- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Turbot tax reporting qualified dividends wrong

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

Are you saying that an incorrect amount is reported as ordinary dividends?

Are ordinary dividends reported on line 3b of the Federal 1040 tax return?

Are qualifying dividends correctly reported on line 3a of the Federal 1040 tax return? Please clarify.

Your income tax on line 16 may be computed on a Schedule D Tax Worksheet

or Qualifying Dividends and Capital Gains Worksheet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

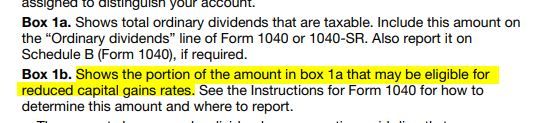

Qualified dividends are included in total ordinary dividends. On a 1099-DIV box 1b, qualified dividends, shows how much of the ordinary dividends in box 1a are qualified. On Form 1040, line 3a, qualified dividends, is the sum of box 1b on all of your 1099-DIV forms, and Form 1040 line 3b is the sum of box 1a on all of your 1099-DIV forms. Form 1040 line 3b includes the amount on line 3a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

My very experienced tax accountant says box 3a Qualified dividends is separate from box 3b Ordinary dividends. The brokerage firm also generates Form 1099-DIV like that: box 1a Qualified dividends is separate from box 1b Ordinary dividends. In other words, Ordinary dividends does not include Qualified dividends,

contrary to what others replying to this thread have said.

I get a warning when I put zero in box 3b Ordinary dividends and some number in box 3a Qualified dividends. The warning says Ordinary dividends must be greater than Qualified dividends. That means TurboTax is going on the assumption that Ordinary dividends includes Qualified dividends. I think that's wrong, unless TurboTax does its tax calculations in a way that still applies capital gains tax rate to qualified dividends and then subtract qualified from ordinary dividends first, then applies income tax rate to the remaining amount.

Can we get an expert answer here?

In here https://www.irs.gov/publications/p550 , I see the following, which strongly suggests Ordinary dividends includes Qualified dividends, but then whoever wrote this explanation might not fully understand the situation either, and the only accurate explanation is to examine the software code used by the IRS to check our returns.

Ordinary Dividends

Ordinary dividends are the most common type of distribution from a corporation or a mutual fund. They are paid out of earnings and profits and are ordinary income to you. This means they are not capital gains. You can assume that any dividend you receive on common or preferred stock is an ordinary dividend unless the paying corporation or mutual fund tells you otherwise. Ordinary dividends will be shown in box 1a of the Form 1099-DIV you receive.

Qualified Dividends

Qualified dividends are the ordinary dividends subject to the same 0%, 15%, or 20% maximum tax rate that applies to net capital gain. They should be shown in box 1b of the Form 1099-DIV you receive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

Sorry but the qualified dividends in box 1b are the part (or all) of box 1a dividends. You might not be able to tell it is being taxed differently on your tax return. Even though the full amount shows up in the total income on the 1040 line 7, if you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from Schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all the worksheets to see it.

See the instructions on the back of the 1099Div

https://www.irs.gov/pub/irs-pdf/f1099div.pdf

It says.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

In this return, I have the same value in Form 1040 boxes 3a and 3b.

I only see Schedule B (Interest and Ordinary Dividends) in my saved PDFs, not Schedule D that you mentioned, possibly because I only received dividends in 2022, and did not have any capital gains or losses to report.

I see that Schedule B line 6 ends up in Form 1040 box 3b, and those are Ordinary dividends. Thus I still cannot tell whether my qualified dividends I entered in Form 1040 box 3a are calculated using capital gains rate, since TurboTax did not generate a Schedule D.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all the worksheets to see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

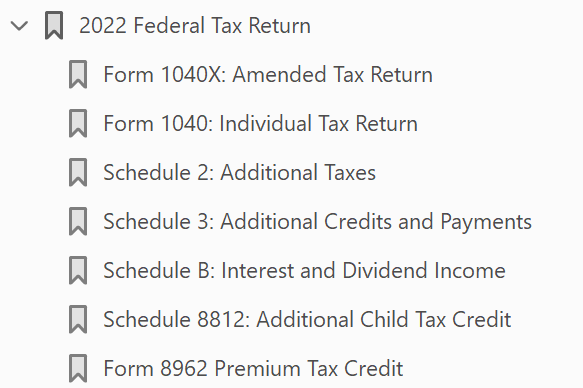

This is all the sections in the PDF downloaded from my TurboTax Online session, and I don't see that worksheet:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

Thanks for all your well-intended comments, but here is what actually happened.

