- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Privately Owned Airplane Mileage Reimbursement Rates

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Privately Owned Airplane Mileage Reimbursement Rates

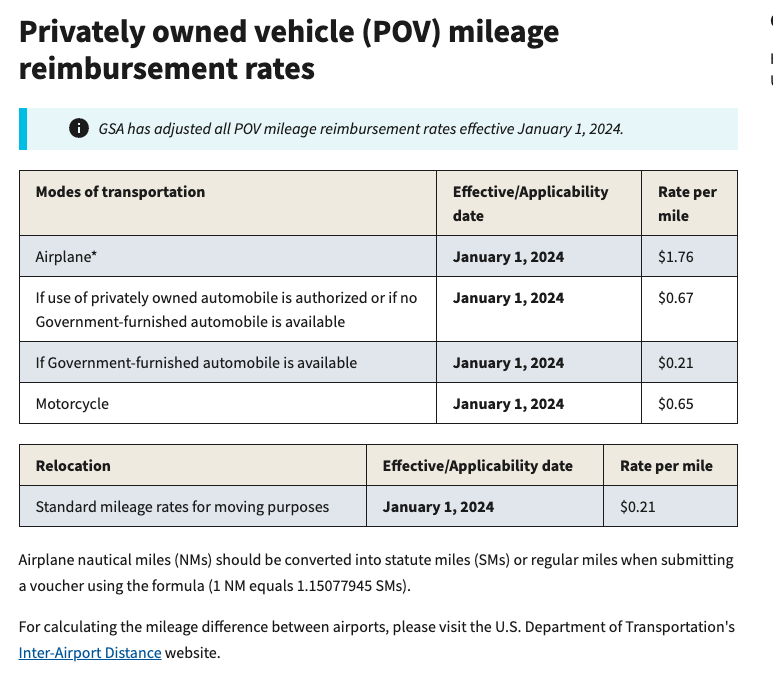

When submitting volunteer time and mileage using Privately Owned Vehicles, as part of the mileage reimbursement rates (https://www.gsa.gov/plan-book/transportation-airfare-pov-etc/privately-owned-vehicle-pov-mileage-rei...), it seems as though Turbo Tax doesn't have a place to calculate for costs associated with miles flown using an aircraft. The rate difference between airplane vs. car mileage is drastic so it's important that we can input all miles and costs associated to effectively deduct our volunteer time. But it seems as though Turbo Tax only has a place to input miles driven by a car, and therefore shows the deduction as much less valuable.

Can anyone provide information on how to input aircraft volunteer mileage and time into Turbo Tax? Can you input airplane rates per mile into the system instead of miles driven?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Privately Owned Airplane Mileage Reimbursement Rates

The link you provided does not open. However, there is not a per mileage rate for charitable or business use of a personal aircraft. Instead you can take an expense per mile or an expense per seat deduction. So if you flew your plane a total of 100,000 miles for the year, half of which was for charity and spent $20,000 on the plane for the year, then you would just take a $10,000 charitable deduction for that.

You will need to keep documented receipts for expenses along with your travel logs.

To enter the charitable expense portion you would select Milage and travel expenses then just enter it as Other Travel Costs total.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Privately Owned Airplane Mileage Reimbursement Rates

Apologies, this forum appears to remove this link that shows the mileage. Attaching screenshot for reference.

This link does show the rate per mile using an aircraft at $1.76. Despite this being 2024, there was a 2023 rate. Does that change your guidance? We flew over 40,000 miles as part of our volunteering so it'd be great to be able to count those miles. Can we also take into account costs associated with plane maintenance?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Privately Owned Airplane Mileage Reimbursement Rates

No, it does not. Based on this link from the IRS, personal aircraft expenses are based on actual/prorated costs. The screen shot you attached looks like it may be something for people using their vehicles for government jobs. It also does not appear that it is specifically addressing charitable miles. Vehicle charitable miles are 14 cents per mile versus 65 cents per mile for business use of an automobile so unless it was specifically addressing charitable donation miles, I would not rely on it.

Additionally, you are able to deduct actual expenses as a donation for many things, including miles driven instead of taking the standard mileage deduction. So when it comes to taxes, the IRS sources would be the most reliable and relevant and even though the link I posted is for business miles, it is a standard method for just about every type of deduction that involves vehicles or property unless it is somehow limited..

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Privately Owned Airplane Mileage Reimbursement Rates

see this link for the deductible expenses for private aircraft used in charitable work. There is no standard mileage rate and some costs are not deductible.

https://flightlevelsonline.com/2023/business-flying-and-taxes-charitable-flying/

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elmcknight

Level 1

w-e-simmons

New Member

MJRB

Level 1

rbentkofsky99

New Member

klma

Level 2

in Education