- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

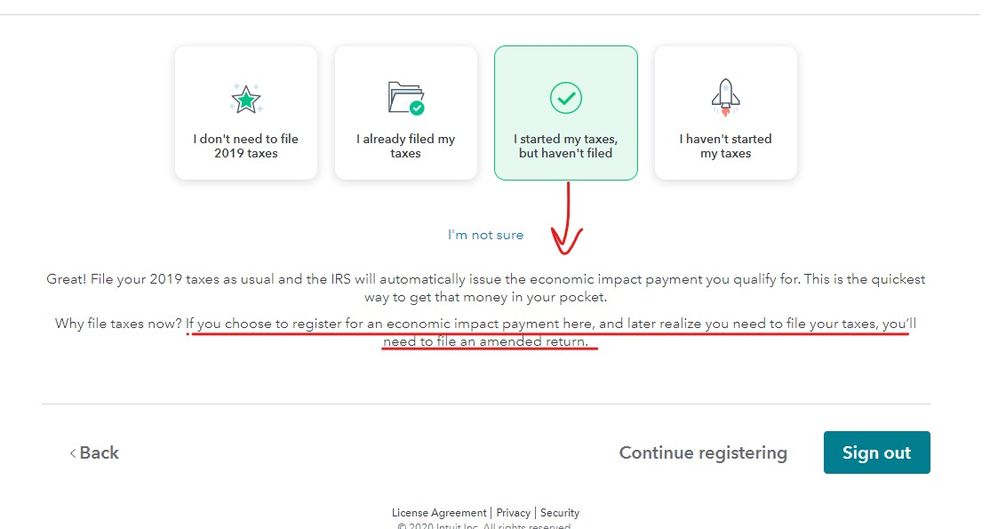

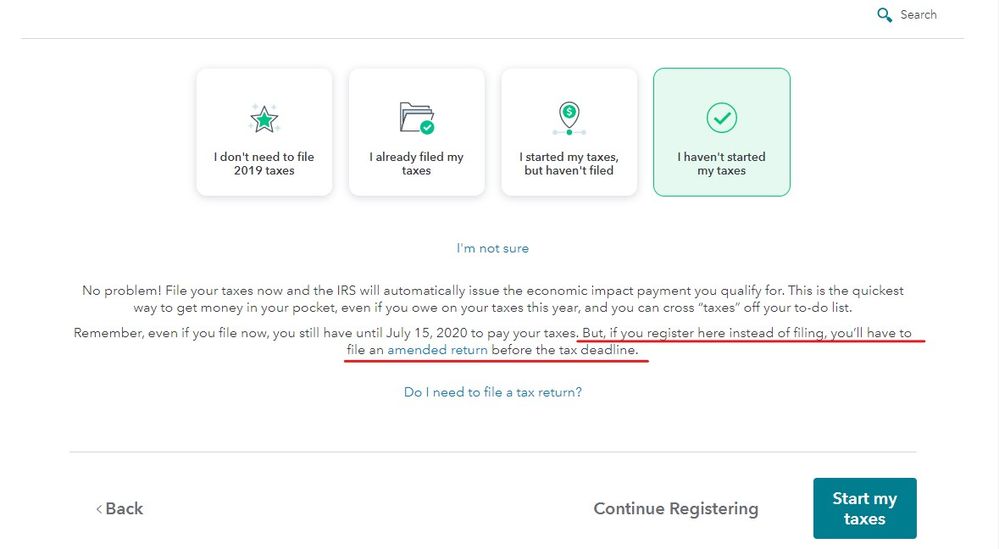

Sorry but the TT program tells you straight up that if you need to file a REAL return after using the registration program you MUST AMEND the return you file ... it is clear as crystal ... if you use the program incorrectly your ONLY choice to correct the error is to AMEND the return. And you are not filing a zero income return ... the return will show $1 of bank interest to trigger the ability to efile. And the proof is the IRS rejecting a second filed return ... that means the return needs to be amended.

Some have posted the "Possible" option to mail in a regular form 1040 instead of the 1040X with a note basically saying " I was dumb and filed an incorrect return so please accept this 1040 as my real return" which of course the IRS could refuse to accept however even if they do it will still need to be processed like a 1040X and that usually it takes 4 months to process those but expect it to take much longer this year due to the backlog of paper returns that are 2 months behind already. For those that did not follow the rules and did the wrong thing anyway then you have no one to blame but yourselves and you will be paying the price with extended processing times.... hopefully you were not expecting a refund sometime soon.