- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: THIS IS THE BEST ANSWER

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

I didn't have to 'right click the area' or 'select Override' to delete the '0' but I'm sure this depends on your computer and version of software. I'm using a MAC computer and TurboTax Deluxe (Fed + State) for desktop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Life is a team sport. I have learned some computers you can modify on the form but on my PC laptop I needed to use the Worksheet. Winning!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

How do I remover this form??7205

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

@Tsbh2427 wrote:

How do I remover this form??7205

If you are using the TurboTax online editions -

To delete the Form 7205

Click on Tax Tools on the left side of the online program screen

Click on Tools

Click on Delete a form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Excellent. Right clicking and then selecting override worked for filing 2024, using Premier. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

I did that and override is greyed out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

How?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Are you trying to delete Form 7205, @nyirishman1877 ? If so, use the instructions below -

How to delete forms in TurboTax Online

How to delete forms in TurboTax Desktop

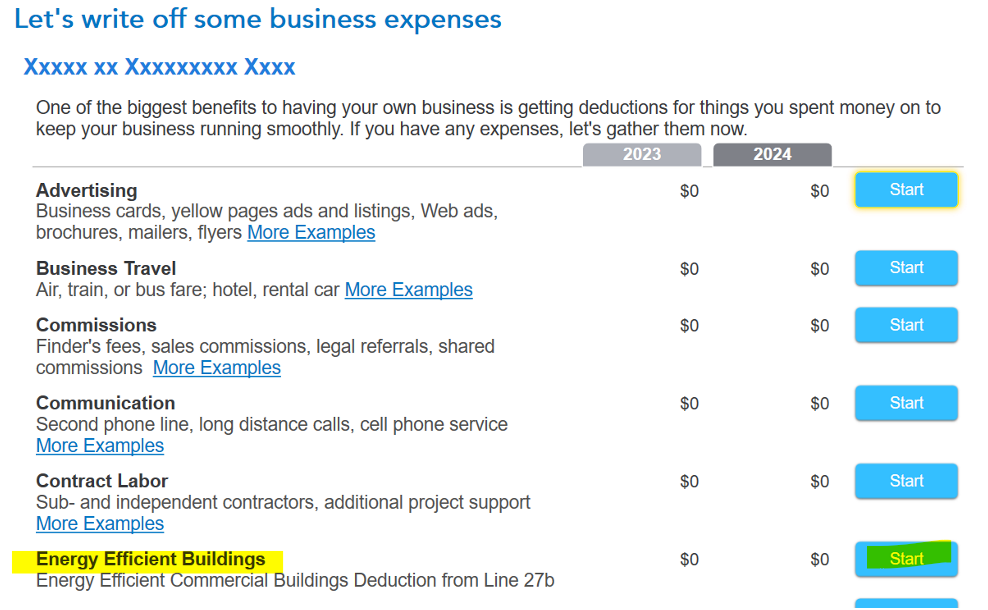

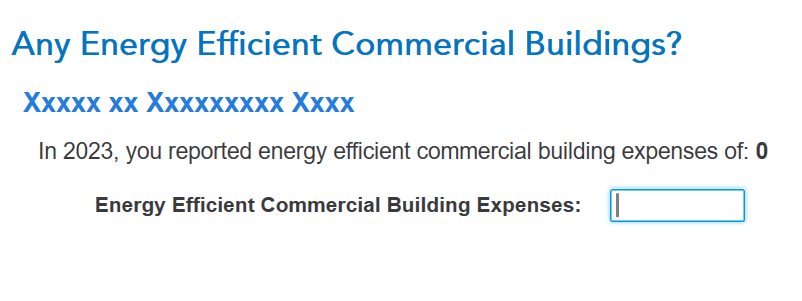

If it won't delete from there, go back to business expenses in the desktop product and delete the zero on the Energy Efficient Buildings screen in the Common Business Expenses section of TurboTax. Leave the field blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Thank you! I used Deluxe for 2024 reporting, and I had this error for the 1st time. Last year I used Home and Business.

When I tried to remove the zero from the Sch C, it still came back.

This time, I went to the forms for the Sch C worksheet, and removed it there for Line 27b, then quickly saved the whole return.

Finally, my e-file worked!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

I am totally lost ...

what a stupid direction Intuit has gone into ... why not make it simple...

I am just tempted to print the return and file a printed copy instead fooling around with it. This time I used Premier instead of home and business as I don''t have any w2 forms or activity .../ does anyone have a solution .. that a lay-man can understand and go step-by-step to remove this idiotic requirement and then eFile?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Oh, I have a feeling that it is another way for them to make money!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Print the IRS Form 7205. Write across the top your name and social/EIN, whichever applies. Write in big letters under your name, this form is not applicable to you. Put a big N//A across the form, sign and date at the bottom. There is not a signature request, but it's always good to sign it and date it to prove it's legit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is calling for form 7205 even though I’m not taking a credit and it won’t allow me to file without it?

Print IRS Form 7205. Fill out the top- name and social/EIN, whichever applies. Underneath write, "This form is not applicable to me." Under the remaining, put a large N/A to cover the page. Sign and date at the bottom, even though it doesn't require those two things. It's better to sign and date so there is no questions on it's legitimacy. Unfortunately, you will have to print your taxes out, attach Form 7205, and mail your taxes in to the address on Turbo Tax cover page when you print out your return.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17714508208

Returning Member

dcarruth56

New Member

moncrief2920

New Member

Basenji

Level 3

sla12345

New Member