- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Partial roth conversion cannot be greater than the amount on line B1 1099r error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

My return keeps getting flagged by Turbo Tax with the following error:

Partial Roth conversion cannot be greater than the amount on line B1, the amount that can potentially be converted to a Roth.

B1 is a checkbox.... not a number amount.

My tax situation is quite simple here and I am not sure what to do. Took a gross distribution from a qualified plan over the age of 60, paid tax on that amount, and converted the rest to a Roth.

Turbo Tax shows the amount of the distribution that can be rolled over to my Roth as the AMOUNT I PAID IN TAXES.....rather than the remaining amount after paying taxes. I cannot edit this line...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

Please clarify your question. There is no B1 or 1B on Form 1099-R. Are referring to a different form?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

The error message should say line B4, not B1. This is probably old message text that was not updated for changes made to the line numbering.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

@dmertz Yes, but why is B4 pulling in that number? Which is the federal taxes paid. That doesn't make sense. How can the tax that was paid to the government be the amount that can be converted?

That's the problem that I can't seem to solve.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

I don't know why line B4 of TurboTax's 1099-R form would have the amount from box 4.

What is the code in box 7 of this Form 1099-R?

Is the IRA/SEP/SIMPLE box marked?

You might try deleting and reentering this Form 1099-R if you have not already done so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

I have tried to reproduce this error, but I can enter these figures without getting that error.

What is your box 7 code? Is your IRA box checked? Are you using the online program or Desktop (download or disc)?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

@JulieS using the desktop online version straight in Chrome Browser.

Box 7 code is "7"

The IRA/SEP/SIMPLE Box is also checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

I haven't been able to reproduce this in Desktop either. The message you are getting actually refers to B2, not B1.

At this point I can only suggest that your delete the 1099-R and enter it again, being very careful about your answers.

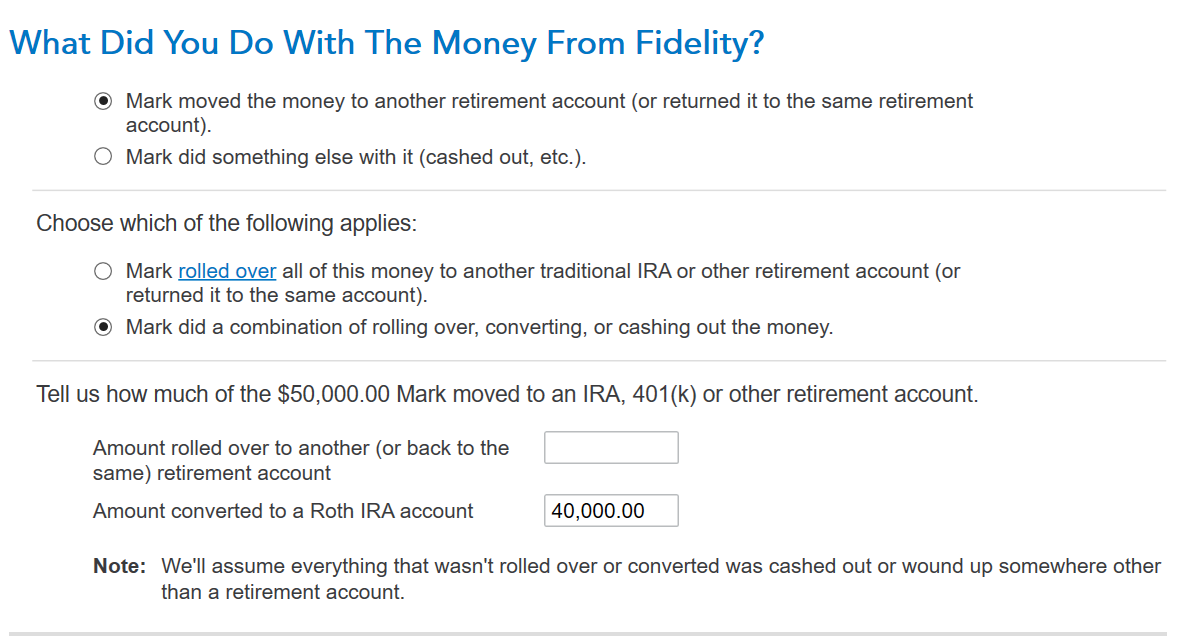

Here is how the rollover should be reported:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

@JulieS definitely appreciate the help. I am not seeing that screen you are though - not sure if the online desktop browser version is different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

Doing a backdoor Roth conversion is a two-step process.

You may want to delete your 1099-R, close TurboTax, clear your Cache and Cookies and revisit the section.

Click this link for steps on How to Enter a Back-Door Roth Conversion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial roth conversion cannot be greater than the amount on line B1 1099r error

Same error message. Solution that worked, deleting and reentering this Form 1099-R.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ackerc21

New Member

user17609814231

Level 1

pipeclamp

Level 1

wolf6

Returning Member

John Maxey

Returning Member