- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Taxcaster inaccurate 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

So in the past TurboTax Taxcaster has been fairly accurate ...for years. However, I just did it for 2021, and I'm getting the lowest refund ever, WITH the expanded Child Tax Credit. My income is $1,000 lower this year than last year, but it seems my refund will be $3000 less than last year. I have the same amount of dependents, same marital status, the only difference is Biden stimulus payment in April and the advanced child tax credit. Even though the tax caster says stimulus isn't taxed, something changes when I put the info in for stimulus recieved. Before I put in the stimulus recieved, itacvaster says I owe $313 but once I put the stimulus payment in it jumps up to $3393 owed (before dependents entered etc.) If I leave stimulus empty, things look normal, to last year. I was thinking it would be the standard refund plus the extra $4500 CTC. Instead it says my refund will be $1800 (when I put the stimulus in) What gives?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

The stimulus is NOT taxed ... the taxcaster asks how much you got in advance so you are not given credit on the return ... it gives you the full credit until you said you already got it (just like the TT program did) ... thus you will see a change naturally. Don't change this or the estimate will be off and not in your favor.

And the advance of 1/2 of the CTC will naturally reduce your refund since you got 1/2 of the credit up front.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

That all makes sense, but clearly something is up. 1) it's increasing my taxes owed (see pictures below) this eating into the second half of the CTC (it's also not including the extra one time ctc payment $500 for dependent in college)

Married, filing joint, with 3 Children under 17 and a 18 yr old going to college, living with me, Ive never owed $3193 in taxes. I only being in $55,000 a year total.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

What will you have withheld on the $55K income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

See that little blue bar under the tax owed amount? And do you notice it is not even half way across the screen? It looks like you have not put in all of the information yet -- at least per the screen shot you have posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

You + spouse + 3 kids under 17 + 18 yr old = 6 people on the return ... 6 x $1400 = 8400 advance stimulus ... you only put 7000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

$2500 for state, 0 for federal. Federal hasn't taken anything out for the past 7 years due to $50-55k income with 4 dependents and a wife with 0 income.

Does stimulus count as income and raise your tax bracket?

Because until I put in the stimulus, the taxes owed was $313 bucks before it calculates my dependents etc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

I'll change it. I couldn't remember the exact amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

You will not be taxed on stimulus money you received. That money is not taxable. But it sounds like you are panicking without entering everything. You are looking at amounts "before" you even entered how many dependents you have.

"....before it calculates my dependents..."

All of your information has to be entered before you take the results seriously.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

The stimulus does NOTHING to your income tax return except if you got the full amount in advance you cannot have it again on the tax return.

Using your info ... 55K/0WH/4kids(3 under 17)/7000 stim cr advance/4500 advance CTC .... I get a refund of $3200 which is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

Doesn't change. Still jumps from $393 owed to $3193. An extra $2,800 tacked on. Then when the credits are all applied, that $3293 gets deducted and I get a $1800 refund. My refund is usually $4000 to 4300 form the past 3 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

But it says I get $1800 when I reach the end not $3200.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

