- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Self-employment tax and US-UK Social Security Agreement

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Once you get to the desktop, you can switch to Forms mode and make the entries directly. You will not file an amended 1040X return, if the original has not processed. You simply want to change the 1040 you filed that wasn't processed. You should be able to download the desktop program. See How to download TurboTax Desktop software from TurboTax.com

Once inside, on the top right, you will see Forms. Select it.

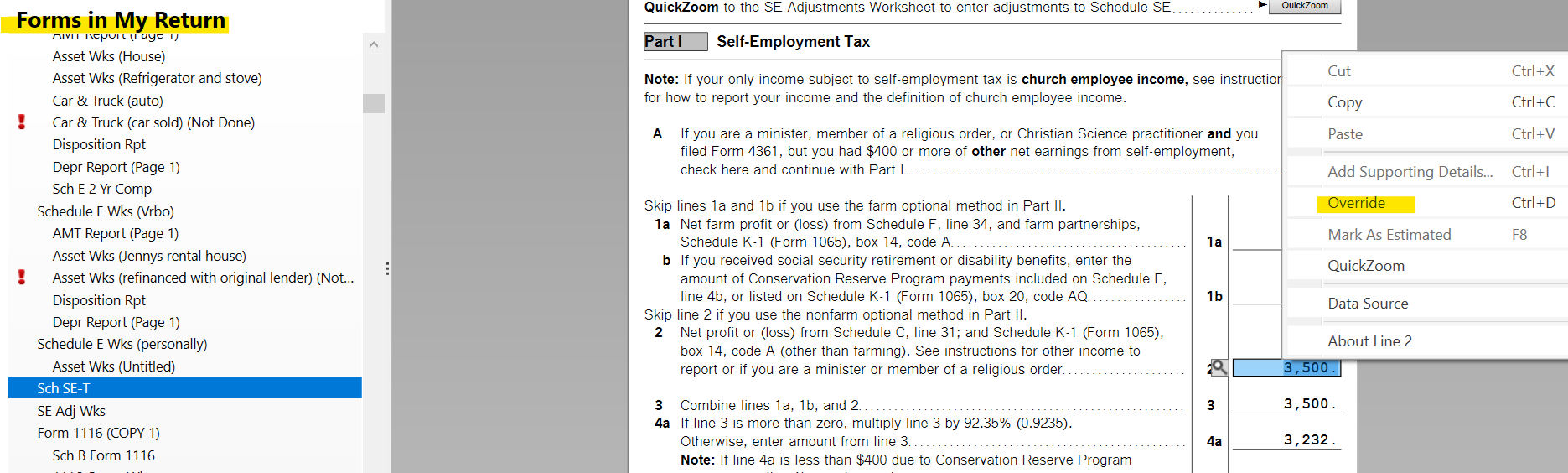

You will see a list of forms, You can find the forms you need. In windows, right click and override the entry needed. Start with the first occurrence and the program will zero out the rest at some point.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Thank you for your response!

I didn't purchase the desktop version so I can't download it, and since I already paid for the filing, I don't want to pay again. Inside my account I can only amend this return now... So, it seems my only option is to print off a schedule C and Se form and mail it in. Can you please make another example you did before so I can see what an entire schedule C and schedule SE will look like once it's adjusted with the overriding?

Thank you in advance for the help, because I am very lost about what to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

