- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Please help! Accidentally submitted a Non-Filer form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

@glennboulder Your filing date is incorrect. If taxes are owed on a 2019 federal tax return, the IRS extended the date to file a 2019 tax return and pay the taxes owed to July 15, 2020 if the taxpayer wants to avoid a failure to pay penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

The $0.00 AGI on your erroneous 2019 Form 1040 has no impact on your Economic Stimulus Payment.

Your AGI for ANY year has nothing to do with the amount you receive as your Economic Stimulus Payment.

Single Filers: $1,200

Married Filers: $2,400

... and then $500 per dependent child.... yadda yadda.

AGI has nothing at all to do with the dollar amount of your Stimulus Payment.

Your AGI only comes into play in determining the DATE, that your stimulus payment will be mailed to you by the IRS.

Lower AGI's get mailed out first... then higher AGI's get mailed out later.... in accordance with the schedule I already posted in this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

You are correct. I mis-spoke.

I have corrected my post to show July 15th 2020.... not June 15th as I originally stated.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

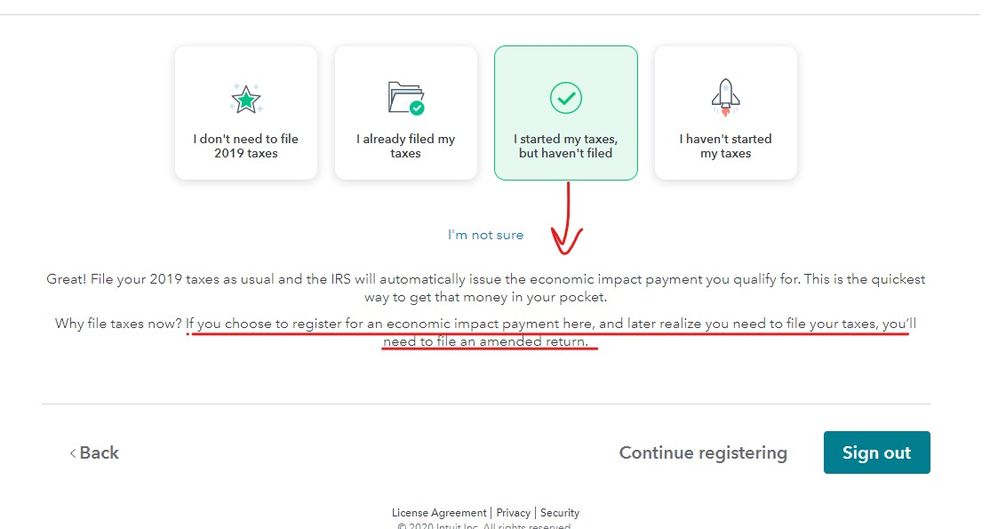

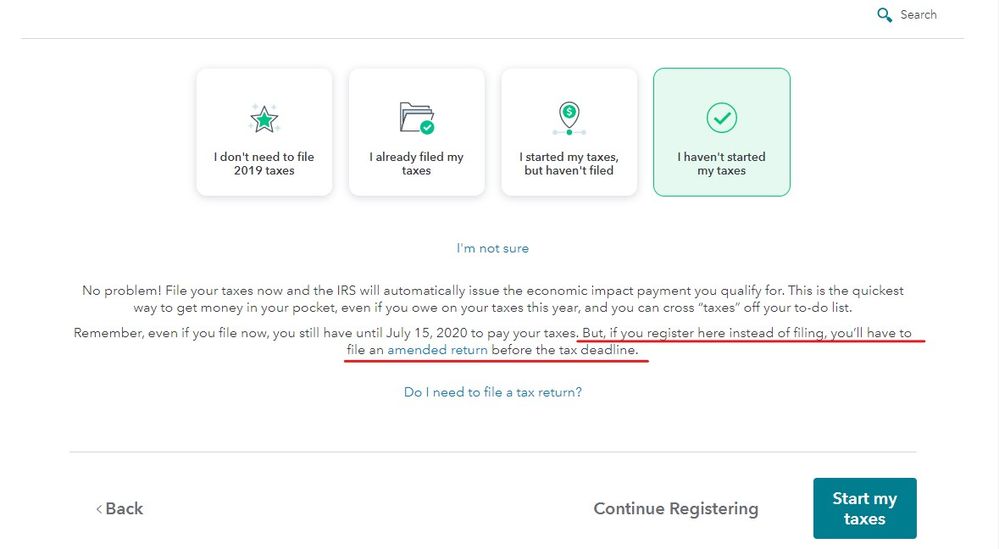

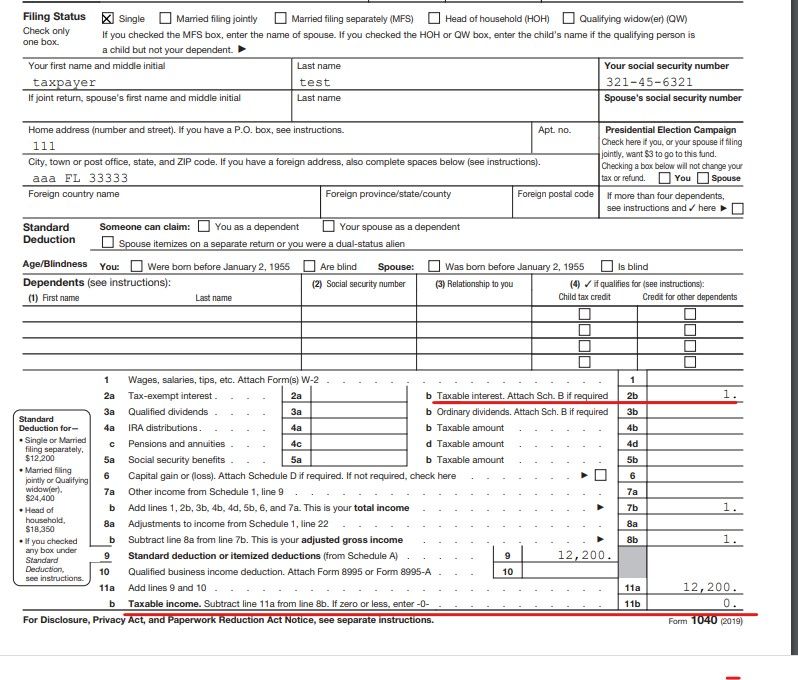

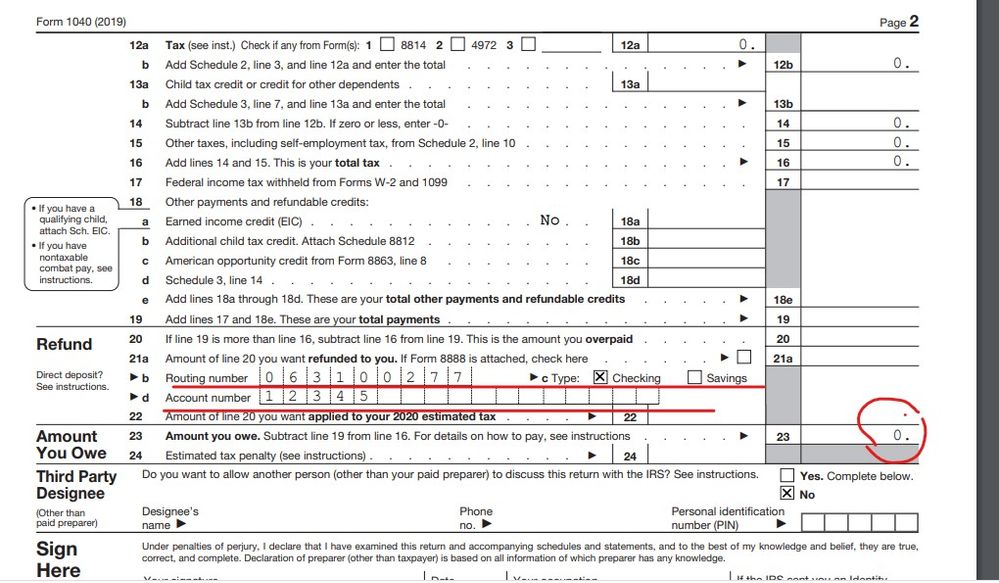

Sorry but the TT program tells you straight up that if you need to file a REAL return after using the registration program you MUST AMEND the return you file ... it is clear as crystal ... if you use the program incorrectly your ONLY choice to correct the error is to AMEND the return. And you are not filing a zero income return ... the return will show $1 of bank interest to trigger the ability to efile. And the proof is the IRS rejecting a second filed return ... that means the return needs to be amended.

