@Erilflynn

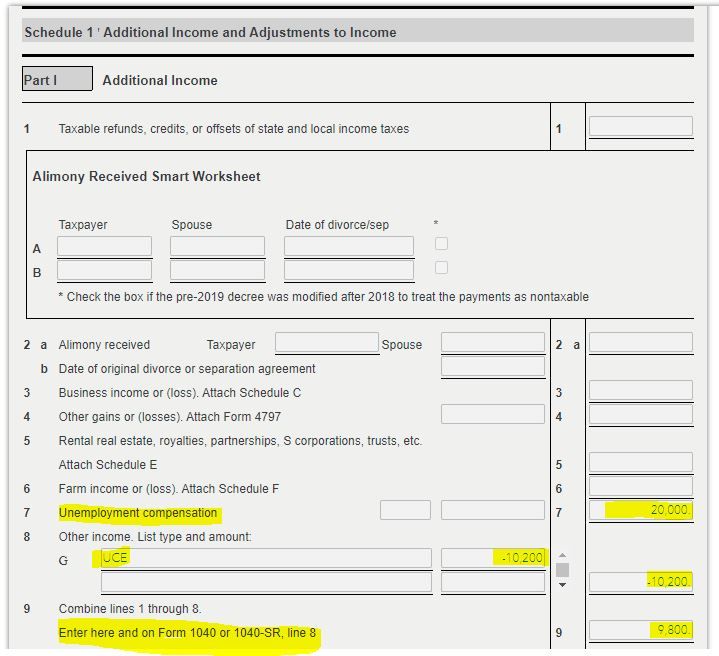

As part of the recently passed American Rescue Plan, the first $10,200 worth of unemployment payments may now be tax-free for a person with an annual modified adjusted gross income of less than $150,000. This expanded tax relief begins this year, starting for taxpayers filing returns after January 1, 2020.

New York state tax treatment in TurboTax is addressed here.

This news article says that the state of New York may move to exclude these unemployment benefits from taxable income.

Senator Jim Tedisco (R,C-Glenville) today announced he will be introducing new legislation to extend New York State’s individual income tax deadline from April 15th to May 17, 2021, and exclude unemployment benefits from taxable income to be consistent with the federal government.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"