- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

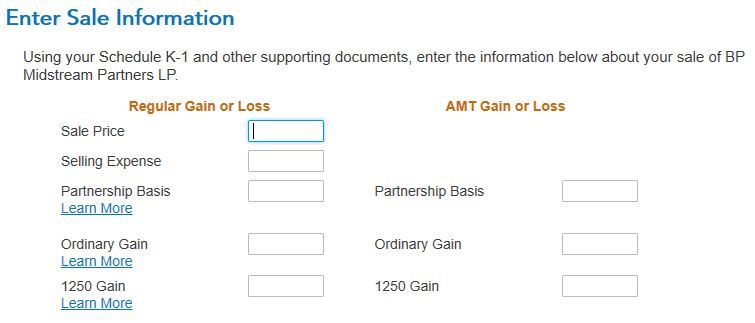

@Mike9241 Thanks for the instructions you provided here last year. They’ll help me as well. I’m in the same situation. If I may ask, could you clarify a couple of things? I suspect the interview has changed for this year. The blanks look like this:

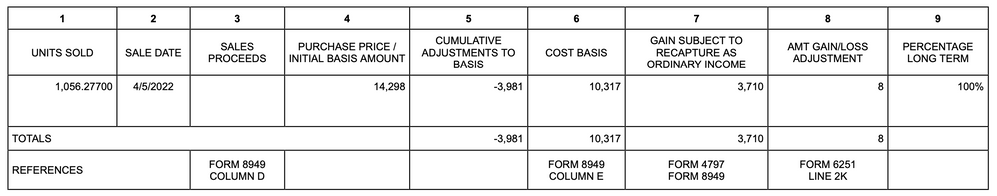

By “cost is zero,” are you referring to the Partnership Basis box, since you’re supposed to end up with zero basis at the end of it all? Or am I misunderstanding? My sales schedule gives a final adjusted cost basis of $10,317 after applying the cumulative adjustments, so I don’t want to enter the wrong value somewhere.

Here’s my sales schedule from the final K-1:

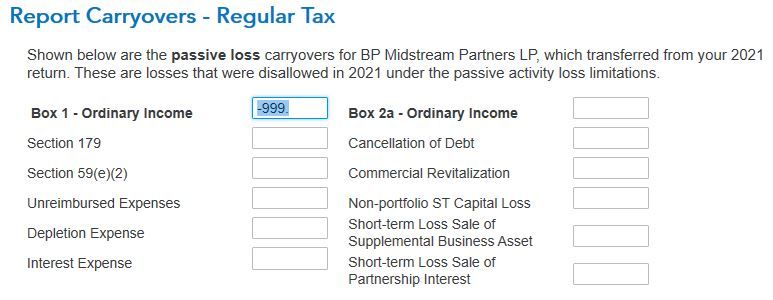

My other question relates to QBI and passive activity loss carryovers from prior years. What does Turbotax do with these, assuming I follow your approach outlined above? My understanding is that they're already included in the "cumulative adjustments to basis" in column 5, right? So I don't want to inadvertently double count them, but I also don't want to lose them.

Turbotax has a step where you enter these (carried over from last year’s return):

Should I delete this information and just follow the procedure you’ve outlined? Or do these still need to be applied?

Thanks again for all the help.