- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Same income reported by two states

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

My situation was that I moved from NY to NJ. My new employer was in NJ, but TurboTax was showing that I needed to pay taxes to both NY and NJ. Even though the money was earned in NJ. Updating residency did not solve this issue. You must change the percentage allocated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

Guys, this is not a Turbo Tax problem. This is MA state problem. I am a paid tax preparer, who uses Drake Tax Software, and just encountered this issue for the first time myself. I did more research and found this info from Tax Act support, as well as confirmed it with my personal accountant. Here's what it says:

"The Massachusetts Department of Revenue informs us that this type of W-2 is compiled in error, and the recommended course of action is to request a corrected W-2 showing only the amounts in box 16 attributable to the state in which they are earned, not each state for which the wages are taxable.

If the employer will not issue a corrected W-2, there are several options available to complete your tax return reporting the correct amount of wages that are taxable to Massachusetts.

Option 1: (Paper filing only, E-File not allowed)

The first option to correct this issue is to make the adjustment reducing the amount of wages directly on Line 3 using the Wage Adjustment Field. Enter a negative adjustment in the amount of the wages that were duplicated on Form W-2. This will properly report the amount of wages taxable to Massachusetts. When using this option you are not allowed to E-File because Massachusetts will reject the return due to total wages in Box 16 of form W-2 being lower than the amount reported on line 3. See Massachusetts - Wage Adjustment for instructions on using this option.

Option 2: (E-File Allowed)

If you want to electronically file your return and cannot get a corrected W-2, you can adjust the amount of wages in Box 16 of Form W-2 to properly reflect the amount of wages that are taxable to Massachusetts. In this case you will need to manually make an adjustment to each state's box 16 so that the total wages reported in all Box 16s are equal to the total amount of state wages earned. When you make this adjustment, you should generally adjust the W-2 so that Box 16 for each state reflects the total amount of wages earned in each state. In addition, you will want to verify the correct amount is still reported on any other states that you may also be attached to your return."

So, this means the W2s are incorrect in this situation. They should not be reporting or withholding on any MA income. MA will still tax you on your full income, if only RI is reported, but not DOUBLE the income. Furthermore, you can then get a credit for the taxes paid on the full income to RI. I can see how this causes an audit. I suggest trying to get a corrected W2 first. If not, then we go with overriding the amount on the W2 and Line 3 on the MA return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

Same issue here. Looks like this has been around for FOUR years!

Company would not issue corrected W2.

Does everyone just do the paper filing, or risk being audited by e-filing and changing W2 reported income for MA to 0 in box 16?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

No. You must fill out your W-2 as shown. As a resident of Massachusetts and an employee of Rhode Island, you will have to file a resident return for Massachusetts and a nonresident return for Rhode Island.

Your Massachusetts resident return will tax you on your entire income. Your Rhode Island nonresident return will tax you on the income you earned within their state lines. However, Massachusetts will give you a credit of tax paid to Rhode Island on your resident return.

The first thing you want to do is make sure you've filled out the Personal Info section correctly:

- With your return open, select My Info in the left-hand menu.

- Then, on the Personal info summary screen, scroll down to Other State Income, and select Edit.

- At the Did you make money in any other states? question, answer Yes and make sure your nonresident state is selected from the drop-down.

- Select Continue to return to your Personal info summary.

After you finish your federal return, you'll move to the State tab, where you'll see your nonresident state(s) listed in addition to your resident state.

To ensure accurate calculations, always complete the non-resident (RI) return first because your resident state (MA) will give you a credit for taxes paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

I'm doing everything you suggested, and I am positive everyone who reported the issue in this thread has done so as well.

I prepared my non-resident Rhode island tax return first and then started with filling MA tax return, but TurboTax MA always double-counts my income. Say, you earn an income of 100,000k in Rhode Island, and you pay $5,000 state tax to Rhode Island. In MA return, Turbo Tax would count the income as $200,000K, the tax rate is 5%, so the MA tax before credit is $10,000. Yes, MA will give you some credit back for the $5,000 tax paid to Rhode Island, but you still end up having to pay MA $10,000 - $5,000 (credit for RI tax) = $5,000, which is totally wrong!

