- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TT reports "A Link to Schedule C should not be linked"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

I am having same problem and cannot get 1099-MISC income linked to a Schedule C business. Clicking and unclicking the box will turn the red text black, but Smart Check will still report the error.

Just spoke to Intuit support. I was told they will roll out an update to fix the bug this week.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

So, I guess we wait for the bug to be fixed. This is one annoying error message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

TurboTax is working to resolve the issue. Workaround: If the income was from self-employment you can enter it as a 1099-NEC or other cash income and you can file with no error. Form 1099-MISC and Form 1099-NEC go to the same place on Schedule C, so there will be no difference on your tax return. If you would rather wait until it is fixed, you can sign up for notifications through this link. @xom21fripp102

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

Some TurboTax customers may be experiencing an error when entering a 1099-MISC: “A link to Schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked.”

See this TurboTax Help.

If you are wanting to report the 1099-MISC as income in the Schedule C, you may be able to delete the original 1099-MISC.

Depending upon how the 1099-MISC was entered, you may be able to remove the 1099-MISC by following these steps:

- Down the left side of the screen, click on Tax Tools.

- Click on Tools.

- Click on Delete a form.

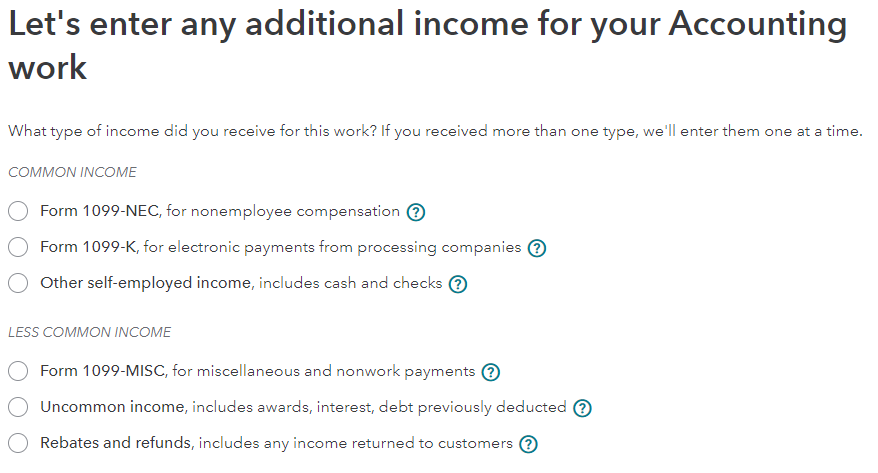

Then enter the income directly in the Schedule C at the screen Let's enter any additional income for your work.

You may select Form 1099-NEC or Other self-employed income, includes cash and checks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

If you link your 1099NEC to Schedule C it will still hit your self-employment tax. I had 2 - 1099NEC and 1 - 1099misc, all linked to Schedule C. All affected self-employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

I deleted the 1099Misc and reentered it as a 1099NEC, which is probably what the payor should have sent me in the first place. Everything stayed exactly the same after I made that change, state and fed total tax, self employment tax, etc. so this does appear to be a fix, at least in my case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

But will the IRS "flag" it because they are expecting you to report 1099 MISC earnings?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

I don't think so. If you run a pdf of the return for filing, you can see that the 1099s are not included in what the taxpayer submits to the IRS so the IRS does not know what 1099 the income is coming from, it is just looking to see that, in my case, the amount is showing up on Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

No, the IRS is looking for total income. If you report the income from the 1099-MISC based on what it was representing, for instance, self-employed income should be reported on Schedule C, there will be no issues. The IRS does not see where your forms are entered into your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

You can’t enter it directly in schedule C. It’s whited out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

INTUIT / TURBOTAX GET THIS UPDATE DONE PLEASE!! GIVE IT HIGHEST PRIORITY!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

IT IS NOW MARCH 1, 2023…. STILL NO UPDATE OR RESOLUTION FOLKS!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

THIS WILL HOWEVER TRIGGER AN IRS AUDIT!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

MARCH 1,2023 and still no update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT reports "A Link to Schedule C should not be linked"

FANTASTIC!! If no fix from Intuit, at least one can still e-file the return. THANK YOU!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jared062488

New Member

AbTrack

Level 2

Tina777

Returning Member

marygold760

New Member

bullarddexter

New Member