- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax keeps reducing my interest deduction from $30k to $10k saying standard deduction is ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

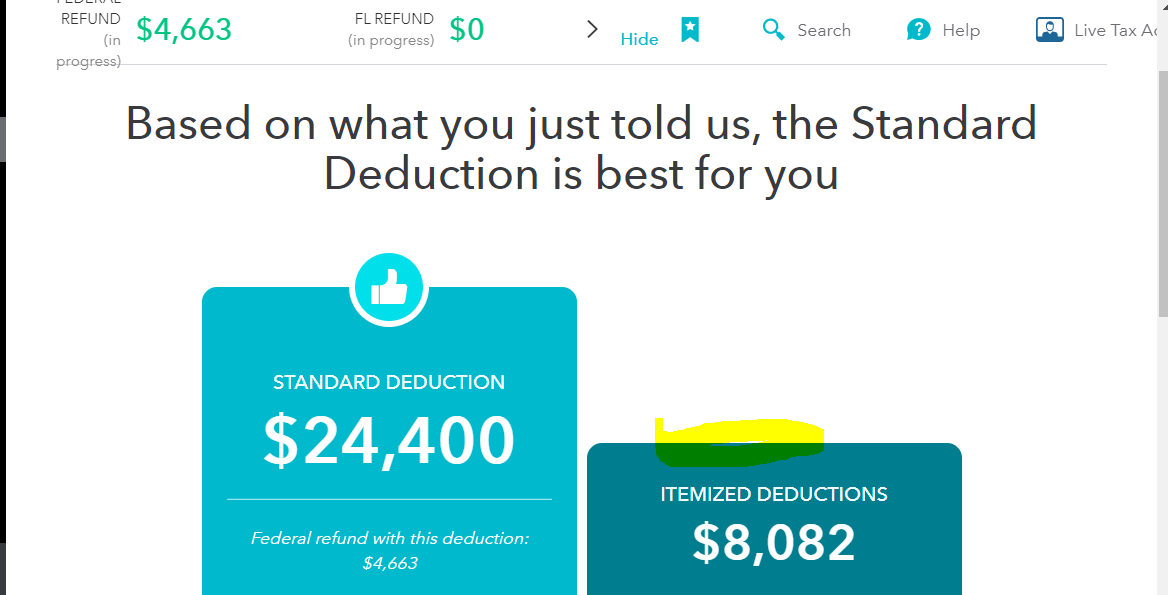

TurboTax keeps reducing my interest deduction from $30k to $10k saying standard deduction is best. This makes no sense as my primary loan was originated in 2016 and has a balance of about $830k. H

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax keeps reducing my interest deduction from $30k to $10k saying standard deduction is best. This makes no sense as my primary loan was originated in 2016 and has a balance of about $830k. H

It sounds like you need to review your entries you made for your home mortgage and for the standard deduction/itemized deduction selection. First, review your home mortgage interest by following these steps:

1. While in your Tax Home,

2. Select Search from the top right side of your screen,

3. Enter 1098,

4. Select Jump to 1098,

5. Select Edit next to your Lending Institution,

6. While going through this section, make sure Box 11 is correct,

7. Follow the On-Screen Prompts to complete this section.

To make sure that you claim your itemized deductions instead of the standard deduction, follow these instructions:

1. While in your Tax Home,

2. Select Wages & Income,

3. Select Deductions & Credits from the top menu,

4. Scroll to the bottom of this screen and select Wrap up Tax Breaks,

5. On this screen you can select either the Standard or the Itemized Deductions, select Itemized Deductions.

I hope this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax keeps reducing my interest deduction from $30k to $10k saying standard deduction is best. This makes no sense as my primary loan was originated in 2016 and has a balance of about $830k. H

I have tried the steps recommended more than once. I am looking to understand why my interest is not being fully counted. I do not see anything I have misentered in system. Who can I speak with to review?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax keeps reducing my interest deduction from $30k to $10k saying standard deduction is best. This makes no sense as my primary loan was originated in 2016 and has a balance of about $830k. H

There is a new question or two you have to answer to get the mortgage interest deduction. Like maybe put in your ending balance. Make sure you answer that the loan is secured by the property. Go back through that section.

One User said.....Two questions on the last two data entry pages for that item: one asking if the loan was secured by the property purchased with the mortgage (my home) and the next asking if the money had been used to build or purchase the home. I suspect both these are qualifying questions for deductibility.

Or is it maybe limiting your state and local taxes paid.

Which includes property tax, any state tax paid like for last year’s return and includes any state withholding from your W2s and any 1099s you have. And any taxes in W2 box 14 and 19 like SDI or VDI. You can only deduct up to 10,000 (5,000 MFS) for SALT State and Local Taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax keeps reducing my interest deduction from $30k to $10k saying standard deduction is best. This makes no sense as my primary loan was originated in 2016 and has a balance of about $830k. H

You may want to contact a specialist that can work through that section of the return with you. @VolvoGirl is correct about the state and local tax being capped at $10,000. That would not include the mortgage interest. Those boxes are picky and must be answered just so, as Regina said above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

botin_bo

New Member

bkeenze1

New Member

Kh52

Level 2

TestEasyFirstName

New Member

realestatedude

Returning Member