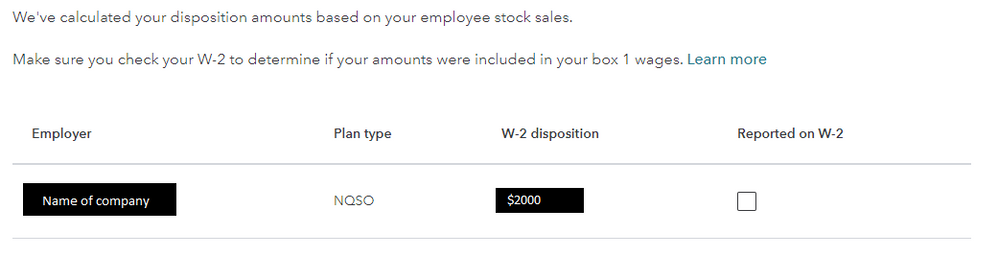

Nonstatutory Stock Options

If your employer grants you a nonstatutory stock option, the amount of income to include and the time to include it depends on whether the fair market value of the option can be readily determined.

Readily Determined Fair Market Value - If an option is actively traded on an established market, you can readily determine the fair market value of the option. Refer to Publication 525 for other circumstances under which you can readily determine the fair market value of an option and the rules to determine when you should report income for an option with a readily determinable fair market value.

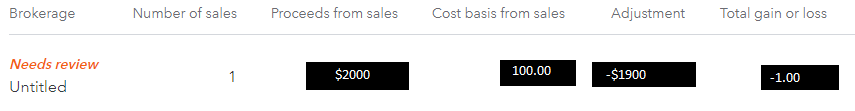

Not Readily Determined Fair Market Value - Most nonstatutory options don't have a readily determinable fair market value. For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option. You have taxable income or deductible loss when you sell the stock you received by exercising the option. You generally treat this amount as a capital gain or loss. For specific information and reporting requirements, refer to Publication 525.

For some great info from TT on how to report see:

I hope this was helpful.