- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TaxCaster 2021 seems inaccurate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TaxCaster 2021 seems inaccurate.

Hello,

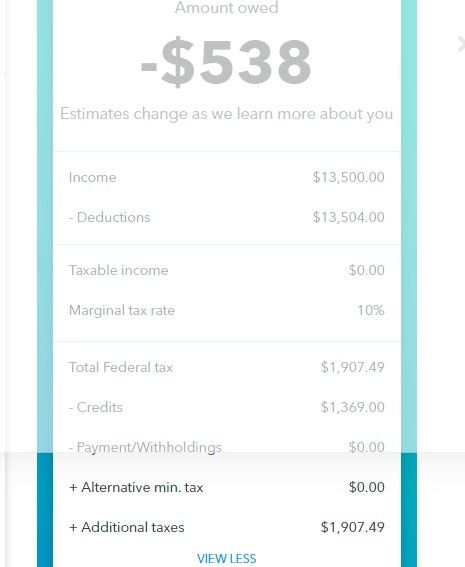

Taxcaster is showing a roughly $540 tax balance due with $13,500 net self-employment income, and the $1,400 stimulus for 2021. This seems far lower than what I had estimated (~$2,000). I'm single, mid-30s, with no dependents.

In the summary I see ~1,900 in federal taxes minus ~$1370 in credits.

I also run this through TurboTax 2021, and got an even lower estimate of $250 due, with possibly slightly lower net income.

So I guess my question is, are these at all accurate estimates?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TaxCaster 2021 seems inaccurate.

Did you get the $1400 stimulus in advance ? If so you do not get it again on the return.

And the EIC has been raised considerably this year ... that is probably what has you stumped.

The tool is correct ... used your numbers :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TaxCaster 2021 seems inaccurate.

Did you get the $1400 stimulus in advance ? If so you do not get it again on the return.

And the EIC has been raised considerably this year ... that is probably what has you stumped.

The tool is correct ... used your numbers :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TaxCaster 2021 seems inaccurate.

If $13,500 net self-employment income is your only income for the year, your standard deduction of $12,550 wipes out most of your income. You also get a deduction for half of your self-employment tax, and you might have a small QBI deduction, so you end up with no taxable income. Look at the summary that Critter-3 posted. Note that is shows taxable income of $0.00. The only tax you are paying is self-employment tax. That's the $1,900 of federal tax. And a large part of that gets eliminated by the Earned Income Credit (EIC). That's what the $1,370 of credits is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TaxCaster 2021 seems inaccurate.

This makes sense. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dferrtullo

New Member

omniologist1

New Member

LindieJ

Returning Member

wilddan

Level 1

sgtburch

New Member