I had two1099's that uploaded perfectly. Two of them had qualified dividends. The total dividend and qualified dividend info uploaded correctly.

I also had cap gains so Turbo Tax calculated my tax using the Qualified Dividends and Capital Gain Tax Worksheet. Turbo Tax did not include both 1099's amounts for qualified dividends in that worksheet: it only picked up one (the smaller one). All the rest of the dividends were treated as ordinary dividends in that sheet, and then on the Form 1040 it did not include all the qualified dividends that were listed on both 1099s. It is a bug in Turbo Tax.

After calling Turbo Tax support, I told them I would simply delete one 1099 and combine all the info from those two into a single 1099 entry. That fixed the problem and I got about $3,450 lower taxes.

I confirmed all the above by looking at the worksheet itself in the details from the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

Did you use TurboTax Online or TurboTax Download for what you described?

Did you use auto transfer from the brokerage firm to bring your 1099-DIV into TurboTax?

Did the brokerage firm treat Total dividends as the value that includes Qualified dividends?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

1. i was using Turbo Tax online, used it for at least 15 years running now so no rookie.

2. The data was uploaded directly from my online brokerage accounts to Turbo Tax by Turbo tax. No glitches, those uploads are correct in each box of the 1099-DIV (and INT also, btw)

3. The firm's 1099-DIV shows all dividends included in Total Ordinary Dividends 1a, qualified or not, and then broke out the amount that was qualifies separately, in line 1b. There were total div 1a and qualified div 1b on each 1099-DIV, one for each brokerage account.

But the form 1040 only showed the qualified div total for one account. The same error was in the Cap Gains and Div worksheet. Looks like TTax only picked up one account's qualified div.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

@myhui wrote:

This is all the sections in the PDF downloaded from my TurboTax Online session, and I don't see that worksheet:

