 on line 28 of $1400. Click here for more information on additional child tax credit.

Starting in 2021, the credit is raised to $3000 per dependent under the age of 18 or $3600 per child under the age of 6. Advance payments will begin the second half of 2021. Click here for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

Any news on when Turbo Tax will be updated regarding repayments of excess premium tax credits paid through the ACA, per the American Rescue Plan? I am getting a message that the Federal Return is already updated but it still shows that I owe a repayment amount. Is this message an error??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

@Mwsanford, last I heard, TT is still awaiting guidance from the IRS on this part of ARPA. Here's the summary of the process for updating TT and any other tax software:

1. Congress passed legislation in March, stating what needs to be done, but they didn't say how to implement it.

2. The IRS is now trying to figure out how to implement all the changes that Congress told them to do. i.e., they have to figure out what forms need new or different line item instructions, then they have to actually change the forms and write instructions for all the new changes. Then they have to figure out how these changes affect other parts of the tax code. Probably this APC that we now don't have to repay will get counted as income. Is that new bit of income taxable or not? (If I had to guess, I would say that it will be taxable, that any excess APC we received will now be basically considered a taxable grant, but don't quote me on that.) The IRS has to decide this, and make further changes to other forms, too. This is where the process currently is.

3. After the IRS figures out how to implement all the changes, then TT and other tax software companies have to write the code for the software updates, then send those software updates to the IRS for testing and approval.

4. Only once the IRS approves the software updates will TT be allowed to push the updates down to us, the end-users.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

if I have mailed my return and I paid taxes on my unemployment. Will the Federal adjust what my refund is supposed to be?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

@LWILLIAMS54 wrote:

if I have mailed my return and I paid taxes on my unemployment. Will the Federal adjust what my refund is supposed to be?

If you already filed - do not amend. See this:

https://www.irs.gov/newsroom/irs-to-recalculate-taxes-on-unemployment-benefits-refunds-to-start-in-m...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

Try updating your software. It should automatically reduce the UI 1099-G.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

TurboTax has finally updated the software to support the American Rescue Plan ACA Credit!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax update to 2021 American Rescue Plan

Updated today for ACA Credit on overpayment.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Werniman0606

New Member

tukus-raides

New Member

aofigueroa117

New Member

in Education

akanding

New Member

olive917

New Member