- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- New Exclusion of up to $10,200 of Unemployment Compensation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

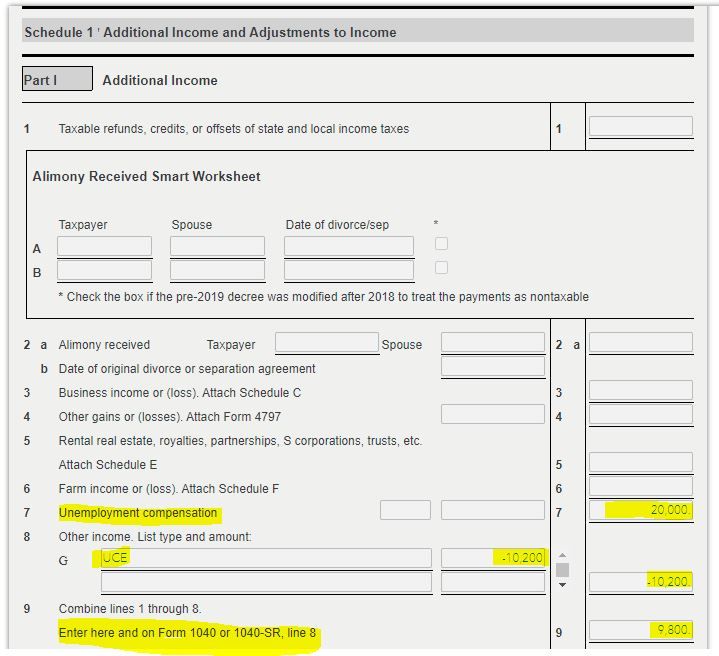

Curious what do you mean? Are you saying you filed with out waiting? My rep from turbo tax told me that the exclusion happened automatically when I filed. The tax bill seemed rather high still and I kind of mistrust the calculations, but never the less he did go into my computer and showed me where on the automatic work sheet under the review 1099 section on the left hand side that the -10,200.00 was taken down. I really did not have to do anything and a paragraph telling me that I qualified for the exclusion and it was automaticaly adjusted did appear prior to me paying the tax bill. This adjusted amount did not show up on the original page where you enter amounts (wages and 1099 from social security and or UI though and this did made me nervous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I e-filed before the March changes allowing up to $10,200 unemployment credit from AGI. The TT updates are irrelevant since I already filed. I did not pay amount owed, opting to wait until deadline. Now I’m in limbo...pay $3k amount owed when I filed, or pay $1k. waiting for IRS is like watching paint dry. Wish there was definitive direction for those who already filed and owe money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I sent a message in support of S5125 to my NYS Senator. Here is a quote from his reply:

The idea of exempting these benefits in line with the federal exemption makes complete sense. There have been discussions to allow such an exemption, but to this point, no final decision has been made. As we negotiate a new state budget (due April 1) this is an issue that may be included. The governor's office has signaled willingness to include the exemption, but again, no final agreement has been approved.

Additionally, I am supportive of Senate Bill 5125 and would certainly vote in favor of the bill.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

That’s encouraging. Please keep us informed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

going to standby mode ...... thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

NYS Senate Bill S5125A is still in committee as of 1PM 3/31.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Funny how this has been about complaining about TT now just about New York

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

It's not really just about NY, this problem persists with Federal as well:

as of this today, TT online still doesn't apply $10.2K Exclusion for 2020 Unemployment to Federal Income, the case was open back on 3/29 and still NOT closed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@eugenebar wrote:

It's not really just about NY, this problem persists with Federal as well:

as of this today, TT online still doesn't apply $10.2K Exclusion for 2020 Unemployment to Federal Income, the case was open back on 3/29 and still NOT closed.

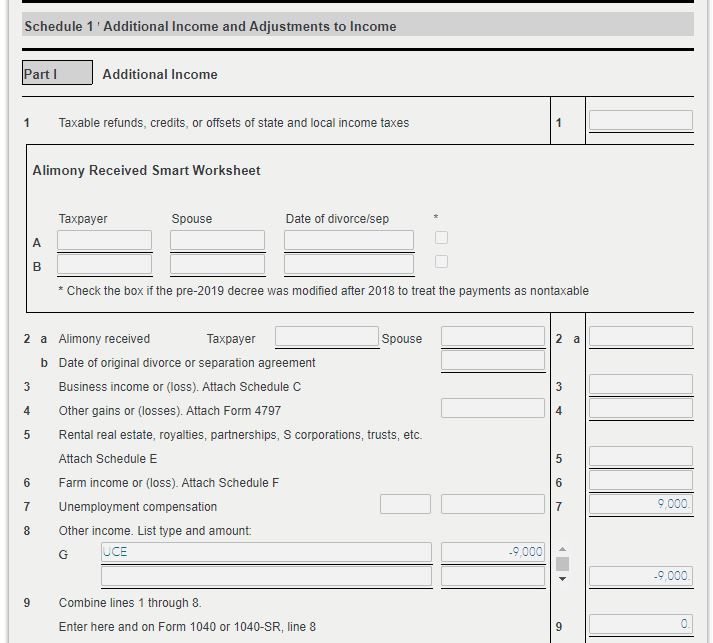

The unemployment exclusion is most certainly available using the TurboTax online editions. The exclusion is on Schedule 1 Line 8 as a negative number.

I have test online accounts for both the Free online edition and Self-Employed online edition with screenshots.

If your modified AGI is $150,000 or more, you can’t exclude any unemployment compensation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I delete the BS posts!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

So I filed prior to TT update. Just received my refund. Should I file an amendment? Since the refund was after the update, the amount received should have been higher.

I thought IRS was supposed to do the calculations and deposit the correct amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@jeshu wrote:

So I filed prior to TT update. Just received my refund. Should I file an amendment? Since the refund was after the update, the amount received should have been higher.

I thought IRS was supposed to do the calculations and deposit the correct amount.

Go to this IRS website for the current information on how the IRS will be handling the unemployment exclusion for those who have already filed their 2020 tax returns - https://www.irs.gov/newsroom/irs-to-recalculate-taxes-on-unemployment-benefits-refunds-to-start-in-m...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

IRS recently announced they would make the appropriate adjustments automatically and then send refunds starting in May.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Do not amend yet. The IRS is still in the process of determining when and how refunds will be sent. Please see the link below for the latest updates.

Unemployment claimed on returns already filed

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I wonder if they will update the transcript to show lower AGI. That way I get the third stimulus check.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eschneck

New Member

pennylaramore1961

New Member

lc3035

New Member

elliott-mercatus

New Member

IFoxHoleI

Level 2