- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax is forcing 1099 NEC as business income not personal income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Hello,

I have already filed and paid my taxes for 2021, but I got notification from California FTB that I still owed business tax of $800 + penalties. I had no idea what this could be for so I called them. I explained my situation and was advised to move the money to personal income and remove the business portion of our return. I can't figure out how to do that in the app.

My wife works part time as an office assistant for a non-profit. She made less than 10K this year. Turbo tax won't allow us to categorize that income as personal and forces me to put it under business income.

What can I do?

Broke in CA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Not sure what you mean (or think you mean by "personal income" instead of "business income." If your spouse received a 1099NEC for her work then she is an independent contractor. The fact that the work was done for a non-profit is irrelevant.

If she worked as an independent contractor, and did not receive a W-2 from which Social Security, Medicare and federal and state tax were withheld, then she has self-employment income. She has to pay self-employment tax on that income for SS and Medicare, as well as ordinary tax to the federal and state governments.

https://ttlc.intuit.com/community/self-employed/help/what-is-the-self-employment-tax/00/25922

https://ttlc.intuit.com/questions/2902389-why-am-i-paying-self-employment-tax

https://ttlc.intuit.com/questions/1901340-where-do-i-enter-schedule-c

https://ttlc.intuit.com/questions/3398950-what-self-employed-expenses-can-i-deduct

https://ttlc.intuit.com/questions/1901110-do-i-need-to-make-estimated-tax-payments-to-the-irs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Not sure what you mean (or think you mean by "personal income" instead of "business income." If your spouse received a 1099NEC for her work then she is an independent contractor. The fact that the work was done for a non-profit is irrelevant.

If she worked as an independent contractor, and did not receive a W-2 from which Social Security, Medicare and federal and state tax were withheld, then she has self-employment income. She has to pay self-employment tax on that income for SS and Medicare, as well as ordinary tax to the federal and state governments.

https://ttlc.intuit.com/community/self-employed/help/what-is-the-self-employment-tax/00/25922

https://ttlc.intuit.com/questions/2902389-why-am-i-paying-self-employment-tax

https://ttlc.intuit.com/questions/1901340-where-do-i-enter-schedule-c

https://ttlc.intuit.com/questions/3398950-what-self-employed-expenses-can-i-deduct

https://ttlc.intuit.com/questions/1901110-do-i-need-to-make-estimated-tax-payments-to-the-irs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Thanks for your reply. I guess I should have phrased my question better.

I understand that we have to pay taxes on that income. The application assumes the 1099 NEC is income related to a business which it is not. It is for work performed as a contractor. I enter it under personal income and the app forces me to claim the income as a business. Does that make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

@wsrsm2002 - your question makes sense and the answer provided by @xmasbaby0 above is still correct.

When you are a 'contractor', in IRS speak, you have a business. don't over think it. 😁

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Thanks for getting back with me so quickly.

I hear you, but I am not satisfied. We are talking about 4k in taxes difference. FYI she made under 10K for the year.

I received a bill for business tax from the state of CA for about $900. I called them to discuss and they said I had entered the 1099 incorrectly. Was advised that I needed to remove the business forms and include it in personal income section.

Is it different for the Federal government?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

@wsrsm2002 - I can't speak for the State tax return, but on federal, consider two things

1) that income is added to your income, so it is taxed at your marginal tax rate. So it is as if YOU made the $10K; it is not taxed at the lowest tax rate when you look at the tax bracket tables. So if you are in the 24% tax bracket, that $10k will cause an additional $2400 in federal income tax.

2) as a contractor, there was no social security or medicare withheld by the employer and that still has to be paid. So you will see "self employment tax" which is no more than the social security and medicare tax that would have been withheld if your spouse was a w-2 employee. On $10k, that is going to be around $1530 as you are responsible for both the employee half and the employer half of these taxes (you get a deduction for half of it - it's complicated)

placed correctly on Schedule C of your federal tax return will properly flow it to the California tax return. Both returns should then calculate the tax correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Thanks for getting back to me. I understand that that income is taxable and that we would have to pay what the employer would have paid if we were W2.

Unfortunately, Turbo Tax won't let me do it that way, and pushes me to file it as business income.

Frustated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

@wsrsm2002 wrote: "I got notification from California FTB that I still owed business tax of $800 + penalties."