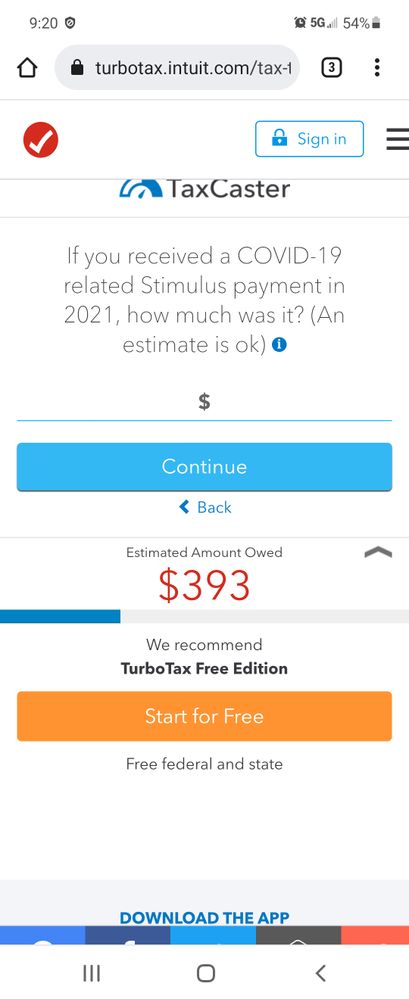

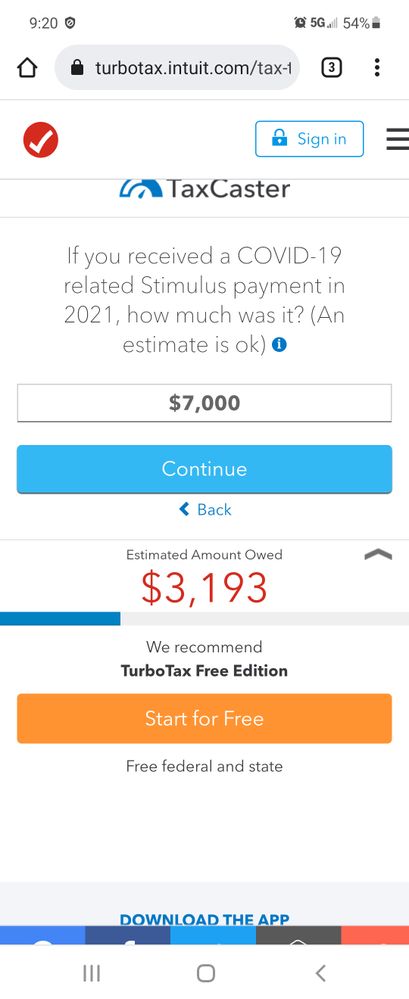

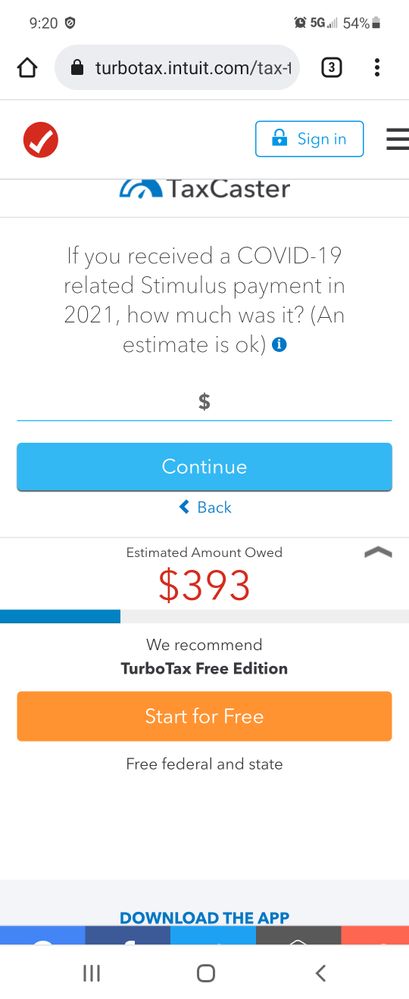

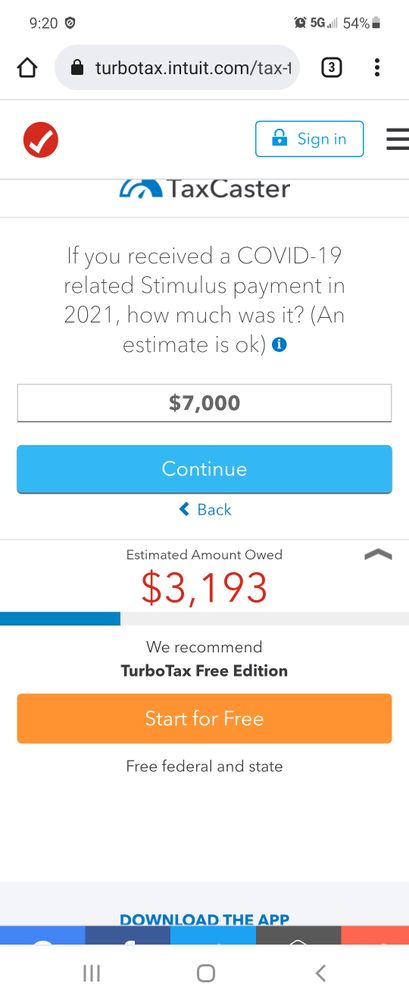

See the images? Before I enter stimulus info, taxes owed (before dependents, credits etc.) Is $393

Then when I put in the stimulus amount, the taxes owed jumps to $3193

It increases taxes owed by $2800 moving through the rest of the application. Perhaps it's a mobile bug.

It just didn't make sense that my refund, according to Taxcaster, is $2,000 smaller than the past 3 years and nothing has changed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

Have you been receiving the monthly advance child tax credit payments that began in July?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxcaster inaccurate 2021?

Yes. But the other half should still be paid out yes? $4500 July-Dec and the other $4500 in refund. But the $4500 is getting eaten up by this $3193 which I've never owed since having 4 dependents and a family of 6. But that $3193 shows up once I put in stimulus recieved. Before I enter stimulus that $3193 is only $393

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

martagrabowski

New Member

RandyW3

New Member

sjh90331

Level 1

chris780

Level 2

flipzbird

Level 1