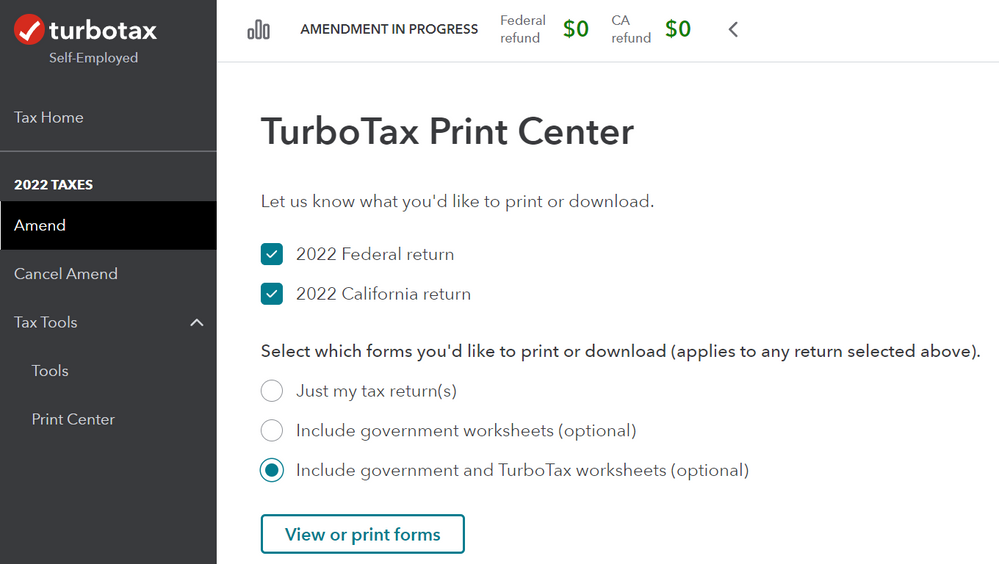

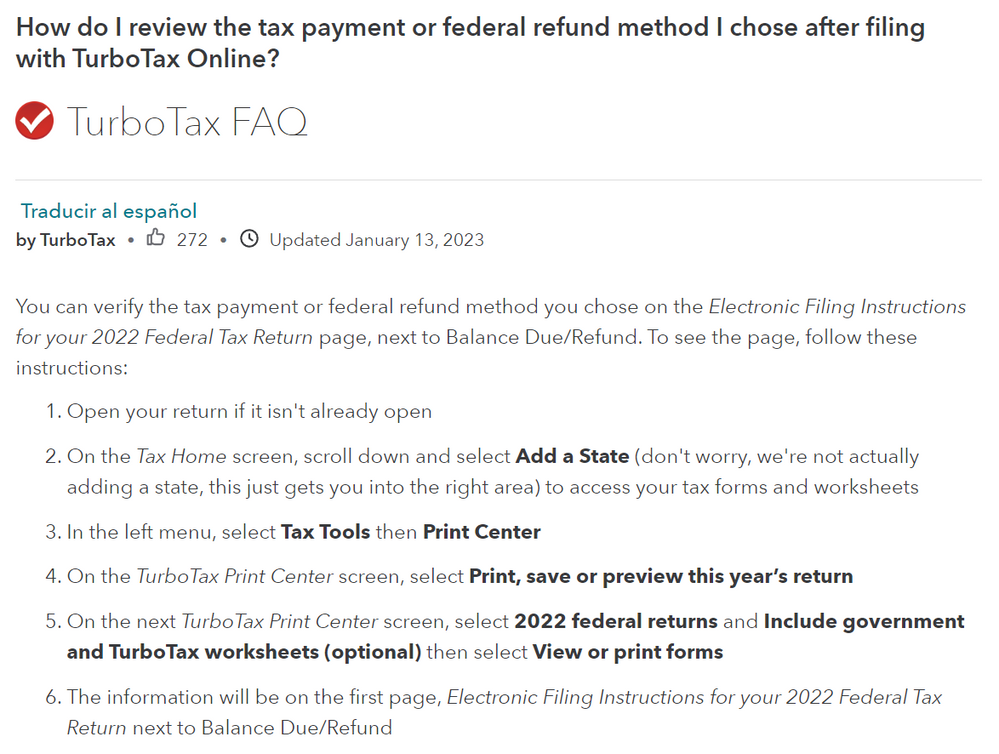

When you created the PDF you selected only the forms required for filing, or "Just my tax return." As VolvoGirl said, in order to see the Qualified Dividends and Capital Gain Tax Worksheet you have to include all the worksheets in the PDF. In TurboTax Online select "Include government and TurboTax worksheets." In the CD/Download TurboTax software select "Tax Return, all calculation worksheets."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

I did the following steps to successfully get all the forms and worksheets saved:

But I only found these two among the forms:

Form 1099-DIV Worksheet 2022

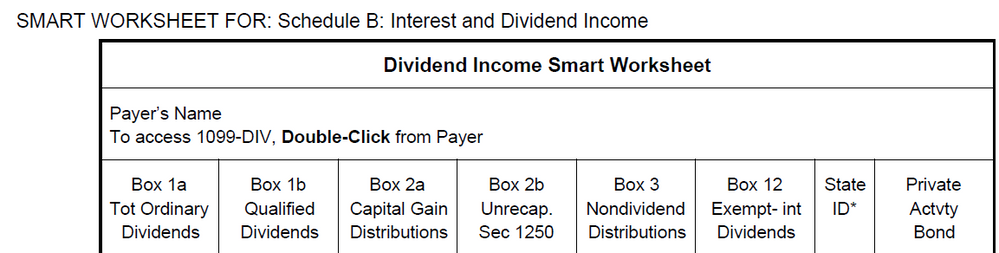

SMART WORKSHEET FOR: Schedule B: Interest and Dividend Income

I do not see the Qualified Dividends and Capital Gain Tax Worksheet that @VolvoGirl noted.

In this amended return, I typed in zero for Total Dividends, so then the only dividends that show up are the Qualified Dividends.

