- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: nexchap - How do I report the sale of MLP units in Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

This current help string has reached 31 pages which explore multiple scenarios going back to 2019.

I am facing the situation as a long-time TurboTax user but as a "newbie" for reporting the sale of publicly traded MLP units during the 2022 tax year.

My question is whether the reporting of a sale of MLP shares in TurboTax really that difficult in most cases? Should I bail on using TT next year and hire a CPA for the first time in 20+ years?

My situation seems relatively simple:

All units purchased at one time in 2014, and sold as one sale in 2022

I usually use the downloaded (desktop) version of TT in the Mac Deluxe version. Does this version adequately cover MLP sales, or would I be better off upgrading to the Premier version?

What information beyond the purchase price and sale price will I need to enter the sale: Distributions? Business income losses from previous K-1's? Carryover losses? etc? Does the final K-1 and/or brokerage 1099 usually include most or all of the required information?

The only thing that may be a confounding issue is that the units were originally purchased by my wife several years prior to our marriage and the K-1 info for those years is on her personal tax returns, while only the last 3 years are on our joint returns. I mention this because I don't know if carryover cumulative business income losses are part of the tax calculation?

Thanks in advance for your input. I'd really like to stick to using TurboTax and doing my own tax returns.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

In most cases, reporting the sale is pretty straightforward. But it does introduce a whole bunch of tax issues that TT “handles”, but doesn’t really explain or simplify. And, unfortunately, TT makes it easy to enter things incorrectly, leading to tax errors. So if this is your one and only interaction with MLPs, you'll have to decide if its worth the hassle to do-it-yourself. But if you’re going to do MLPs / partnerships again, or are comfortable dealing with taxation, it’s very doable with the help available on the forum.

You’ll need

- Your original purchase info and the ‘Sales Schedule’ that will come with your 2022 K-1

- The correct carryover losses. You get to report these when you sell, but to do that you’ve got to get the right number into TT. Ideally, in the first year you used TT for the K-1, you’d have entered the suspended losses from your wife’s return into TT when it asked about prior carryover losses. If not, you can add them in during the 2022 interview, but that leaves open the possibility that something in a prior year’s return was incorrect.

- An ending capital account balance (section L of your last K-1) that’s above $0 (to make sure you’re still in the ‘simple’ category). If your capital balance has dropped below $0, you may not have basis, or investment at risk, which definitely makes this complicated and expert help is probably called for.

If you’ve been using Deluxe so far, and entering all your K-1 info there, then it will also work for the sale.

Hope that helps.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

you should really start your own thread.

this is based on Turbotax for 2021. they could change the programming which could change how the disposition is entered.

MLP reporting k-1 and 8949

Please follow these instructions. Incorrect entries can result in entering the sale twice or otherwise incorrectly. Also see the sales schedule that was included with the k-1

Enter the k-1 info

Check the PTP box

If total disposition proceed as follows:

Check final K-1 (s/b marked on actual k-1)

Check sold or otherwise disposed of entire interest

Use QuickZoom to get to the following section

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words ”gain subject to recapture as ordinary income”

Cost is zero

Ordinary income is the sales price.

This info flows to form 4797 line 10 and is taxed as ordinary income.

Now for the 8949.

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not the correct.

The correct tax basis is:

What you paid originally, should be the same as what is on 8949,

Then there is a column on the sales schedule that says cumulative adjustment to basis. If it’s positive add it to the original cost. If it’s negative subtract the amount

Finally add the amount of ordinary income reported above.

The result is your corrected cost basis for form 8949.

Some other things. Look at lines 20Z1. That number should be added to the ordinary income above for reporting the 199A (qualified business income from the PTP). You don’t have to enter this but the you lose out on a tax deduction = 20% of this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

Thank you very much Nexchap & Mike9241. Your time and efforts are very much appreciated. It is a little complicated. Since you both replied to my question on this thread can I ask if you are both saying the same advice, but in two slightly different ways?

Mike gives step by step instructions which I gather would be entered directly (or at least corrected) on the indicated forms. Nexchap sounds like it's a matter of following the prompts in the EasyStep interview to get the info entered. Am I understanding this correctly?

Also, I was going to start my own thread, but frankly I couldn't find the proper place to get that started.

Thanks again for all of your help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

@Stumas11 Mike's script is basically the same step-by-step guidance already described on this thread in multiple spots. My point is a little different: for simple tax issues, TT requires no thought or understanding of tax. TT will ask for all the data required, do all the calculations, and produce a perfect return. With partnerships (including MLPs), there are multiple ways to make mistakes that TT won't catch (e.g., did your suspended losses get released, did you calculate the correct basis, did you get the QBI deduction). Even worse, just following the basic interview can create mistakes. So the best approach is to both a) understand what is supposed to be showing up on the different forms, and why, and b) follow step-by-step guides on how to make that happen in TT.

There's lots of help on the forums for both a) and b), and many first-time MLP sellers have used that help to get through it. But whether one invests the time to figure it out, or hires outside help, is just personal preference.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

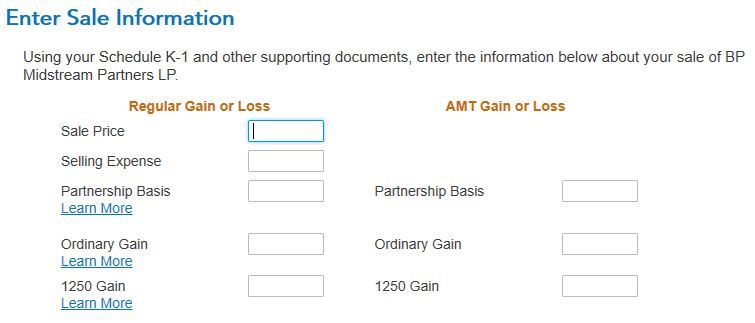

@Mike9241 Thanks for the instructions you provided here last year. They’ll help me as well. I’m in the same situation. If I may ask, could you clarify a couple of things? I suspect the interview has changed for this year. The blanks look like this:

By “cost is zero,” are you referring to the Partnership Basis box, since you’re supposed to end up with zero basis at the end of it all? Or am I misunderstanding? My sales schedule gives a final adjusted cost basis of $10,317 after applying the cumulative adjustments, so I don’t want to enter the wrong value somewhere.

