- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Need help with "Do any of these uncommon situations apply to this W-2?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

Hello,

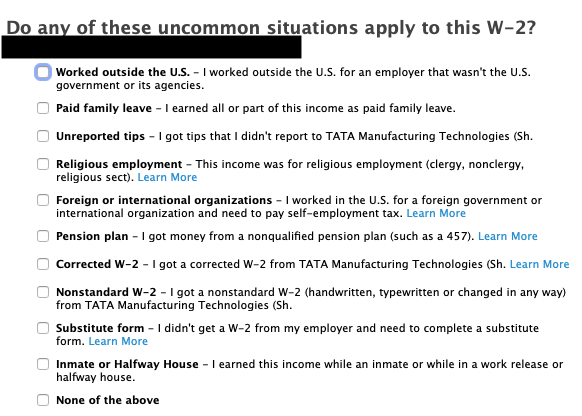

I have an odd situation from last tax year and require help. I worked for a company in China while living here in the USA for the entire 2020 tax year. In the past, when I was living in China for many years, I always checked the box of "Worked outside the US".

Given the situation above, which checkboxes should I check below, if any? I have a feeling which one(s), but I want to get some input.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

As a US citizen working in the US for a Chinese company your wages are subject to social security and medicare tax. The employer should have withheld those taxes per IRS instructions. China is not on the Totalization Agreement list.

If you have a W2 then "None of the above" would apply. If not, you may be using the option "Substitute form".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

@DMarkM1 - thanks for the reply.

So I would check "Substitute Form"?

Would I also check the "Foreign and International Organizations" too? I don't think it totally applies since I was not self-employed by the Chinese company, rather I was directly employed.

Given the answers above, will Turbotax then be able to determine which forms apply?

Additionally, I used to check "Worked outside the US". Then I would also enter in the amount of foreign tax paid to the Chinese government. If I choose these boxes suggested, will I also be able to enter the amount of foreign tax too (so that I can claim a Foreign Tax Credit I believe)?

Thanks for all your help. 😃

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

No, you would not check that you worked outside the US. You were physically present in the US when you performed the work so you are not considered as working outside the US even though your employer was outside the US.

You can use the Foreign Tax Credit for paying taxes to another country on the same income. It has to be a tax imposed on the income.

Refer to this IRS page about foreign taxes paid.

Where do you enter this credit?

Both the credit and the deduction are entered in the same place. Here's what you do:

- Make sure you've entered all your foreign income.

- From within your return, search for foreign tax credit and select the Jump to link in the search results.

- Answer Yes to Did you pay foreign taxes in 2020 or have credits to use from a prior year?

- Follow the instructions to get the credit or deduction.

In most cases, taking the credit works out better than the deduction. We'll help you decide which one's best for you when you go through this section. If you choose to take the credit (most people do), we'll attach Form 1116, Foreign Tax Credit if your situation requires it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

Hi @DianeW777 ,

Thanks for the reply, but I am still a bit confused which box should I check for the "Do any of these uncommon situations apply to this W-2".

So if I do not check the "Worked Outside the US" box, which do I check, if any?

Do I check "Foreign or International organizations"? I don't know because was not self-employed. I was employed through that company with a Chinese work permit.

Do I check "Substitute Form"? I do have all of the electronic paystubs for last year on the gross wages received an taxes paid to the Chinese government.

Or perhaps do I just click "None of the Above"?

I really need some help here... 😢

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

Hi @DMarkM1 ,

Thanks for the reply.

I am not for sure I understand completely. Perhaps I can explain a little clearer.

I was in the USA for the entire 2020 tax year.

I was located in Michigan for the entire 2020 tax year.

I was employed by a Chinese company (not a US company) for the 2020 tax year from January to September.

I paid taxes to the Chinese authorities based on my income there.