I don't know whether this will help or just make things worse for you. I've never used the online version. I always purchase the TT Home & Business DVD, so I don't depend on what the online version does or doesn't support or allow. However, you use the words "overwrite the SE tax" in your question. I understand that the previous responses in this thread recommend doing that, but I don't actually do that. Instead, I do this: The SE Adjustments Worksheet (form "SE Adj Wks") has a line labeled, "Less other SE exempt nonfarm profit or (loss)" on line 7 of Part II of the form. NOTE: The following step won't work for you, if the online version doesn't allow you to enter anything on that line. The purpose of that line is to allow you to enter an amount to subtract from your "Nonfarm Profit or (Loss)", to reduce your SE income (for SE tax purposes). I enter the total of my outside-of-the-USA SE income there (which is already on line 1a in the same section), which reduces my income (for SE tax purposes) to zero, and that effectively zeroes out the SE-tax-owed on the return *without* having to override anything. This tactic is consistent with the USA-UK Totalization Agreement, under which I pay no USA SE taxes as long as I pay the required amount into the UK National Health System, their equivalent of Social Security. This past year, I also had to make sure that TT did *not* generate a deduction for the SE tax I might have paid, or else that deduction would show up on the filing, even though I paid zero SE tax. I don't recall exactly where, but at one point, TT asks you to check a checkbox, if you want to use the SE tax deduction: You *do not* want to check that checkbox when it is first shown to you during the "interview". If you inadvertently check it, going back and unchecking it later has no effect (possibly a bug or oversight in the software). I had to run the whole program again from scratch to get rid of the deduction. One last concern: you'll notice in my previous post that I found no way in the program to annotate for the IRS my use of the "Less other SE Exempt nonfarm profit (or loss)" line. When I use this tactic, I am required to attach the UK form, "HMRC form CA3940, Certificate of Coverage" to my return, and I suspect that's something you cannot do, if you use the online version. I apologize if this isn't the help you need. I'm not a TT expert or consultant: I learned all this from other forum posts and a lot of head-scratching and trial-and-error. The fact that TT has perennially refused to offer a straightforward way to manage this sort of SE reporting is the primary reason I'm planning to eschew TT and instead trial the new IRS Direct File option next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Thank you for your response!

I actually live in a country too that has a totalization agreement with the US, and I'm waiting for my certificate of coverage.

You could help me with one thing, would you please attach or screenshot the form schedule C and SE form that shows the number after you applied what you're referring too? It would help so much for me because I need to fill out a paper version now. I can't modify online either, only if I amend but I can't amend yet because they didn't process my tax return. I'm not asking for your real numbers just to see an example of the actual forms not the SE worksheet. thank you in advance!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

It occurred to me that I should enhance my answer, by describing to you the relevant line entries on last year's filing. I first completed the return in TT without doing anything special for SE tax. When I did, line 2 on the form, Sch SE-T, showed the SE-income value, 16,899, and the rest of that form showed various values for the calculation of owed SE tax. The SE Adj Wks form showed 16,899 on line 1a of part II and also on line 8, "Total for Schedule SE, line 2". Just above line 8, line 7 showed zero. After I made the changes to SE Adj Wks that I described in my last post, form SE Adj Wks, Part II, line 1a still showed 16,899. Line 7 now *also* shows 16,899 (where I entered it), and line 8, "Total for Schedule SE, line 2" now shows 0. Now form Sch SE-T, line 2 shows zero and the total SE tax owed in line 12 is now blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Thank you again for trying to help!

Can you please tell me what are the numbers after this adjustment on schedule C and schedule SE? I just need to know that because from an example I can make my numbers too.

Each line that you have/ had numbers on, not on the schedule worksheet, on the actual forms that you filed to the tax office. Schedule C and schedule SE!! This would help tremendously I can't find any other help. Thank you in advance!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Since you have already filed with the online version, you can download the desktop version for free. See How to download TurboTax Desktop software from TurboTax.com

The Schedule C is the reporting of the business income and it is whatever it is. There will not be any changes to the income on Sch C. The only change will be the SE tax. I love the idea above of going around it in the program instead of doing an override. The SE form should have the zeroes showing no SE tax for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Thank you for being patient and kind and keep responding to me!

I was wondering what goes on these forms. So what these would look like after you have done that

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

This is what I see and I can't click on it, can't download it. Do you have any suggestions how to go about it, what to do next?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Try going back to your homepage, scroll to your 2023 and select that you need to amend using the desktop version. You should be able to download since you filed already. You may have to contact support to get it pushed to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Thank you, I tried downloading under the amendment but it gave me an error and said to try later but it never worked.

I'll contact the customer service.

Thank you again!

Just in case I can't get this download fixed, could you please send me an example of these sheets filled out? ( What would they look like after the change) an example with numbers would be appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Hi, you helped me so much so far, can you please also tell me, what will be the amounts on line 29, 30, and 31 (shedule C) and what will be the amounts on lines 2-12 on schedule SE? I know you mentioned line 2: 0, 12: blank and what about the rest?

Please, nobody could help me. Thank you again for your time!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employment tax and US-UK Social Security Agreement

Sorry to bother you again, I just wanted to let you know that I found a solution, it is actually possible to modify schedule C in TurboTax online, I found the steps here in the community.

Now I just hope that my certificate of coverage will be accepted with my return.

Thank you again for helping!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aprilshowersrt75

New Member

Vermillionnnnn

Returning Member

lozzakozza

New Member

CPpa

Returning Member

juham2013

Level 3