- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

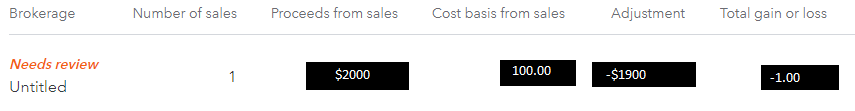

@maglib Oh, now I'm confused because after I filled in the information it asked for, my taxes did go up by the amount I expected. I went and took a screenshot of the stock income page on turbotax as is it currently, and replaced my actual numbers with fake numbers, to give you an idea of what I input.

In this fake example, $2000 would be the amount I received a check for, and $100 is the result of multiplying the number of total shares times the exercise price. (There was no commission.)

The negative number, ~$1900, is something Turbotax calculated for me, I did not input that. Same with the gain/loss amount.

The brokerage is still untitled since I left it blank, but I can change that to the company's name like you mentioned.

Here is the edited example:

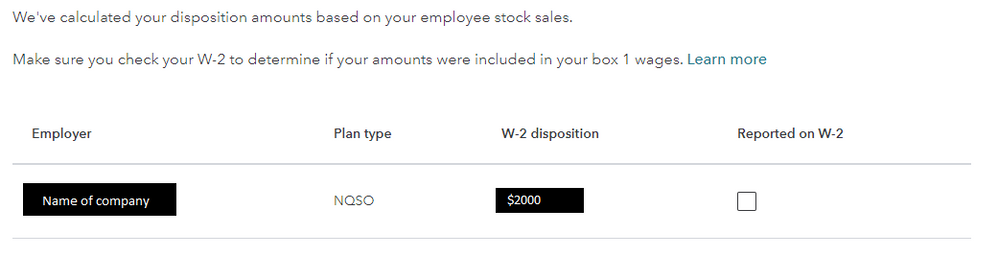

Edited to include a second screenshot of the next page Turbotax takes me to:

Here, "name of company" is where it asked me to link these shares to one of my employers that I already entered a W-2 for. I chose NQSO for plan type, and W-2 disposition field was filled in by Turbotax, and it matches the total check amount I received. Then, I unchecked "reported on W-2" since it was not reported there.

After submitting all of this, my taxes went up by the expected amount. Did I do something incorrectly here?