Some have posted the "Possible" option to mail in a regular form 1040 instead of the 1040X with a note basically saying " I was dumb and filed an incorrect return so please accept this 1040 as my real return" which of course the IRS could refuse to accept however even if they do it will still need to be processed like a 1040X and that usually it takes 4 months to process those but expect it to take much longer this year due to the backlog of paper returns that are 2 months behind already. For those that did not follow the rules and did the wrong thing anyway then you have no one to blame but yourselves and you will be paying the price with extended processing times.... hopefully you were not expecting a refund sometime soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

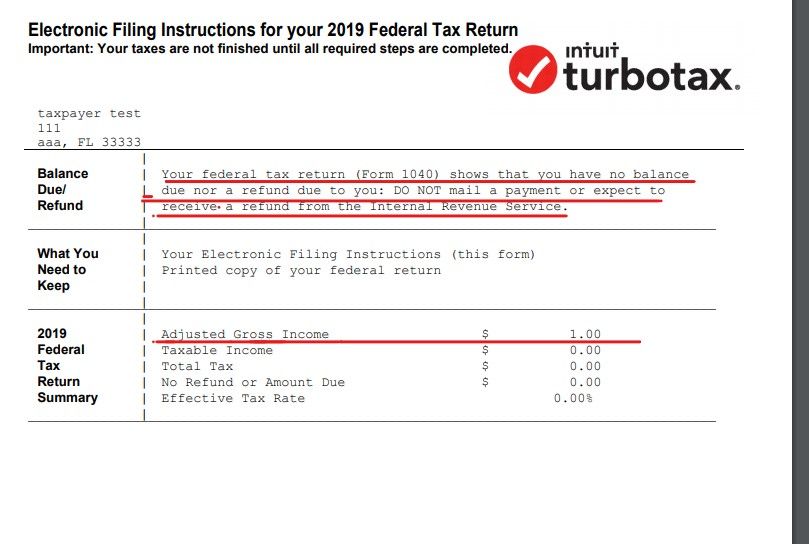

See the return that is filed via the registration portal ... you filed an actual return showing $1 of income ... see the 1040 & the instructions below for reference ... so since you filed an actual return you must amend said return if you need to make any changes to this VALID tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Critter.... I already addressed your annotated screen shots from the TurboTax web site yesterday.

Here it is AGAIN....

1) The IRS has NO written guidance on this topic. NONE! There's NOTHING from the IRS on this topic.

2) Since the IRS has NO guidance on this topic, aren't you inclined to wonder WHERE Turbo Tax is getting their information? They aren't getting it from the IRS because the IRS has said NOTHING on this topic.

3) You are quoting the TURBO TAX web site, NOT the 'IRS regulations' as you previously claimed. There are NO IRS REGULATIONS for this scenario. TurboTax has NO information that is any different from the information that anyone else has.

4) TurboTaxe's notations in your screen shot says "AMENDED RETURN'. It DOES NOT say to file a Form 1040X. The $1 VS $0 distinction that you are making is what's called "a distinction without a difference".

5) If you had put any effort at all into critical thinking, you aught to be wondering....

- How is it possible for TT to know more about IRS 'regulations' than the IRS does? (pssst... they don't)

- TurboTax is a repository of good information... SOMETIMES. Other times TT is dead wrong about some things. You are acting as though TurboTax is infallible. They are VERY fallible.

- How is it that Turbo Tax is publishing information that the IRS ITSELF has not published yet. Seriously... how is that even possible?

- Why doesn't all of these considerations even occur to you as a problem? These are HUGE and glaring problems. TT is claiming something, and you are repeating this something, that has never been determined, or published by the IRS?

- I have suggested to you on MULTIPLE posts that you ACTUALLY LOOK at a Form 1040X. There is NO PROVISION on that form for the set of circumstances that these filers are faced with. The Form 1040X DOES NOT WORK in this case. This scenario DIDN'T EXIST at the time of the publishing of the Form 1040X.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

GOOD NEWS!GOOD NEWS!

I deleted my Accidental Non-Filers 2 weeks ago, today I went in to check the status of my tax return, It stated the below

You may have not entered your information correctly but at the same time It gives me a second option stating.

