- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

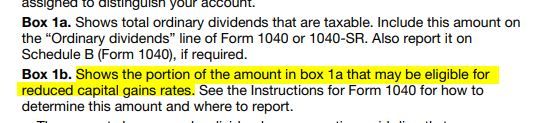

Sorry but the qualified dividends in box 1b are the part (or all) of box 1a dividends. You might not be able to tell it is being taxed differently on your tax return. Even though the full amount shows up in the total income on the 1040 line 7, if you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from Schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all the worksheets to see it.

See the instructions on the back of the 1099Div

https://www.irs.gov/pub/irs-pdf/f1099div.pdf

It says.....

March 17, 2023

9:32 PM