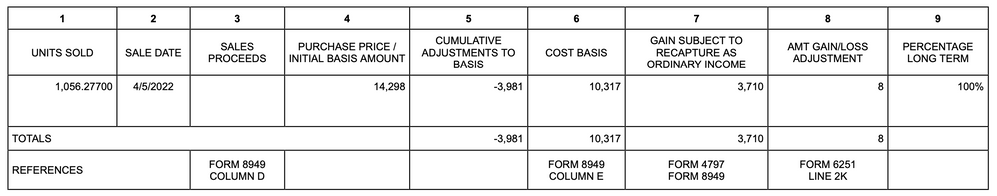

Here’s my sales schedule from the final K-1:

My other question relates to QBI and passive activity loss carryovers from prior years. What does Turbotax do with these, assuming I follow your approach outlined above? My understanding is that they're already included in the "cumulative adjustments to basis" in column 5, right? So I don't want to inadvertently double count them, but I also don't want to lose them.

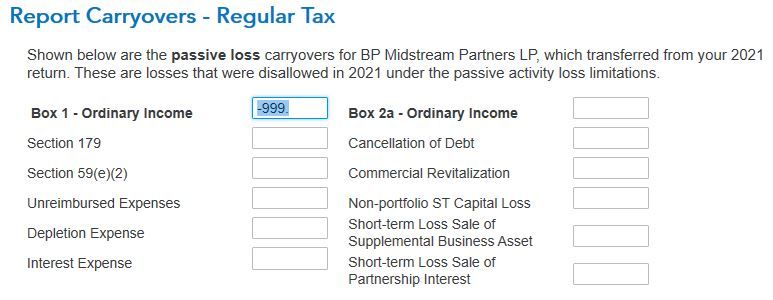

Turbotax has a step where you enter these (carried over from last year’s return):

Should I delete this information and just follow the procedure you’ve outlined? Or do these still need to be applied?

Thanks again for all the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: nexchap - How do I report the sale of MLP units in Turbotax

the instructions (i used desktop) provided by Turbotax are wrong/incomplete

"Note: if this is a full or partial disposition of a publicly traded partnership (PTP) or master limited partnership (MLP) that was reported to you on a Form 1099-B enter a sales price of zero on line 5 and a basis of zero on line 7 below. Enter the 1099-B transaction on Schedule D, checking the appropriate “Reported on 1099-B” box A or B. See help."

*******************************

Certain MLPs/PTPs carry no 751 assets like investment partnerships. therefore, the 751 income will be zero. so the above would be correct in those cases. what isn't stated is how and where to report any 751 income that is reported on the supplemental schedule and box 20AB of the k-1. reporting the 751 income, which is always ordinary income, through this section of the k-1 is the most practical place to report it. it carries this to the 4797 line 10. The broker does not have your tax basis because they don't get it and therefore don't adjust for the activity. What they report as cost is what you paid to purchase it. Every 1099-B that I have ever seen reporting the sale uses type B or E which means tax basis is not reported to the IRS and what is shown as tax basis agrees with the supplemental schedule ($ round excepted and in rare cases brokerage fees are not included) column that reports purchase amount/initial tax basis. some supplemental schedules will give you the total tax basis including the 751 amount others give the adjusted tax basis before the 751 amount to which you must add the 751 amount (the 751 increasing the partnership income increases the tax basis). for you add columns 6 and 7 as tax basis on schedule D/8949

**********************

yep, cost is the same as partnership basis. sorry, I didn't realize they change the wording. there are two elements to selling a partnership interest 1) ordinary income i.e. the 751 gain if any and 2) the capital gain or loss. The 751 part has a zero basis

*****************************************

you can not report the complete sales detail through the k-1. the type would be C or F - neither proceeds nor tax basis reported to IRS which even if you were to delete the sale form the 8949 broker report would result in a letter from the IRS because what you will show as reported proceeds will be less that what the IRS broker report shows.

*******************************************

yes QBI is the same or almost the same) as the cumulative k-1 line 1,2 and 3 income/loss reported on the K-1s since 2018. with PTPs/MLPs ordinary losses (lines 1 thru 3 off k-1) are not deductible. they are suspended until there's either income from the same PTP/MLP or complete disposition of that security. The same applies to the QBI. if you properly entered the QBI info Turbotax carries it forward. with positive QBI from a PTP, you get a deduction from taxable income of 20% of the QBI amount from PTPs (any non PTP QBI income deduction can be limited). it shows up on form 8995 and on line 13 of the 1040. it can not go negative.

*****************************************

that -999 is losses that haven't been deducted on your return because of the tax laws. upon complete disposition of your partnership interest, it is allowed but as a twist, it is treated as non-passive. the supplemental schedule has already accounted for that loss so you do not adjust your tax basis for it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmgretired

New Member

dpa500

Level 2

Questioner23

Level 1

colinsdds

New Member

johntheretiree

Level 2