But I believe you that Total Dividends includes Qualified Dividends, although I still have not proven that myself by typing in the same number in both Total and Qualified and check that the whole amount is treated as Qualified dividends.

Thus I still have the problem that I do not see how much tax is calculated for my Qualified Dividends, since both these forms:

Form 1099-DIV Worksheet 2022

SMART WORKSHEET FOR: Schedule B: Interest and Dividend Income

merely repeat the fact that they have the proper amount for Qualified Dividends, but no info on what tax is calculated for them.

Here is the SMART WORKSHEET FOR: Schedule B: Interest and Dividend Income:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

Please enter the 1099-DIV in TurboTax as it comes from the brokerage. Do not enter zero in any box if the 1099-DIV from the brokerage has an amount. Then see if you have the Qualified Dividends and Capital Gain Tax Worksheet.

When you are entering the 1099-DIV, be careful to enter each amount in the correct box. In your first post above you said "The brokerage firm also generates Form 1099-DIV like that: box 1a Qualified dividends is separate from box 1b Ordinary dividends." That's backwards. Box 1a is Total ordinary dividends, not Qualified dividends. Box 1b is Qualified dividends, not Ordinary dividends. I'm sure the brokerage did not fill out the form the way you stated it.

In some unusual cases your tax might have to be calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet, even if you do not have Schedule D in your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbot tax reporting qualified dividends wrong

