- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I jus...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

No...don't change anything.

The new FLI limits for NJ have not yet been implemented in the software..."supposedly" they will be by 28 29 January. Come back then and go thru your error checks and reviews again after that date...it should clear by then.

And Don't attempt to file until AFTER 12 Feb. The may be other things you actually "forgot" about and may get more tax forms you must include in your file. The IRS is not starting to work on anyone's tax return until after 12 Feb, and filing early does not mean it will be processed any sooner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

No...don't change anything.

The new FLI limits for NJ have not yet been implemented in the software..."supposedly" they will be by 28 29 January. Come back then and go thru your error checks and reviews again after that date...it should clear by then.

And Don't attempt to file until AFTER 12 Feb. The may be other things you actually "forgot" about and may get more tax forms you must include in your file. The IRS is not starting to work on anyone's tax return until after 12 Feb, and filing early does not mean it will be processed any sooner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

An FAQ was issued...keep an eye on the "expected" ready Date.....now 29 Jan:

https://ttlc.intuit.com/community/payroll-reminders/help/new-jersey-sdi-tax-and-fdi-tax/00/1807763

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

I don't understand this. I lost more than I won so what is the problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

This is already April so things should be settled

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

that is wrong and disgusting, but the tax process makes you account for what you do daily from your heart, im disgusted , i also need help, i cannot afford the cost of living with a job!!!! at what point does this stop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

Please verify that your system is up to date. To make sure the program is updated, see:

- be sure to check for updates and close the program for the CD/Download, or

- close the program and the browser window for TurboTax Online. Re-open using Chrome on a Windows 10 device.

For steps on how to enter New Jersey Family Leave Insurance, see: Where should I enter New Jersey Family Leave Insurance (NJ FLI)?

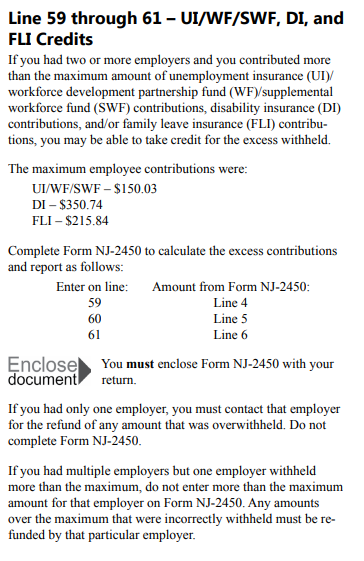

Click the link for more details from PDF page 43 &44 of 2020 New Jersey Resident Return NJ-1040 Tax Booklet or see the screenshots below:

NJ FLI is not related to losses. If you are referring to gambling losses, New Jersey does allow the gains and losses to be netted in the same category of income. For more information, see: 2020 Instructions for NJ-1040, page 9 and 20

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

No, these three suitcases are in great shape. They don't look used much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax stopped my filing because my NJ FLI was 31.59 which exceeds max of 29.00? Can I just change the amount to 29.00?

No, don't change anything.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

loreyann

New Member

smiklakhani

Level 2

RichInPitt

Level 3

rhett-hartsfield1

New Member

rafaxxxxxxlol

New Member