Based on your link, "U.S. citizens, resident aliens, and nonresident aliens employed outside the United States by a foreign employer are not generally subject to Social Security and Medicare tax withholding. However, an American employer with a foreign affiliate may request that Social Security and Medicare taxes be withheld from the wages of U.S. citizen and resident alien employees of the foreign affiliate by filing Form 2032, Contract Coverage Under Title II of the Social Security Act.", it would seem that I should NOT have to pay Social Security and Medicare tax, correct? Because I am a US Citizen employed outside the US. I was not employed by an American employer with a foreign affiliate.

Can you please advise?

Would I then still check ONLY "Substitute Form"? I have all of my electronic paystubs with gross wages, taxes paid, and net wages from China.

Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

To answer your questions and clarity a few points:

- Mark ONLY the box for a Substitute W-2.

- Do NOT check "Foreign and International Organizations." You were not self-employed and you worked for a "company in China" not a foreign government or international organization.

- You were NOT "employed outside the United States by a foreign employer." You remained inside the U.S. working for a foreign employer.

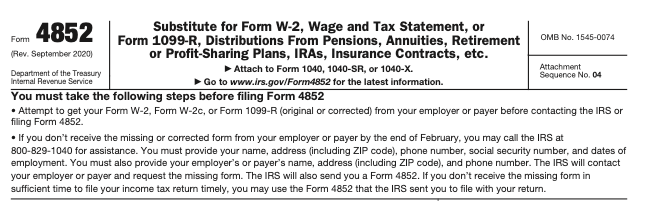

Please see this TurboTax Help article for filing a substitute W-2: How do I file a substitute W-2 using Form 4852?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

HI @Irene2805 ,

Thanks for your reply. It really helped me.

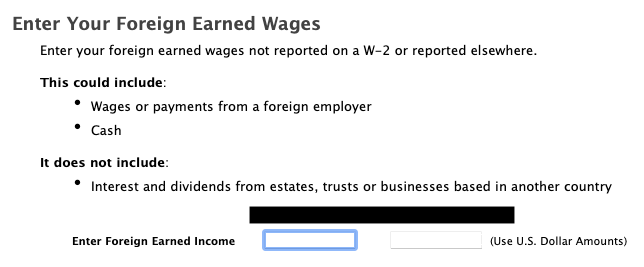

Instead of checking the Substitute W-2 box, I also found that just by going into declaring Foreign Earned Income, it basically does the same thing in terms of declaring my wages from China. Does this work as well @Irene2805 ? I didn't try the Substitute W-2 box, but I always did the Foreign Earned Income page in the past.

I know that I will not qualify for the Foreign Income Exclusion, so that has been deleted from my profile.

I do believe after that, I will be able to go through the Foreign Income Credit page and get some deductions there.

@Irene2805 - Does this sound like a good plan as well in comparison to what you have described?

Thanks and I look forward to hearing from you. 😃

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

No - Your plan would have worked last year, when you were actually working in China!

According to the IRS, foreign earned income is "income you receive for services you perform in a foreign country in a period during which your tax home is in a foreign country and you meet either the bona fide residence test or the physical presence test." [IRS Foreign Earned Income Exclusion - What is Foreign Earned Income]

Since you were working in the U.S. your income is not considered foreign earned income.

However, if foreign taxes were withheld, you may qualify for the Foreign Tax Credit. To enter this in TurboTax:

- On the Deductions & Credits screen, go to the Estimates and Other Taxes Paid section.

- Click the Start box next to Foreign Tax Credit.

- Continue through the screens, entering the requested information.

For more information, please see IRS Pub. 514 - Foreign Tax Credit for Individuals

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

Hi @Irene2805 ,

Thanks for the reply. I have another couple quick questions.

Since I do the Form 4852 now, I assume I put my wages that I earned from China on this form correct?