@rjs

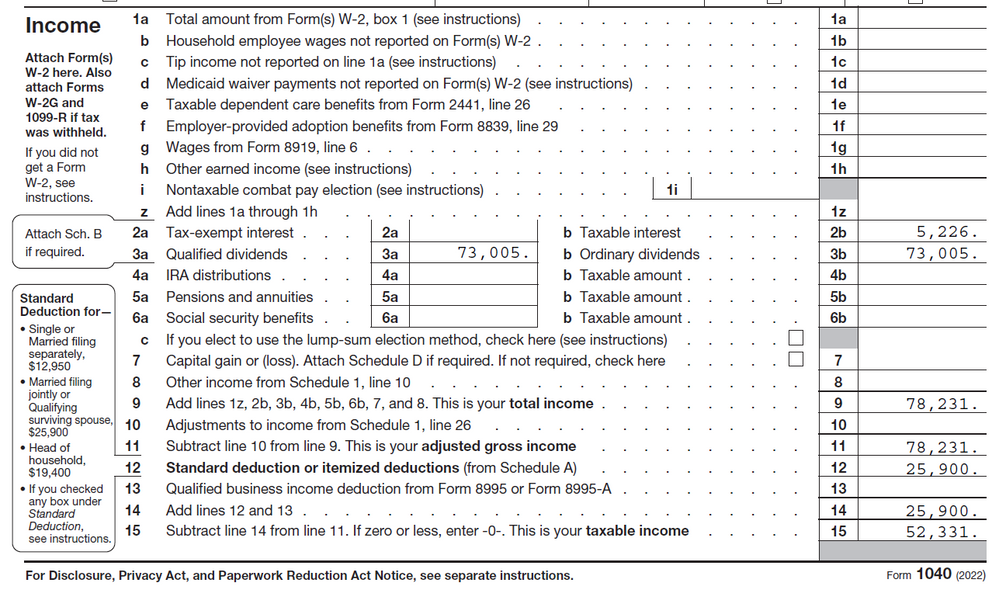

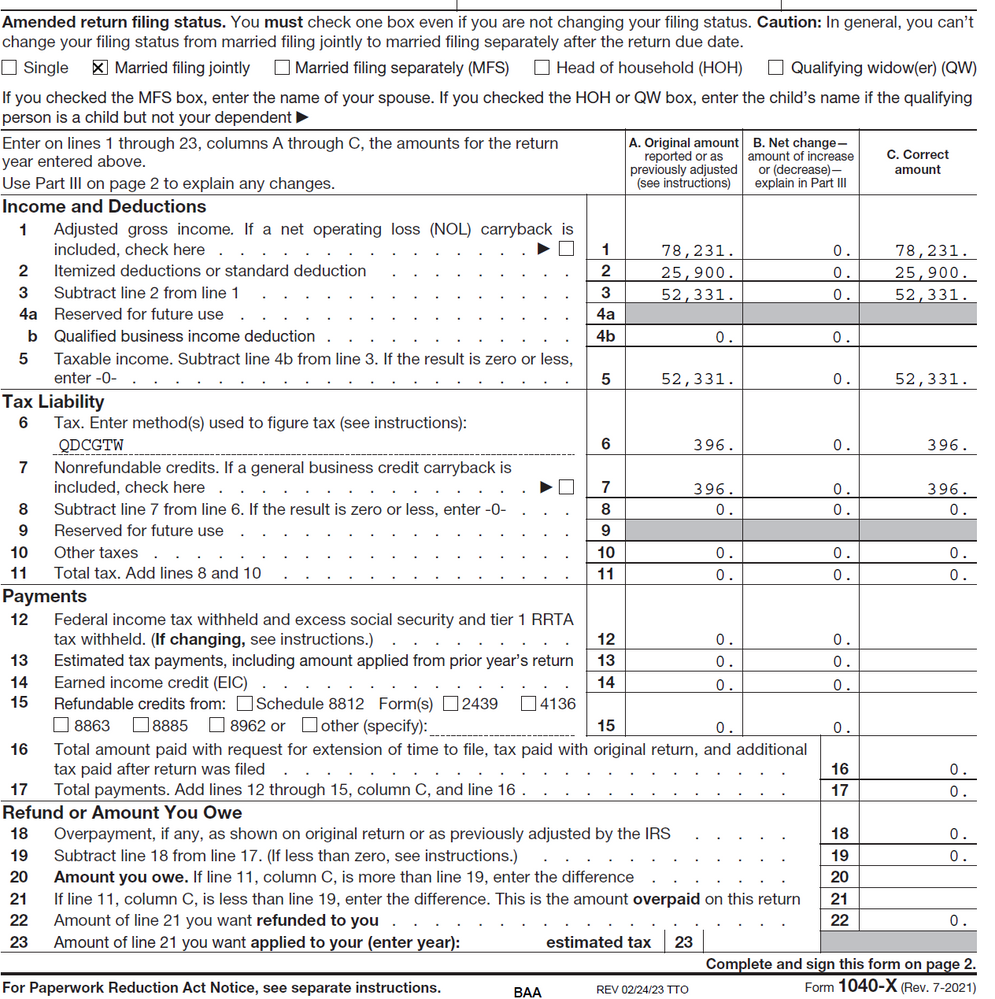

Is it possible that the decidedly minimalist return I have already filed that I don't mind sharing below

is pushing the TurboTax algorithms to not bother showing the Qualified Dividends and Capital Gain Tax Worksheet since, please note, that there is actually no tax owing due to box 15: Taxable income being so low?

I had put in a lot of detailed deductions for record keeping, and they all show up in the smart worksheets, but that's all superseded by box 12: Standard deduction.

I had gone almost all the way with a second amended return with zero in the box 3b: Ordinary dividends in Form 1040, but I didn't file that. I then told TurboTax Online to cancel that amended return, and did the procedure I showed earlier to get all the worksheets and schedules. That is most likely why on that many pages long PDF I see zero in the box 3b: Ordinary dividends in Form 1040, but it shouldn't be like that, since I had already told it to cancel the amended return.

Thus one question is: can I get the full printout of the first amended return that was filed? Despite me canceling this second amended return, it seems like some of the modified figures have remained.

I have filed an original and amended return already, where everything is directly imported from my brokerage's Form 1099-DIV by electronic transfer between Intuit's servers and my brokerage's servers, hence I didn't even need to have the 1099-DIV on my local disks. Those original and amended returns both have the same number in Ordinary dividends and Qualified dividends in both Forms 1040 and 1099.

The mix-up between boxes 1a and 2b that @rjs noted was just my own typo in these messages, not what actually went in to TurboTax Online.

In that amended return's 1040-X, Part III Explanation of Changes, I put:

Added investment interest and tax preparation software expense.

Hence the changes are not relevant to the treatment of dividends that we are discussing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

claire-hamilton-aufhammer

New Member

xiaochong2dai

Level 3

Cindy10

Level 1

Blue Storm

Returning Member

RandlePink

Level 2

in Education