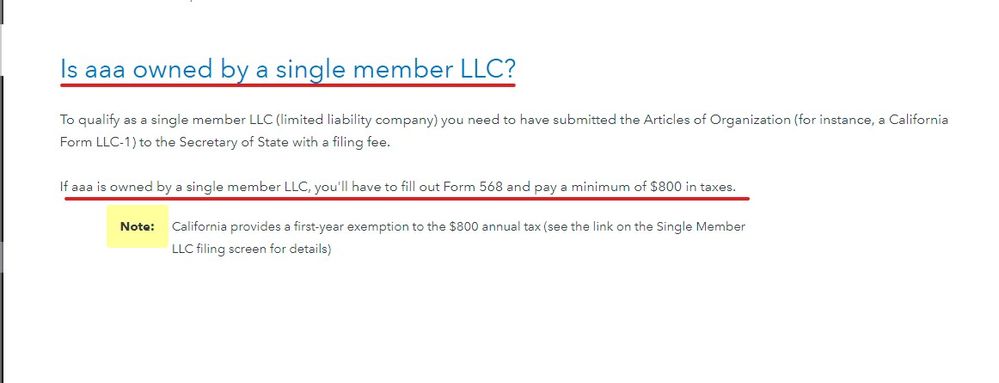

$800 happens to be the exact amount of the annual tax that California assesses on each LLC. Is your wife perhaps registered as an LLC in California?

https://www.ftb.ca.gov/file/business/types/limited-liability-company/index.html#Filing-requirements

This is entirely separate from the California income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

@wsrsm2002 - if you are using Turbo Tax, and post the 1099-NEC, it will list it as 'business income' and create a Schedule C.

that is the way it works.

it is "business income".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

I'm not particularly familiar with California taxes, but a "business" tax of $800 sounds like California's annual $800 tax on LLCs. Your wife's business is a sole proprietorship and is presumably not an LLC, so I don't see where there would be any extra $800 California tax on her self-employment income. It seems unlikely that this has anything to do with your individual income tax return; the $800 annual LLC tax is paid separately. It might make sense to ask the FTB if the $800 tax is the annual tax on LLCs and ask why they think that you or your wife have an LLC.

[Edit: I see that TomD8 beat me to it by a few minutes.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Not LLC. It seems that the way IRS vs. CA FTB view the income is different. Ugh

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

If your wife did NOT register the "business" as an LLC with the state then she will not owe that fee ... you may have entered something incorrectly in the state interview. Contact the state if that is the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

Something in my return triggered the state to think she was an LLC. I need to find that and correct it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

@wsrsm2002 wrote: "It seems that the way IRS vs. CA FTB view the income is different."

Not so. A sole proprietor and a single-member LLC (unless it has elected to be taxed as a corporation) each reports its business income on the federal Schedule C.

Since the CA tax return (CA Form 540) starts with the federal adjusted income, the Schedule C income is already accounted for on the state return.

Also, note that CA requires sole proprietors to report their 1099 income as business income on the federal Schedule C.

https://www.ftb.ca.gov/file/business/types/sole-proprietorship.html

You don't have an income tax issue; you have a California business (LLC) tax issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is forcing 1099 NEC as business income not ordinary income.

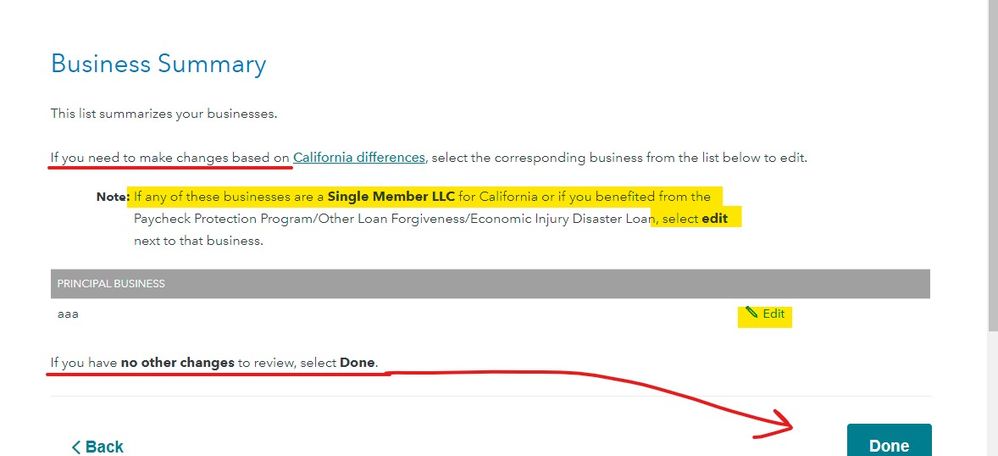

I think you made an error here in the state interview ... failure to read and understand this section may be the issue. A call to the state and/or simply responding to the notice may be all you need to do the correct this issue.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CCCD

New Member

davsemah

New Member

TaxpayerNoDoubt

Level 1

albuque20

New Member

RyanK

Level 2