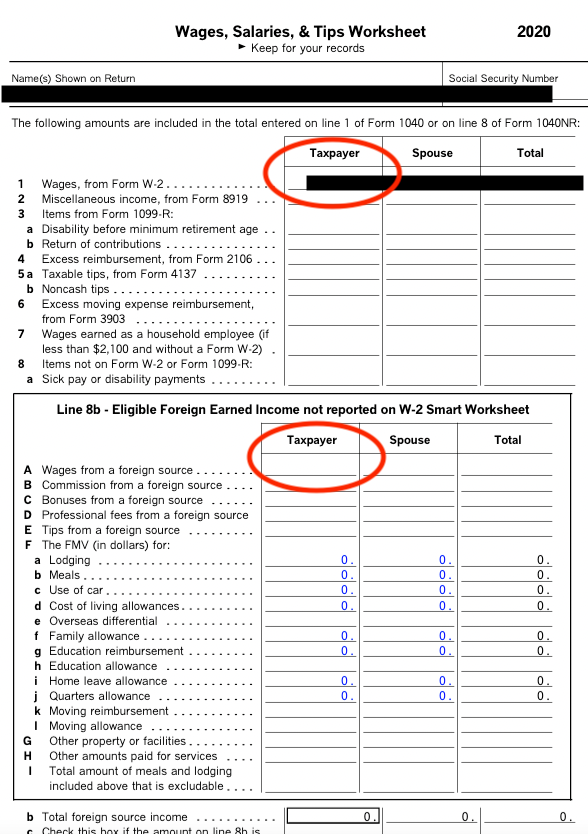

Additionally, in the "Wages, etc. Wks" in Turbotax, there is Line 1 which is for my wages earned from China, correct?

Furthermore, in the "Wages, etc. Wks" in Turbotax, if I put my wages in Line 8b section A from China here as well, it will effectively double my wages. This doesn't seem correct. I assume I just put my wages in Line 1 and leave Line 8b section A blank, correct?

For the taxes I paid on my China wages, I report them only when trying to take the Foreign Tax Credit, correct? I do not report them as well on the Form 4852 (Substitute W-2), correct?

Lastly, on the Form 4852, it states that if I cannot get a W-2, I have to call the IRS at [phone number removed] and explain the situation to them. Then the IRS will send the Form 4852 to me. Is this necessary to contact the IRS or is Turbotax handling this part for me since Turbotax creates the Form 4852 for me?

Thanks for your help and I look forward to hearing from you soon! 😃

I have also uploaded the images to this message...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

Hi @Irene2805 ,

Just a quick question for this. My work is not considered self-employment income since I was legally employed by my Chinese employer with a valid work permit and paid taxes to the Chinese government however lived in the US for the 2020 tax year, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

@DTaxGuy When you enter your income amount for a Foreign Tax Credit, you are not being taxed again on the income.

The income amount is needed for form 1116 to calculate your Income/Tax Ratio in determining the amount of your Foreign Tax Credit. Choose 'general category income' and indicate that Yes, you have reported the income.

You can report your Foreign Income as you suggested as a 'substitute W-2' with Form 4852, or you can report it as 'Other Taxable Income', where you can enter a description of the income.

Same outcome, tax wise, without the need for a 4852.

Click this link for more info on How to Enter Other Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with "Do any of these uncommon situations apply to this W-2?"

Hi @MarilynG1

Thanks for the response. Understood and thanks for the response.

Technically I was employed by a Chinese company and my contract ended in September 2020. I was physically residing in the US, but not actually working. I was receiving long-term sick pay wages due to a critical health condition I found out about and I paid the Chinese government my corresponding taxes for those sick pay wages.

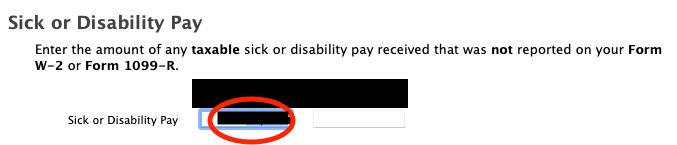

Would I enter then my sick-pay wages here at "Sick and Disability Pay"?

I assume my situation is also not considered "Self-Employment Income", correct? This has been a lot of confusion for me given my difficult situation and I have been receiving some potentially conflicting information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rcmelvin

New Member

turbosapper

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

20-Seferaj-d

New Member

RobertBurns

New Member

aj-sanchez111

New Member