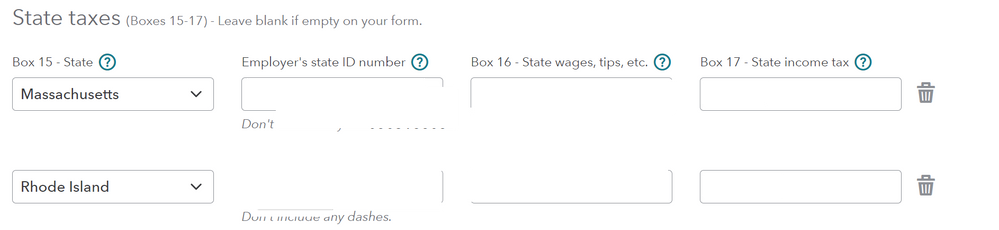

FYI, I received only one W2. In box-16, there are two rows: one for Rhode Island where the income is actually earned, and another for Massachusetts for the same amount of income. In box-17, there are also two rows: one for Rhode Island showing state tax withheld, the other row for Massachusetts with much smaller amount.

When I prepare Massachusetts return, it added up the amounts of both rows in W2 box-16, which doubled what I actually earned. Turbo Tax gave the option of only importing MA return, but then one has to mail in the return. Some other posts reported similar issues. If one modifies the row for Massachusetts in box-16 to 0, he can E-file, but someone has been audited by Massachusetts Department of Revenue for doing so in the past.

My employer said the W-2 was correct and I need to check with TurboTax or find another accountant to properly file the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

@kongf2012 I would suggest Deleting your W-2 and re-entering it manually. Click this link for instructions on How to Manually Enter a W-2.

Your Massachusetts State Return should only pick up the line with MA Income and MA Tax from your W-2 and should ignore the Rhode Island line entirely.

In fact, you may want to Delete Massachusetts and then add it again after re-entering your W-2 manually in your Federal Return.

Click this link for instructions on How to Delete a State.

Your employer is incorrect to take taxes out for two states on the same income. Since the income is earned in Rhode Island, they should only withhold RI tax, so you can get credit for tax paid to RI on your MA Resident return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

I did exactly what you suggested and the problem has always been the same.

It should be very easy for you to reproduce the problem by entering the following two lines in W2. Put in some number for Box 16 for both rows, they should be the same. MA state tax return will add both up, instead of only importing one.

I am a software architect. This is a Turbo tax bug. Please report it to IT and have someone fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

Any luck? Did you fix this ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

I've been doing the paper filing for my MA State Tax the last 3 years due to my company having me travel to the office in NYC periodically. I put in % for my allocate wages for NY and select the option to use my wages from my federal return. I personally would not update the W2 so would be one less reason to be audited.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

@MarilynG1 I'm having the exact same problem @kongf2012 has. I've reported this on other trails were people wrote about the exact same issue, for MA and RI and also for other states.

I've tried changing the order on how I'm entering the states in the W2, I've also change the order on how I started the state returns, a combination of the below and many other tips I've found on the web.

Last time it let me move forward till the last check point, post payment, and now I'm stuck again with the extra issue that now I can't delete the State Return to start over.

In summary, I've paid to e-file and my returns are stuck with this issue. Someone needs to fix this or I wan't me money back and after 11 years of using TT I'll move somewhere else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Same income reported by two states

@FrankSTein It sounds like you're experiencing issues that require one-on-one assistance. Please call and speak with someone on our phone support team. The following Help Article will assist you in connecting with the right person to get the help you need: What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Baobao

New Member

bethann7137

New Member

ronnystephens

New Member

jh73

Level 3

albrechtl27

New Member