If your personal data was correct, please answer the following questions:

Asking to reconfirm the date I filed & if it was Paper or Electronic.

Giving me the option to accept or not accept what i accidentally filed 3 weeks ago.

The tax return seems to be cancelled and no longer able to find, Thank God!

We are in situation that NO ONE HAS THE RIGHT ANSWER TO! I don't care if you are an CPA or Accountant.

Also, I don't suggest taking advice from anyone named Critter? Not even a verified CPA on through TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

"I was dumb."

"For those that did not follow the rules and did the wrong thing anyway then you have no one to blame but yourselves "

Crap comments like these are why I refuse to hear anything else you have to say. You simply refuse to accept that this mistake was in part due to how the original non filer form was set up.

You're dumb for adhering to such a stubborn position.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

RE: jamesmahonede "GOOD NEWS"

This is an interesting result that you stumbled upon.

I guess the real defining question would be...

Have you attempted to re-submit your Form 1040 via e-file, after you discovered, "The tax return seems to be cancelled and no longer able to find." ?

This would be the most important result to know.

In this thread, there have been accounts of successfully "deleting" the original Form 1040 ... and having it "no longer showing up". (including me)

BUT, even when this has been the case, we have still been "locked out" of the e-file system, and have not been able to get e-file to accept a second attempt.

Have you tested this yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

So, you say giving it a time frame of a week or two might help us submitting e-file once more?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I deleted the original submission.... then waited from last Friday, until today (Wednesday) (2-3 "business" over-nights) hoping that would be enough time for the system to allow a second attempt... if at all.

It didn't work.

e-File would not let me submit anything again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I haven’t even attempted to truly file my tax returns yet but now that you mention it.

I will try to get this done and keep you updated within 24 hours.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Considering my scenario, where system was processing my 2019 e-file and then suddenly that disappeared from WMR and a crazy me submitted non-filer; that allowed the IRS system to delete my old data. Then they should allow to delete this data as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

- Married couples who file jointly and whose 2019 AGIs do not exceed $150,000 are eligible for a full $2,400 stimulus payment. From that point, payments shrink by $5 for every $100 of income, before expiring at $198,000.

So just to clear our AGI on 2018 was more than $150,000 versus our AGI on 2019 which is less than $150,000. So my point is, since I filed the non filer and our 2019 is rejected then I don’t have the choice but to put my 2018 claim on the “need more information” section when I check my payment status on the IRS website. So the AGI for our 2018 return has been accepted by the IRS when I completed the “ need more information” under the the check my payment status a week ago. So really we could have gotten a full $2400 if we didn’t file the non filer and if we filed our 2019 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

YOU WROTE:

So just to clear our AGI on 2018 was more than $150,000 versus our AGI on 2019 which is less than $150,000. So my point is, since I filed the non filer and our 2019 is rejected then I don’t have the choice but to put my 2018 claim on the “need more information” section when I check my payment status on the IRS website. So the AGI for our 2018 return has been accepted by the IRS when I completed the “ need more information” under the the check my payment status a week ago. So really we could have gotten a full $2400 if we didn’t file the non filer and if we filed our 2019 return.

Ahhhhhh..... Got it....

That "little detail" that your AGI in 2018 was over $150,000, (and disqualifying) .... was kinda an important detail that wasn't revealed until just now.

Yes... that does make a difference. Based on 2018 you don't qualify.... but based on 2019 (yet not-filed) you DO qualify.... but since you submitted a non-filers 1040 via e-file by mistake, the IRS doesn't know that you qualify for $2,400 and there is no mechanism available to you now, to let them know this.

Ouch!!

Now I feel your pain. I understand.

The only remedy at this point to let the IRS know that you qualify for the $2,400 Stimulus Money, is to send in a paper Form 1040 for 2019. But that could take at least 6-12 weeks before the IRS processes it. Even when they finally do process it, I don't think anyone knows how you would go about getting your $2,400 retroactively.

Certainly, the IRS will eventually catch up and see you qualify and get you the $2,400 you are owed. But it could be months. It certainly doesn't help you in your moment of need... right now.

I'm sorry this happened to you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jimenezdiego513

New Member

adriyana-allen2000

New Member

229hawk

New Member

229hawk

New Member

user17684639366

New Member