- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Please bring back the running total refund/tax due at the top of the screen

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

Please try this as an alternative.

On the top left side of the screen

- Next to the TurboTax Logo

- It says [Explain my Taxes]

- Click the little arrow next to it.

- It should bring back the tax meter.

Please contact us again with any additional questions and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

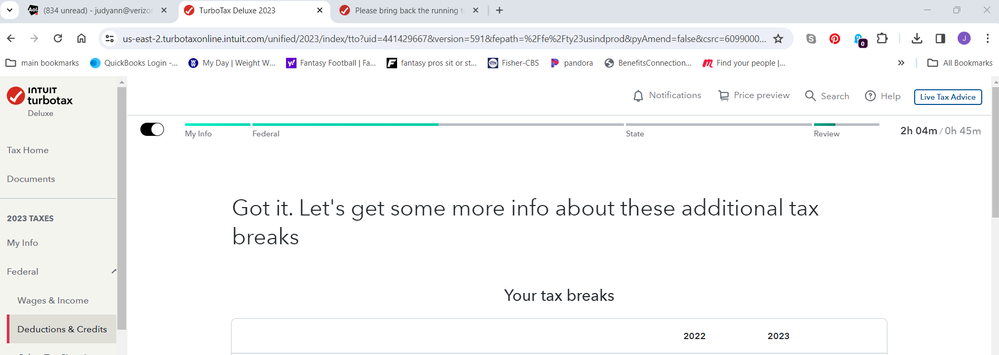

Thanks for taking the time to reply, but as has been stated none of what you are describing is present for us. Look at the screenshot posted earlier in the thread by ewgrose. No "Explain my taxes", no arrows, just a slider switch that makes the progress bar go away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

Yeah, they messed with the ubiquitous red/green dough-o-meter !?!?!?!?

Looks like upon successful completion of the Review section questionnaire, the dough-o-meter magically appears at the upper left of the screen. Once the meter displays, you can do the 'what-if' experimentation by changing income or deduction fields as in prior years and the values change in real-time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

I agree with the others who are not seeing the running total. I've spent more time trying to figure that out than I have on doing my actual taxes. None of the fixes you have suggested have worked. There is nothing other than the Your Progress button that can be clicked. I've tried this in both Chrome and Edge. It really is frustrating also agree that seeing the running total is one of the best features of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

There is nothing above the progress line. I also cannot click on anything in the progress line. I have cleared cache, tried different browsers and have restarted my computer. Nothing seems to work. Very frustrating

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

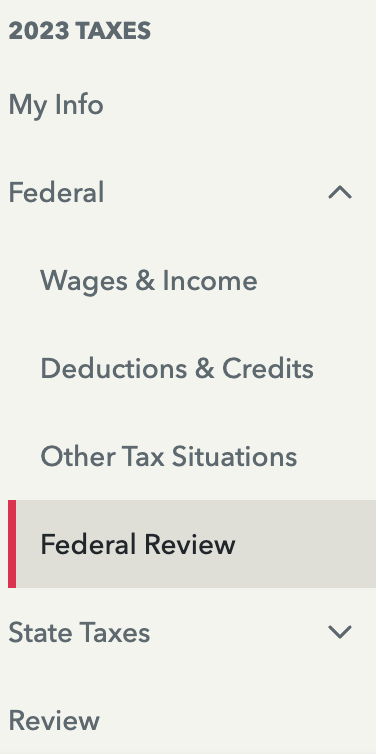

Trying clicking on Review on the left menu. Sometimes you have to click through the income/deductions section too to let the software know that you are done with that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

Agree 100% with what Vann1 said. There is nothing above the progress line. Nothing next to the Turbo tax logo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

I do not have anything above the green progress bar that says "Explain my taxes>" - there is nothing there to click on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

Update: i've entered all of my federal info (wages, deductions etc.). when i clicked "Federal Review", the running total (for me "Federal due" and "State due") appeared at the top of the screen where it was in previous years.

My ask to Intuit remains the same: always make this total available from the start of anyone's return. at this point in the game, it's much less value to me as I've completed 100% of my Federal return and most of my state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

Oh my god! I am a NEW TurboxTax user. I can't believe I cannot see the running owe/refund preview, no matter what I tried. This is a must-have feature because it alerts me if I enter the wrong figure. All other tax software vendors have this feature. This makes TT useless for me. :<

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

If you have started to enter information such as a W-2, and don't see the meter go to the Federal Review section. Click on all the way through ignoring the prompts to fix things and the meter should turn back on.

Then return to the section needed to enter your other income or deductions/credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

Intuit TurboTax removed the running total refund/tax due at the top of the screen, according to customer support on 4/7/2024.

I pointed them to this thread and explained that like may others, I have a blank white bar where it's supposed to read "Explain my taxes" and have the running amounts. I have tried several browsers on several computers with no success. I've tried proceeding through the various federal, state, and overall review pages, but I cannot get through them without completing the return, so that does not seem like a viable fix.

As many have stated, tracking the refund/tax due as I enter data is vital to catching errors and understanding what is affecting my taxes. I explained that its removal severely diminishes the value of TurboTax and will have me looking elsewhere.

Before the call, I had dug a bit deeper. I used the browser's right-click "Inspect Element" tool on the white bar to look at the relevant html and javascript. I searched for "Explain my taxes" and found related sections of javascript, but I couldn't make sense of them. In the console, there was a long list of page load errors (over 500 initially upon login, growing to over 1000 with time). There were over 30 errors of "failed to load resource" due to a 403 (access denied) error relating to a widget or plugin called "refund-data-monitor" which from its name seems to be the piece we're all missing. The resource these were all trying to reach begans with: https://plugin.intuitcdn.net/refund-data-monitor/

For example, https://plugin.intuitcdn.net/refund-data-monitor/main.css.map

Many of them have a long alphanumeric string after the resource name, something potentially tied to me as a user, so I'm not going to share that.

Given the late date, I'll probably suffer through using TurboTax as I file my 2023 returns, but this is likely my last time. TurboTax has gotten too expensive, and each year brings changes that confuse the process and remove functionality.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

This is not a running total. In the past I have stopped entering information when I have arrived at the point that the deductions would not help my tax situation as a small business owner. I NEED to see the results as I enter the information. This is a disaster for me as I am spending far too much time entering information (e.g medical bills etc. ). I need to know when to STOP entering information! The reason for using TurboTax was for it to do that work for me!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

As a business owner, the IRS does not allow you to manipulate your income by not entering all of your business expenses. You cannot just enter expenses until you get to the right income numbers for business. You are required to report ALL income and claim ALL expenses.

"A self-employed individual is required to report all income and deduct all expenses. Revenue Ruling 56-407, 1956-2 C.B. 564, deals with the issue of taxpayers not taking all allowable deductions in computing net earnings from self-employment for self-employment tax purposes. Rev. Rul. 56-407 held that under §1402(a), every taxpayer (with the exception of certain farm operators) must claim all allowable deductions in computing net earnings from self-employment for self-employment tax purposes". Earned Income, Self-employment Income and Business Expenses

You can however stop entering expenses as itemized deductions once they are no longer being counted or adding to your deduction because you have already wiped out all of your income and this does not manipulate your income in any way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please bring back the running total refund/tax due at the top of the screen

I can't belive they removed this feature or removed it for some users and not others. Perhaps, it is going to be a feature that is only supported by the higher more expensive tier product. Either way, after 8 years this is a real deal breaker for me. Turbo Tax needs to fix this yesterday.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jenniferbannon2

New Member

RamGoTax

New Member

RyanK

Level 2

jpin44

New Member

TimO610

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill