- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: on a QCD there is no 4b line to enter amount. Where do we enter information?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

Check the birth date that you entered in the Personal Info section. For 2024 your birth date has to be before July 1, 1954 in order to get the QCD question, so that you were 70½ before the end of 2024.

According to IRS rules you have to have been at least 70½ when the distribution was taken from your IRA. TurboTax doesn't ask you the date of the distribution, so it does not check so precisely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

It's a Treasury Dept. secret. TurboTax enters "QCD" on your 1040 next to the amount to be taxed which is less the amount for the QCD. I assume people doing their taxes by hand, pencil in QCD and do the subtraction for the govmint. Good luck finding instructions about this in any of the IRS documents and forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

The "secret" instructions for reporting a QCD are in the instructions for Form 1040 lines 4a and 4b on page 27 of the IRS Instructions for Form 1040, in the left column under the heading "Exception 3."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

TurboTax does not give me an opportunity to enter a QCD anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

I don't see it. I am 73 years old,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

@HDieterich wrote:

TurboTax does not give me an opportunity to enter a QCD anywhere.

Providing you are age 70 1/2 or older, you checked the box for IRA/SEP/SIMPLE and you have a code of 7 in box 7 of the Form 1099-R, then after entering the 1099-R there will be a series of screens asking questions. On the screen Do any of these situations apply to you? select the statement I transferred all or part of this money directly to charity

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

There isn't a code on the 1099-R to indicate a QCD. After you have entered all of your 1099-R forms, there will be additional follow up questions in the interview. It is in this section that you will indicate that you had a QCD and provide the amount of the charitable distribution.

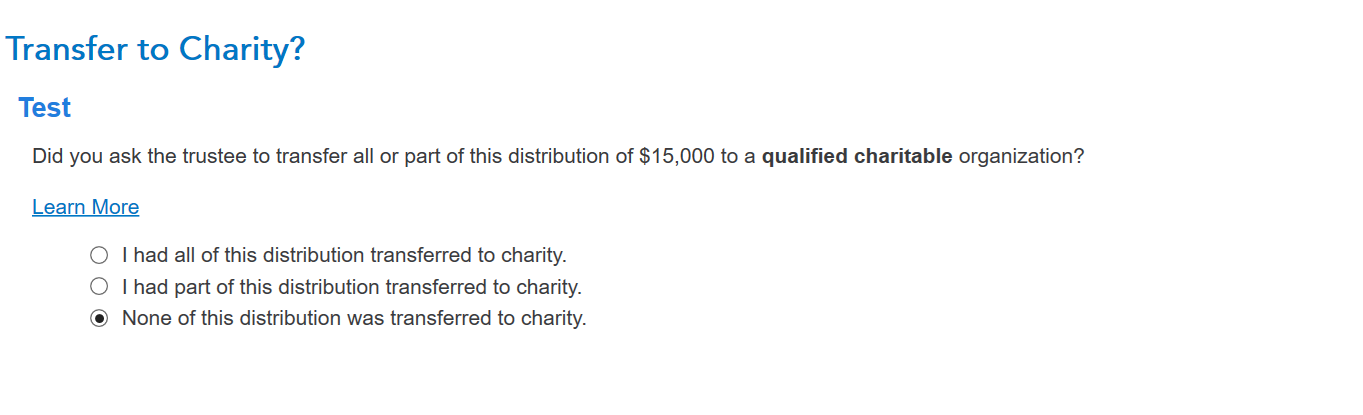

The top of the screen should read "Transfer to Charity?" and look similar to the below photo:

If you don't see this question, delete the 1099-R and re-enter it manually. Be sure that the "SEP/SIMPLE/IRA" box is checked (or question answered "yes") and that the code in Box 7 is "7".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

on a QCD there is no 4b line to enter amount. Where do we enter information?

@HDieterich wrote:

I don't see it. I am 73 years old,

This screen after entering the Form 1099-R using the TurboTax online editions -

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

RyanK

Level 2

RicsterX

Returning Member

freedom_111_07

New Member

girishapte

Level 3